According to the project "Converting tax management models and methods for business households when eliminating contract tax" (project) issued with Decision 3389/QD-BTC in 2025 of the Ministry of Finance.

Tax management for households and individuals doing business based on revenue when eliminating contract tax from 2026 will be divided into 3 models:

- Group 1: Revenue ≤ 200 million VND/year (no tax paid, but must be declared according to regulations).

- Group 2: Revenue from 200 million VND to ≤ 3 billion VND.

- Group 3: Revenue > 3 billion VND.

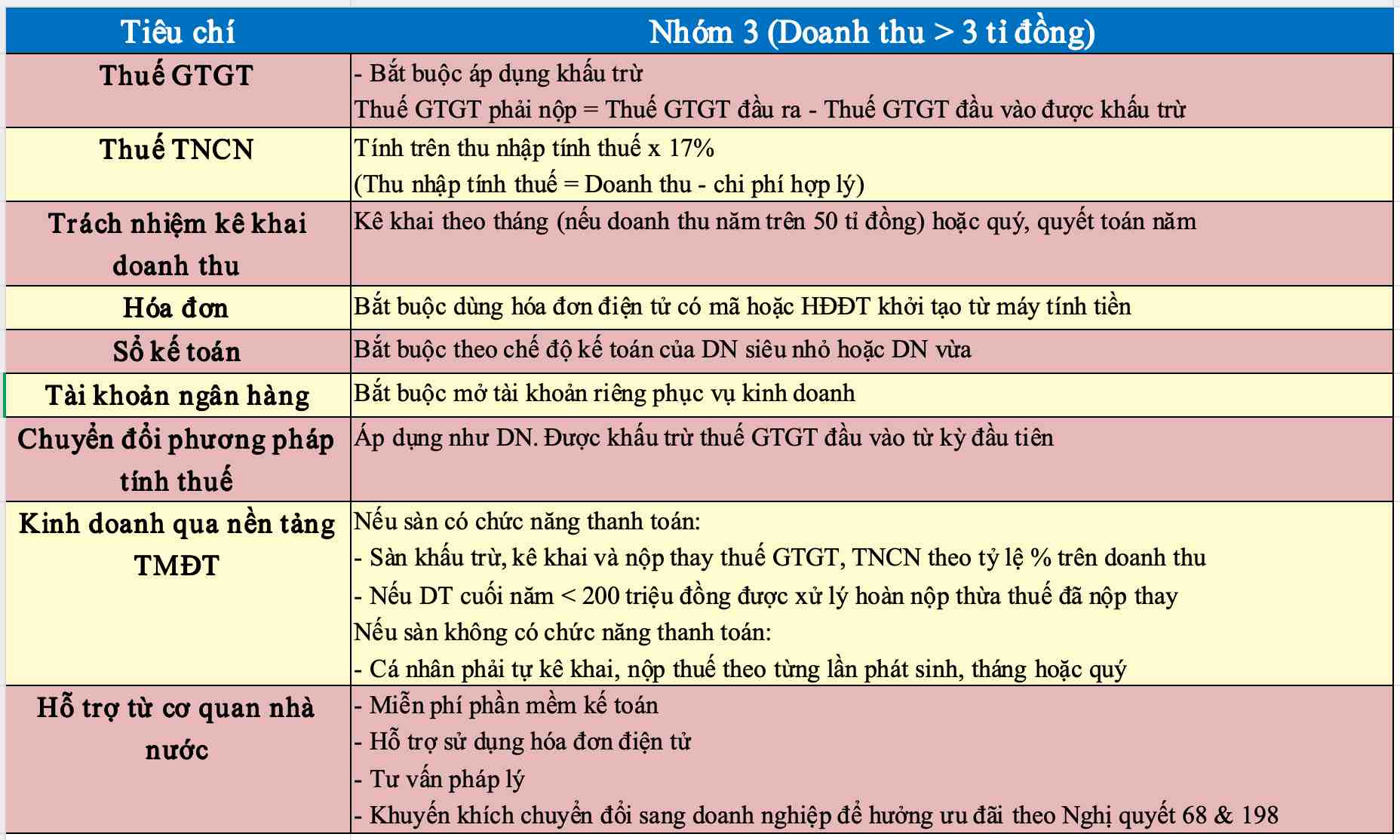

In particular, business households in group 3 with revenue greater than VND3 billion/year will implement tax management measures such as deductions, accounting regimes, and invoices similar to micro and medium-sized enterprises:

According to the above project, business households with a revenue of over VND3 billion/year from January 1, 2026 are required under the accounting regime of micro or medium enterprises. At the same time, it is mandatory to use electronic invoices with codes or ID cards generated from cash registers.

The Ministry of Finance also plans to amend Circular 132/2018/TT-BTC guiding accounting regimes for micro enterprises and Circular 133/2016/TT-BTC guiding accounting regimes for small and medium enterprises to suit the application to business households in Group 3 from 2026.

The Ministry will also advise on reviewing and amending the Law on Fees and Charges, the Law on Enterprise Support; proposing the development of the Law on Individual Business to specify the policies stipulated in Resolution 68-NQ/TW dated May 4, 2025 on private economic development.

The goal is to perfect the legal framework to eliminate the method of collecting contract tax for business households, creating a transparent legal foundation for converting all business households to the declaration method, while minimizing the difference in tax obligations between business households and enterprises, ensuring tax fairness in business.

The Ministry of Finance sets a target that by January 1, 2026, the contract tax mechanism will end, all business households with taxable revenue will self-declare and self-pay taxes according to actual revenue. Tax authorities play a role in guiding, supervising, and checking after-sales - instead of fixing collection from the beginning as a contract method.