Gold and silver prices continued to skyrocket in the trading session on December 12, as investors believed the US Federal Reserve (Fed) was getting closer to a new policy easing cycle. The decline of the US dollar and US Treasury yields further boosted these two precious metals.

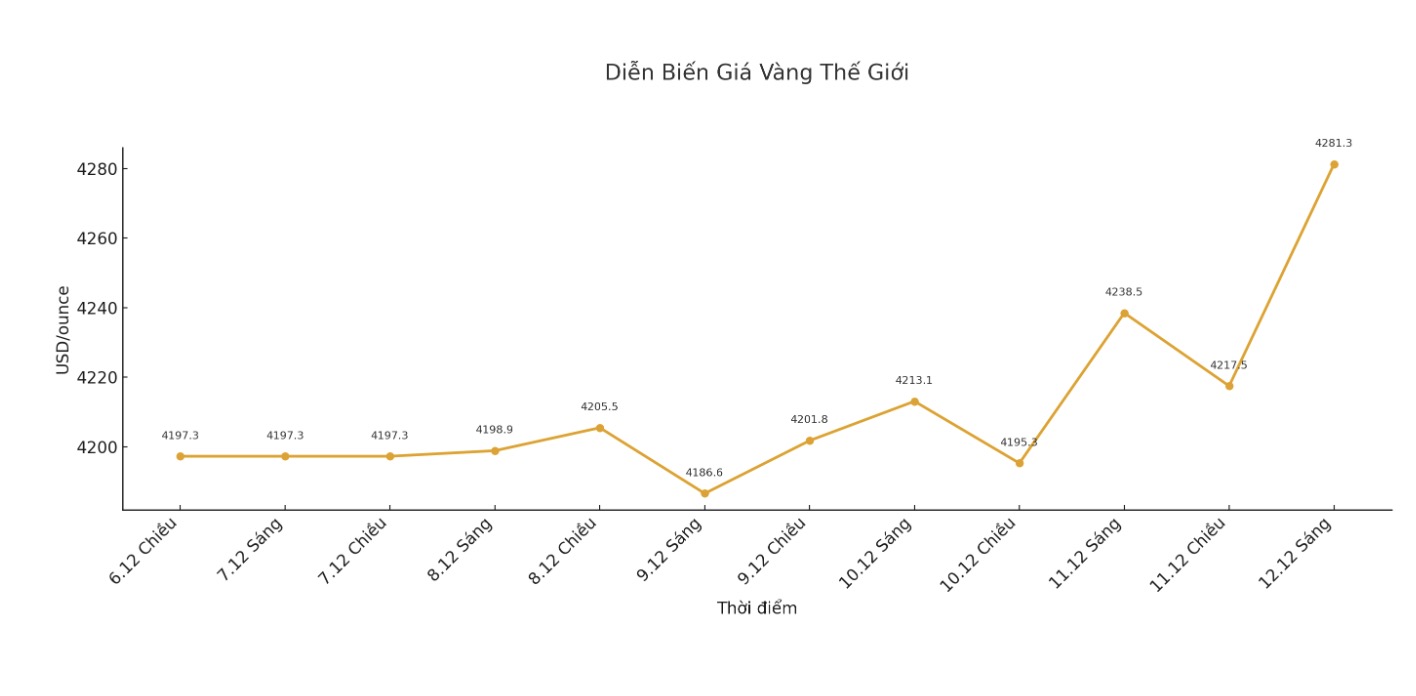

During the session, gold increased by 1.2%, reaching 4,273.25 USD/ounce, while silver at times surpassed 64 USD/ounce - an all-time high before falling slightly to 63.72 USD/ounce. At the same time, the Bloomberg Dollar spot index decreased by 0.3%, reflecting the trend of withdrawing capital from the greenback to find safe-haven assets.

At the midweek meeting, the Fed cut interest rates by 0.25 percentage points, as expected, but what caught the market's attention was a signal paving the way for further cuts in 2026. Despite three members' objections, investors still believe that the rate cut roadmap will be maintained, even further than the Fed's official forecast.

Even new data on the labor market shows that the largest increase in unemployment claims since the pandemic has not undermined this expectation. Traders still maintain the view that the Fed must maintain a loose policy to support growth in the context of the US economy gradually losing momentum.

Mr. Bart Melek, Head of Global Commodity Strategy at TD Securities, commented that the Fed's expansion of the $500 trillion accounting balance sheet is a positive factor for gold. Fake positions before the meeting are being washed away, he said.

Melek also noted that a new currency operator with a more dovish stance will take over the Fed next May, which could make the current liquidity measures stronger.

In a low-interest-rate environment, gold and silver non-yielding assets are often becoming more attractive. Since the beginning of the year, gold has increased by more than 60%, while silver has increased by 116%, the strongest increase since 1979.

This breakout is supported by record net purchases from central banks and the trend of withdrawing capital from government bonds and traditional currencies of investors.

According to the World Gold Council (WGC), capital flows into gold ETFs have increased for most of the year, except for May. Meanwhile, silver is fueled by soaring industrial demand, especially from the solar energy industry, along with a shortage of supply at major transaction centers.

Mr. Trevor Yates, senior analyst at Global X ETFs, commented: City is breaking all records as the market re-evaluates the macro outlook for 2026 more positively, with expectations that the Fed will maintain a dovish policy. We predict that the silver market will continue to lack supply next year due to the recovery of industrial demand and the only modest increase in supply.

The increase in silver is also amplified by technical factors. More than 21,000 sports options have expired, according to iShares Silver Trust (SLV), the world's largest silver ETF with an implementation price of $77. The need for market makers to buy to balance their positions has contributed to the stronger increase in silver prices.

As of the morning of December 12, spot gold increased by 1.1%, silver increased by 3.1%, while platinum and palladium both increased.