Gold prices recover as investors consider the prospect of the US Federal Reserve's (FED) interest rate roadmap after data showed that the US labor market showed signs of stabilizing again.

According to ADP Research, the US private sector has added 42,000 jobs after two consecutive months of decline. The report is one of the few monthly data on the labor market released as the US government undergoes its longest-running closure in history, delaying official economic data. Although it helps to ease concerns about the possibility of a faster weakening of the job market, this modest increase still reflects a gradual decline in labor demand.

Some economists believe that the weaker recruitment trend could make the Fed leaning towards the possibility of continuing to cut interest rates. Gold often benefits in a low interest rate environment because it does not yield.

The precious metal's strong rally since the beginning of the year has encountered significant resistance in recent two weeks, as traders took profits after a period of rapid increase. The cautious stance of policymakers on monetary easing also puts pressure on gold prices.

As of the end of October, total holdings of gold exchange-traded funds a measure of demand from institutional and individual investors have recorded two consecutive weeks of net withdrawal.

According to Mr. Greg Roberts - CEO of A- Mark Precious Metals, one of the leading wholesalers and retailers of precious metals in the US, after participating in the global wave of cheap hunting, US individual investors have "temporarily rested" last week to observe and evaluate market developments.

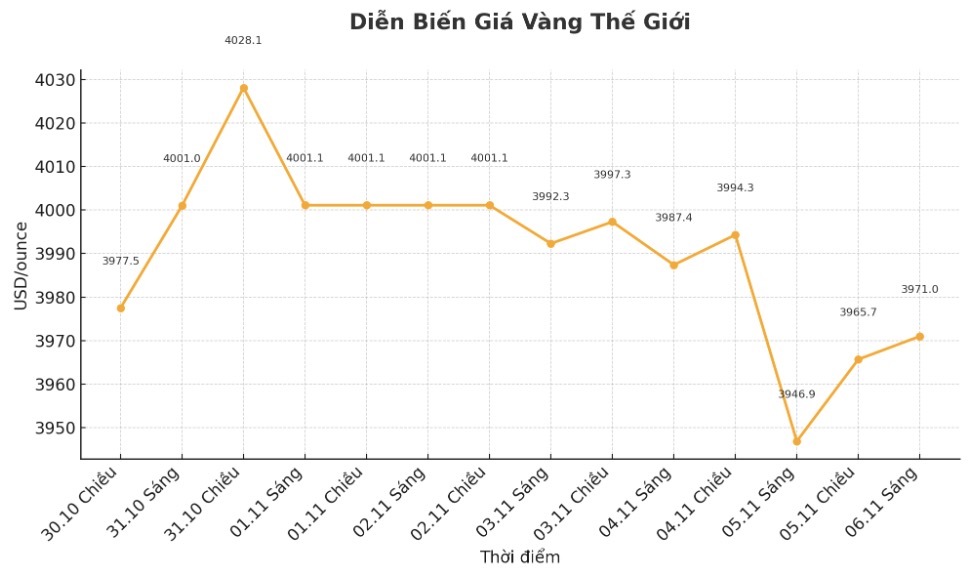

TD Securities strategist Bart Melek commented in a report that: "It is not surprising that this precious metal is accumulating in the lower price range, around 3,800 - 4,050 USD/ounce" - and said that this reflects the lack of clarity on the FED's interest rate cut prospects and concerns about retail demand in China.

However, according to Mr. Bart Melek, the factors that have driven gold prices to increase strongly this year are still intact, including high net buying by global central banks and strong demand from individual investors - two forces expected to bring gold prices back after the current accumulation period.

Mr. Greg Roberts from A- Mark Precious Metals also predicted that demand from individual investors will continue to maintain, as they seek to diversify their portfolios and increase their holdings of precious metals.

In New York, at 3:03 p.m. yesterday afternoon, gold prices increased by 1.4% to $3,986.94/ounce. The Bloomberg Dollar spot Index remains stable after closing at its highest level since mid-May. Silver prices rose 2.3%, while platinum and palladium also rose simultaneously.

On the London Metals Exchange (LME), copper prices rose 0.3%, to 10,697.50 USD/ton, while other base metals all decreased.