Insurance business activities improve

Bao Minh Joint Stock Corporation (Code: BMI) has just released its financial report for the third quarter of 2025 with impressive growth results. The company's pre-tax profit reached VND 126 billion, up 215.4% over the same period in 2024; profit after tax reached VND 113 billion, up 120.3%.

The main driving force for Bao Minh to break through this quarter came from insurance business activities - the core area of the enterprise. apparent profit from insurance activities reached VND91 billion, while in the same period last year, the loss was VND19 billion. This positive reversal comes from both factors: Increased net revenue and significantly reduced operating expenses.

apparent revenue from insurance activities increased by 3.6%, reaching VND 1,331 billion, while insurance business expenses decreased by 4.9%, to VND 1,240 billion. Effective cost control helps the gross profit margin improve significantly, contributing greatly to the profit growth of the whole system.

In the product structure, health insurance continues to play a key role with revenue of VND 1,821 billion, accounting for the largest proportion in the portfolio. Fire and explosion insurance products (914 billion VND), motor vehicles (734 billion VND) and credit (407 billion VND) also recorded stable revenue, contributing to maintaining the overall growth rate. This shows that Bao Minh's strategy of diversifying products and expanding customer base is bringing positive results.

On the other hand, financial activities recorded unsatisfactory results when net interest decreased by 14.3%, down to VND 87 billion. Financial revenue reached VND 120 billion, down 19% over the same period, while financial expenses decreased by 29.2%, to VND 33 billion. Other activities such as real estate business and investment and business do not contribute significantly to total profits.

pouring nearly 370 billion VND into stocks, setting aside 100% of bond investments

Accumulated in the first 9 months of 2025, Bao Minh's net revenue from insurance business activities reached VND 4,021 billion, up 4% over the same period last year. Pre-tax profit reached VND 302 billion, up 37.9% over the same period, completing nearly 101% of the profit plan for the whole year. This result shows the operational efficiency and risk management ability of enterprises, although the insurance market is competitive fiercely and the industry's profit margin tends to narrow.

As of September 30, Bao Minh's total assets reached VND 7,538 billion, down 2.7% compared to the beginning of the year. Cash and cash equivalent units decreased sharply by 48.6%, from VND 446 billion to VND 229 billion, mainly due to changes in the structure of financial deposits and investments.

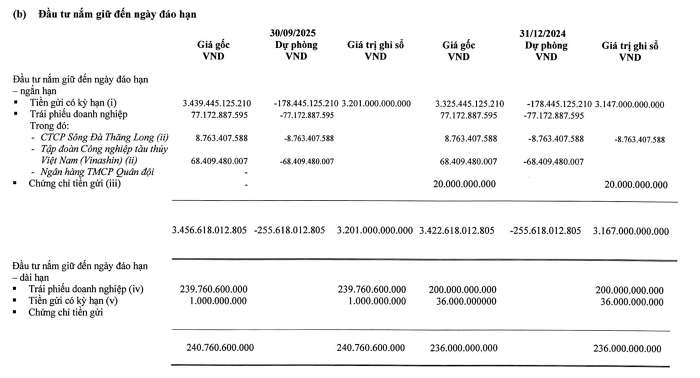

The balance of short-term financial investment reached VND 3,577 billion, up 9.7% over the same period, while long-term financial investment reached VND 537 billion, up slightly by 0.8%. Of the total of more than VND 3,500 billion in short-term investment, the majority are investments held until maturity (VND 3,456 billion, VND 255 billion has been provisioned), mainly term bank deposits.

In addition, the stock market investment portfolio has a book value of nearly 370 billion VND, with a reserve of more than 53.4 billion VND.

Bao Minh is also holding a number of corporate bonds such as Vinashin and Song Da Thang Long; all of these bonds have been set aside with 100% value reserve to ensure safety in the investment portfolio.

In the capital contribution investment segment, the enterprise currently owns shares in many units in the finance and insurance industry such as Lien Ho Insurance Company (48.85%), Vietnam - Vinare National Reinsurance Corporation (6.43%) and Saigon Kim Lien Joint Stock Company (10.13%), and a number of other enterprises.