After abolishing fixed tax, business households must declare according to actual revenue and use electronic invoices for all transactions. This is an important change in tax management, causing more than 3 million households to switch from manual recording to software operation, from making invoices according to needs to making mandatory invoices according to the time of occurrence.

In the first month of implementation, many industry groups recorded rapid increases in errors. Retailers, F&B, fashion, cosmetics or businesses doing business through social networks - who are familiar with small-scale transactions without invoices - have to make invoices immediately when collecting money or completing services. Changing habits leads to slow, insufficient or wrong time setting, especially during peak hours or when processing online orders.

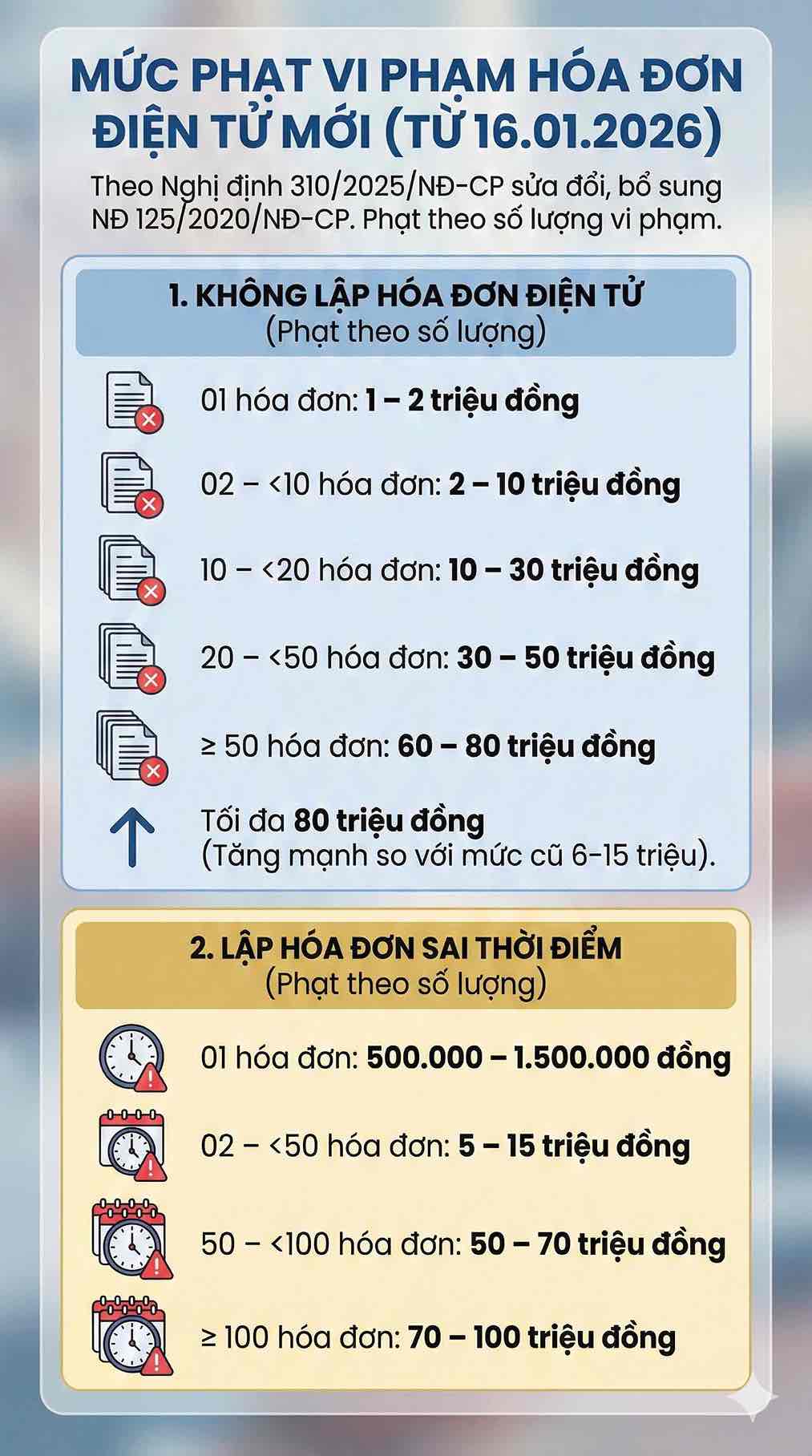

New penalty framework tightens e-invoice violations

On December 2, 2025, the Government issued Decree 310/2025/ND-CP, amending Decree 125/2020/ND-CP, effective from January 16, 2026. An important new point is that the fine level is divided according to the number of violation invoices instead of applying a uniform level as before.

For the act of not issuing electronic invoices, the fine is divided into 5 levels:

- Not making 01 invoice: fine of 1 - 2 million VND.

- Not issuing from 02 to less than 10 invoices: fine of 2 - 10 million VND.

- Not making from 10 to less than 20 invoices: fine of 10 - 30 million VND.

- Not making from 20 to less than 50 invoices: fine of 30 - 50 million VND.

- Not issuing from 50 invoices or more: fine 60 - 80 million VND.

Thus, the maximum fine increased to 80 million VND, much higher than the previous 6-15 million VND framework.

Similarly, the act of making invoices at the wrong time is also stratified:

- Time error for 01 invoice: fine of 500,000 - 1,500,000 VND.

- Time error from 02 to less than 50 invoices: fine 5 - 15 million VND.

- Time error from 50 to less than 100 invoices: fine of 50 - 70 million VND.

- Time error of 100 invoices or more: fine of 70 - 100 million VND.

In addition to the two most common groups of errors, Decree 310/2025/ND-CP also amends regulations on providing inaccurate information, storing - providing invoices not in accordance with regulations and prolonged errors. Cases of force majeure such as natural disasters, fires, epidemics... are supplemented to consider mitigation. At the same time, the decree clarifies the responsibilities of individuals or organizations authorized to fulfill tax obligations.

Business households need more support to reduce errors

Most business households do not have their own accountants, so all operations related to electronic invoices are carried out by household owners themselves. Identifying the correct time to prepare invoices, software operations when the volume of transactions is large, or electronic data management is still a challenge in the early stages of conversion.

To reduce errors, business households can standardize the process in some directions as follows:

- Create invoices right at the time of transaction instead of waiting until the end of the day; this helps avoid overlooking and ensures timelines.

- Use easy-to-operate software with clear instructions, suitable for people without accounting expertise.

- Periodically back up data, avoid losing information when needing to retrieve invoices.

- Separating personal accounts and business accounts, helping the system accurately record cash flow and support faster comparison.

With the characteristics of online business groups, establishing a unified application processing process from application closing, receiving money, making invoices to delivering goods will limit the situation of being late or making insufficient invoices.

Electronic invoices are not only a legal requirement but also a tool to help business households monitor revenue more transparently and professionally. When the hierarchy penalty framework of Decree 310/2025/ND-CP comes into effect, understanding regulations, accurate operation and strict data management will help business households operate stably, reduce risks and better adapt to the post-tax period.