Why is Tesla stock plunging?

Despite Elon Musk's close relationship with former President Trump, this doesn't seem to help Tesla's stock as its value has plummeted.

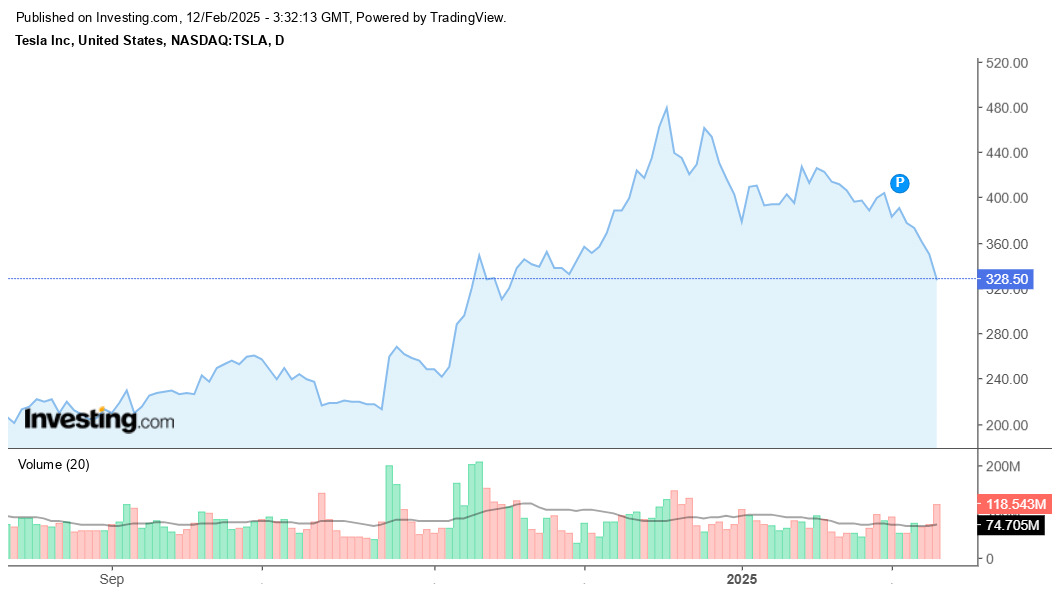

Tesla shares have fallen 28% since peaking at $349.18 on December 18, 2024, shortly after Trump’s election victory, making it the worst-performing stock among the “Magnificent Seven,” which also includes Meta, Amazon, Microsoft, Nvidia, Google, and Apple, according to Yahoo! Finance.

Investors had hoped that Musk’s support for President Trump would benefit Tesla, especially in approving self-driving cars. However, the reality has not been as expected.

According to the latest update, Tesla stock has fallen below its 50-day moving average. If Tesla stock breaks the support level of $334 (100-day moving average), the downtrend could extend to $286 (200-day moving average).

Why Tesla is struggling

Sales slump: Tesla is having a rough start to 2025 as sales in major markets are plunging.

In China, Tesla sold just 63,238 vehicles in January – down 33% from the previous month, according to the China Passenger Car Association (CPCA).

In Australia, Tesla sales also fell 33% year-on-year, according to a report from the Electric Vehicle Council of Australia (EVC).

This has raised concerns that Musk's closeness to President Donald Trump may be negatively affecting the Tesla brand.

Rising manufacturing costs: President Donald Trump has just signed two executive orders imposing 25% tariffs on steel and aluminum – two key materials used in Tesla’s car production. The new trade war with China is adding to the tension, as 40% of Tesla’s battery suppliers are Chinese companies.

Disappointing results: Earnings per share (EPS) fell short of analysts’ expectations. Car sales fell 8% as Tesla continued to slash prices to stimulate demand.

The fully autonomous feature, expected to be Tesla's "trump card", is still unlikely to be launched in Europe and China in the first quarter of 2025.

Where is Tesla going?

Data from Yahoo Finance shows that analysts are sharply cutting Tesla's profit forecasts for 2025 and 2026. Some experts are even warning of an "electric vehicle decline" — that consumers are losing interest in the vehicle due to high prices, incomplete charging infrastructure, and increasingly fierce competition.

JPMorgan analyst Ryan Brinkman, one of the most pessimistic about Tesla, even predicted that Tesla's stock price could fall to $135.