Revenue maintained at a high level but profits were slim

Ha Long Canned Food Joint Stock Company (Halong Canfoco, code: CAN) was established in 1957, in Hai Phong, formerly Ha Long Canned Fish Factory. This is one of the enterprises with a long history of operation in the field of processed food in Vietnam, with a list of popular products such as Hai Phong lamppost pate, liver pate, salmon pate, oil-soaked tuna, canned meat and canned fruits.

Over many decades of operation, Ha Long Canned Food has gradually expanded its production scale, developing more product lines from seafood, processed meat to canned food, serving both the domestic and export markets. According to published financial reports, this enterprise has maintained a large revenue scale for many years, with regular revenue ranging from 700-800 billion VND per year.

There was a period when revenue exceeded 800 billion VND, showing the significant consumption scale of Ha Long brand products on the market. Although the after-tax profit margin is not high compared to revenue, in terms of cash flow and operating scale, Ha Long Canned Food is still classified as a group of processed food enterprises with a certain position.

From 2020 to now, Ha Long Canned Food's net revenue has maintained a high level, but profits are insignificant compared to revenue due to the cost of goods sold and various types of costs that erode profits, especially selling costs.

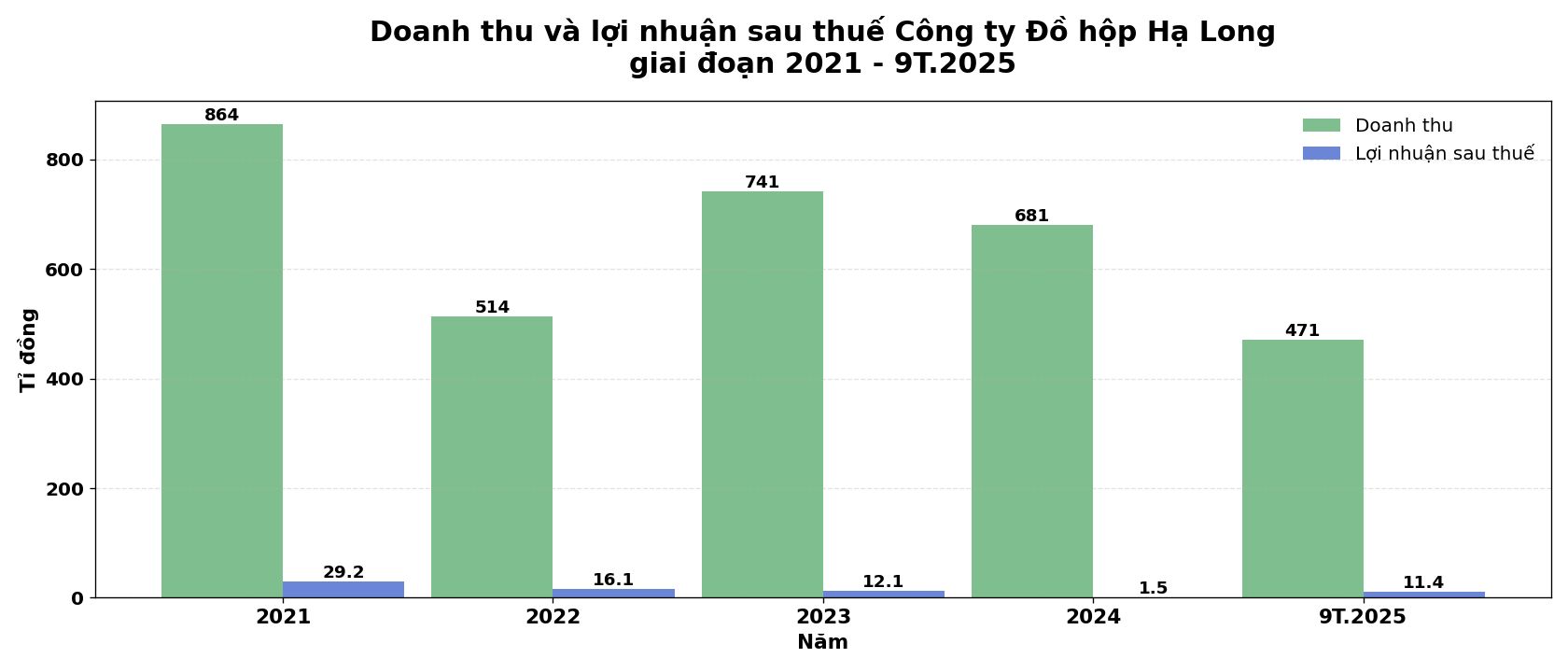

In 2021, the enterprise achieved positive revenue of more than 864 billion VND, profit after tax reached 29.2 billion VND. In 2022, revenue decreased to 514 billion VND, profit after tax reached 16.1 billion VND.

In 2023, revenue recovered to VND 741 billion, but after-tax profit continued to decrease, to VND 12.1 billion.

By 2024, revenue reached 681 billion VND, while after-tax profit was only 1.5 billion VND.

Increased profits thanks to cost control

In 2025, the consolidated financial statements for the third quarter of 2025 showed that Ha Long Canned Food recorded net revenue of 170 billion VND, down 14% compared to the same period. However, thanks to the sharp decrease in cost of goods sold compared to the revenue decrease, gross profit reached 43 billion VND, up 13%. After deducting expenses, after-tax profit reached 7.6 billion VND, nearly 4 times higher than the same period last year.

Accumulated for the first 9 months of 2025, the enterprise's revenue reached 471 billion VND, down nearly 11% compared to the same period. In the context of reduced sales, cost savings helped after-tax profit reach 11.4 billion VND, improving compared to the loss of 6 billion VND in the same period last year.

As of the end of the third quarter of 2025, Ha Long Canned Food's total assets reached 344 billion VND, an increase of 19% compared to the beginning of the year. In which, inventory accounted for the largest proportion with a value of 189 billion VND, an increase of 30% compared to the same period last year. The main inventory structure includes raw materials 116 billion VND, finished products 28.3 billion VND, unfinished production and business costs 28.4 billion VND and goods 19 billion VND.

As of September 30, 2025, the total payables of enterprises were at 186.8 billion VND, an increase of 32% compared to the beginning of the year, of which outstanding loans were nearly 80 billion VND. Owner's equity reached 157.3 billion VND, an increase of 7.8% compared to the beginning of the year.

Plan to mobilize capital to build a new factory

In parallel with production and business activities, the enterprise is implementing a large-scale investment plan. At the 1st Extraordinary General Meeting of Shareholders in 2025, Ha Long Canned Food shareholders approved a plan to offer 5 million shares to existing shareholders at a ratio of 1:1, at a price of 15,000 VND/share. The total expected mobilized amount is 75 billion VND, expected to be implemented in 2026.

According to the approved plan, 50 billion VND will be used for building a new factory and purchasing equipment, and the remaining 25 billion VND will supplement working capital. The Board of Directors said that it has considered financial risks and believes that the project will bring long-term efficiency.

Another important content is the plan to relocate the factory at No. 71 Le Lai, Ngo Quyen ward, Hai Phong city. According to the leadership, relocation is an urgent requirement after the Ngo Quyen district sub-area planning project to 2040 was approved in April 2025, in which the land area currently used by the enterprise is planned to become public green space. Since 2023, the company has returned more than 5,000 m2 of land to the city.

To serve long-term production, shareholders also approved the lease of a 20,000 m2 land plot in Nam Dinh Vu Industrial Park (Zone 1), Dong Hai ward, Hai Phong, for a term of 34 years until 2059, with a total lease value of more than 68 billion VND. On this land, Ha Long Canned Food is expected to deploy the Ha Long Hai Phong Canned Food Factory project, with a total investment of more than 166 billion VND, of which about 83.7 billion VND is equity and more than 82.2 billion VND is credit loan capital.

On the stock market, in the morning trading session of January 8, CAN shares were under strong selling pressure, being massively sold off by investors, thereby reducing the entire range and falling into a "floating" state. After the adjustment phase, the stock price stopped at 29,000 VND/share, equivalent to a decrease of 6.5%.

Matched order volume reached 13,500 units, a sharp increase compared to the previous period when there were many consecutive sessions with almost no transactions, or only fluctuating around 100 shares per session.