"It only took a few seconds, the savings suddenly disappeared" Ms. T (Hanoi) shockedly recounted her clicking on a fake bank link in November 2023. Such incidents are no longer strange in the era of financial digitalization. Not only in Vietnam, this problem is becoming a global obsession. The Bank for International payments (BIS) warned: Digital fraud has become one of the biggest threats to the financial system, not only causing people to lose money but also posing risks to both banks and the economy.

According to BIS, fraud tricks are increasingly sophisticated and unpredictable. They can be unlicensed payment transactions (stealing card data via malware or fake messages), defrauding payment processors (impersonating banks or reputable partners to lure customers to transfer money themselves), defrauding bank products (impersonating savings, credit, insurance or investing in "super profits") and breaking into the banking system (taking access rights, changing information to verify security).

The State Bank of Vietnam leads a "clean" campaign and protects customers

From the end of 2023, the SBV issued Decision 2345/QD-NHNN on safety solutions in online payments, then institutionalized by Circular 50/2024/TT-NHNN, requiring transactions of VND10 million or more to be biometrically authenticated. This creates an important "lock" right from the transaction stage.

The SBV also connected the bank with the VNeID electronic identification database, allowing the use of an electronic ID card to replace traditional documents when opening an account and transacting, increasing the ability to verify identity, while preventing account opening with fake information.

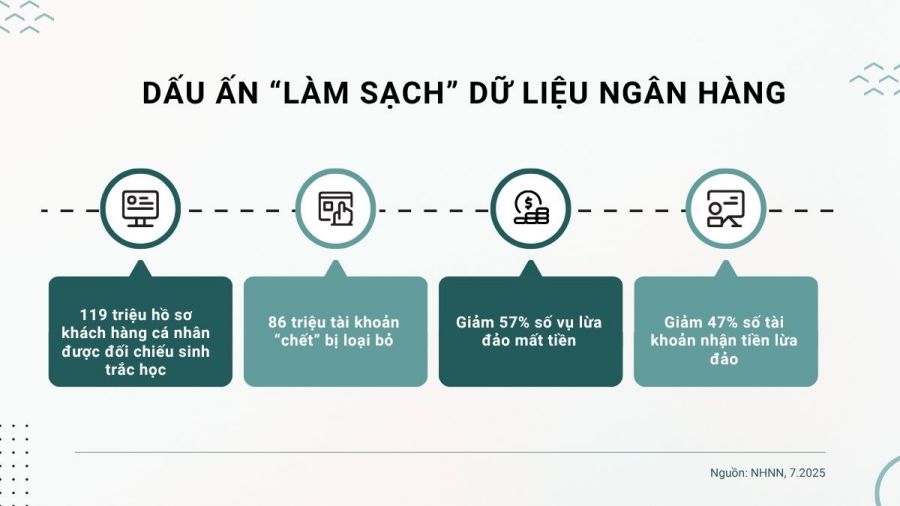

In particular, the customer data "cleaning" campaign has made a big impression. By June 2025, more than 119 million personal records had been biometrically compared, eliminating nearly 86 million "dead" accounts. According to Deputy Governor Pham Thanh Ha, "the number of money loss fraud cases decreased by 57%, the number of accounts receiving fraudulent money decreased by 47% compared to the same period in 2024" - the results showed the power of drastic actions.

In addition to techniques, the SBV also focuses on communication and financial education: Deploying periodic warning plans, building a Fanpage "SBV Communication", coordinating with the press to disseminate skills in fraud prevention and updating new tricks. At the same time, the SBV built a shared database of suspected fraud accounts, supporting credit institutions to identify risks early.

Banks proactively set up "smart fences"

Based on the orientation of the State Bank, commercial banks are also proactively implementing their own solutions.

From June 30, 2025, Vietcombank will test the automatic warning feature for accounts showing suspicious signs on VCB Digibank. When customers transfer money, the system will immediately compare it with the database from the authorities and warn if the recipient's account does not match the information, is on the warning list or shows signs of abnormality. Customers are provided with information about the safety level of their beneficiary accounts to proactively decide on transactions, emphasized Vietcombank representative.

BIDV is also a pioneer in implementing Smart Alert - a feature that automatically scans and warns of suspicious accounts as soon as customers log in to the beneficiary account number. This system connects with many databases from the Ministry of Public Security, the State Bank and functional agencies, helping to early identify the risk of fraud.

BIDV said that the unit has the most connected database sources, related to the list of accounts suspected of fraud. However, in this list, there are real fraudulent accounts, but there are also accounts that are suspected (based on signs of suspected accounts according to Circular 17 of the State Bank), or new suspected accounts that have not been updated in time to be on the list. Therefore, in addition to support from banks, authorities and users themselves also need to be vigilant and guard against the risks of fraud and forgery.

Techcombank focuses on researching AI and GenAI to improve experience and security: Virtual assistant, personalized services and improved employee performance. According to Mr. Nguyen Duc Lam - technology expert at Techcombank, " data security and privacy are always a top concern. The biggest challenge today is not only technology infrastructure, but also high-quality AI human resources and data protection mechanisms in the AI era".

Solutions from experts: methodical and flexible AI application

To improve the efficiency of technology application, especially AI in banking, Mr. Doan Huu Hau - Director of Transformation and AI Services FPT Digital - recommends: To effectively deploy AI, banks need to consider IT infrastructure options suitable for financial capacity, AI use level and governance capacity, and at the same time ensure compatible systems.

The application of AI in banking requires a clear and highly flexible roadmap with specific goals, clearly defining priority areas for implementation, based on technology status, data and processes. A successful implementation plan must not only focus on technology but also invest in human resource training and development. Bank employees need to be equipped with the necessary knowledge and skills to be able to proficiently use and effectively exploit the capabilities of AI.