According to Resolution 198/2025/QH15 passed by the National Assembly, the regulation on the application of contract tax will expire from January 1, 2026. This is a major change in tax management policies for millions of business households across the country.

Raising the threshold of non-taxable revenue

The most important and beneficial change for small business households is increasing the level of non-taxable revenue.

Currently (according to Circular 40/2021/TT-BTC): Business households with a revenue in the calendar year of VND 100 million or less do not have to pay VAT and personal income tax.

From January 1, 2026 (according to Official Dispatch 4613/CT-CS in 2025): This revenue threshold will be increased to VND 200 million or less. Business households with revenue below this level will not be subject to VAT and will not have to pay personal income tax.

Classifying 3 groups of business households for tax management

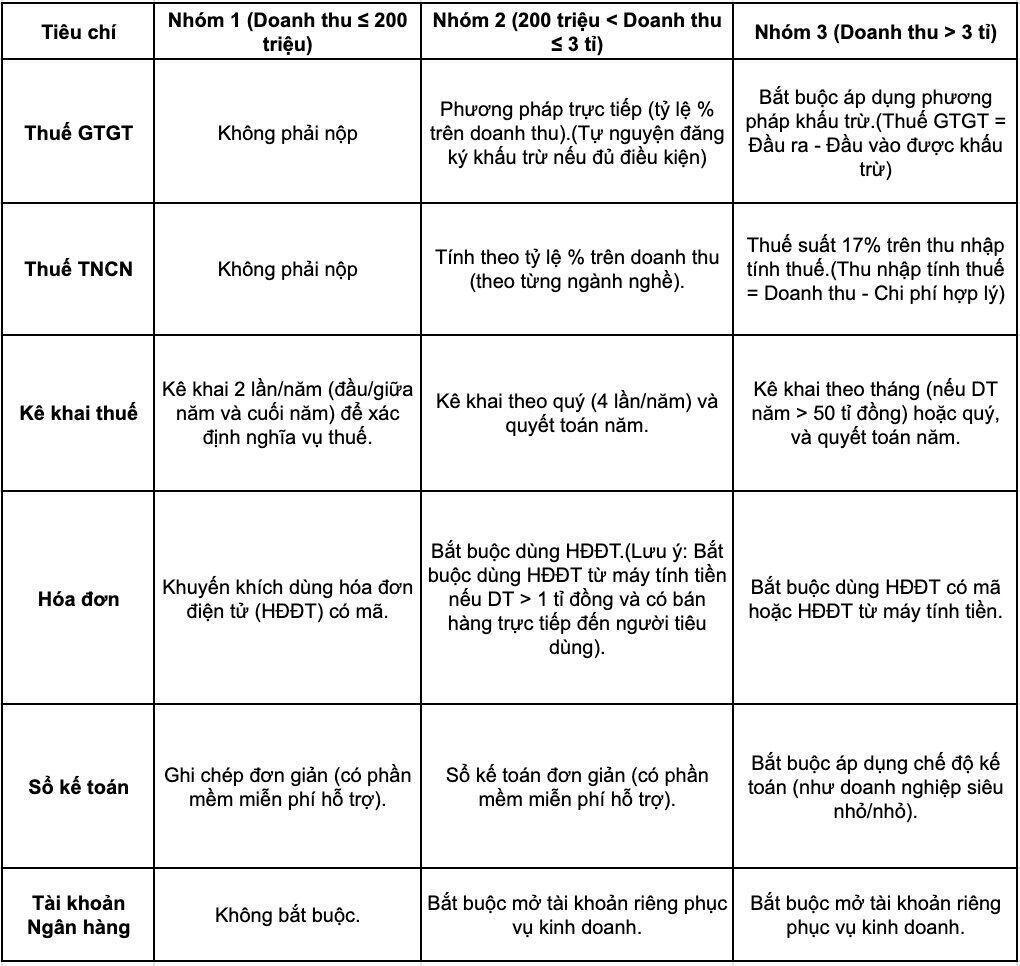

To replace the contract tax method, the Ministry of Finance has issued a Project (attached with Decision 3389/QD-BTC in 2025), dividing business households into 03 groups to apply different tax management and calculation methods:

Group 1: Business households with revenue under 200 million VND/year.

Group 2: Business households with revenue from 200 million to less than 3 billion VND/year.

Group 3: Business households with revenue of over 3 billion VND/year.

How to calculate personal income tax, value added tax of business households and declaration obligations from 2026

The obligations regarding taxes, invoices, and accounting books of these 03 groups will be clearly different, summarized in the table below:

General regulations on e-commerce business

For business households (belonging to all 3 groups) operating on e-commerce platforms, the regulations are as follows:

If the exchange has the function of payment: The e-commerce platform will be responsible for deducting, declaring and paying VAT and personal income tax (according to the percentage on revenue) to business households.

If the exchange does not have the function of payment: The business household must self-declare and pay tax according to each arising time, monthly or quarterly.

Note: If a business household is allowed to pay taxes on behalf of the tax floor, but at the end of the year the total revenue is determined to be below 200 million, the business household will be processed to refund the excess tax paid.

Support from state agencies

To facilitate business households' conversion, state agencies will provide general support (applicable to all 3 groups) such as:

Free simple accounting software.

Support the use of electronic invoices.

Legal advice.

Encourage business households (especially Group 3) to convert to the business model to enjoy related incentives.

Currently, the tax authority still maintains the same connection to both systems: https://dichvucong.gdt.gov.vn and https://thuedientu.gdt.gov.vn so that the tax authority has time to propagate and instruct taxpayers to the new interface for registration and use.

This means that after this period, the electronic Tax system (thuedientu.gdt.gov.vn) will stop operating and be disconnected to only maintain 01 Tax Department Administrative Procedure Information System.