Gold prices first surpassed 5,300 USD/ounce on Wednesday, amid the USD falling to its lowest level in nearly four years and the market waiting for a monetary policy decision from the US Federal Reserve (Fed).

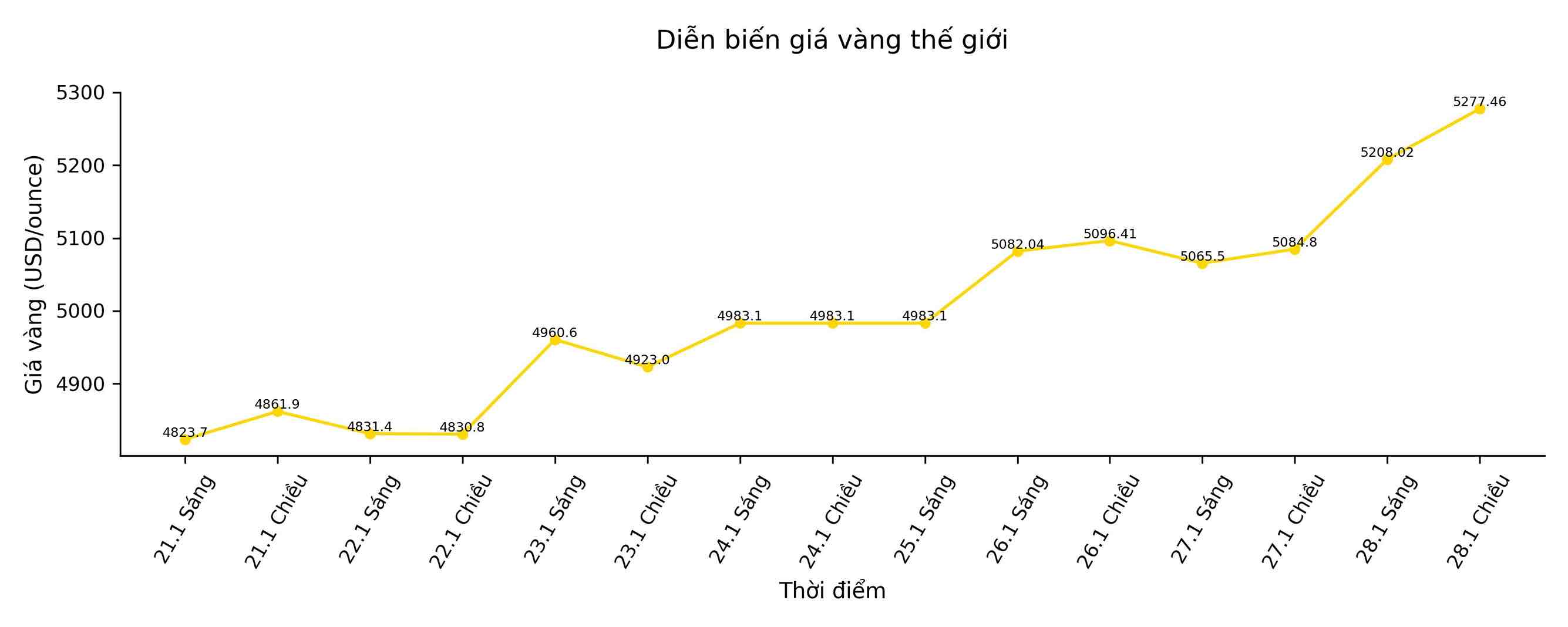

Spot prices slightly decreased to $5,277.46/ounce in the afternoon trading session of January 28, after hitting a record level of $5,311.31. Since the beginning of the year, gold prices have increased by more than 20%. US February gold futures increased by 4.3% to $5,301.90/ounce.

The USD faced a "confidence crisis" when falling to a 4-year low, amid stronger selling pressure after President Donald Trump's statement that he believes the "money is in good shape" when asked if the USD has fallen too deeply. The weakening greenback makes gold - which is valued in USD - cheaper for international buyers.

According to Kelvin Wong, senior analyst at OANDA, the upward momentum of gold reflects a strong negative correlation with the USD, along with Mr. Trump's assessment implying that the White House may accept a weaker USD in the near future.

The US President also said he would soon announce the selected personnel for the Fed Chairman position, and predicted that interest rates would fall when the new head takes over. Mr. Ilya Spivak - Global Macro Research Director at Tastylive - said the market is maintaining a cautious state ahead of Chairman Jerome Powell's speech on the day.

The Fed is forecast to keep interest rates unchanged at the ongoing January meeting. In a low-interest environment, gold – a non-interest-generating asset – is often more advantageous.

Deutsche Bank on Tuesday forecasts gold could reach 6,000 USD/ounce in 2026, based on sustainable investment demand as central banks and investors increase their allocation to tangible and non-USD assets.

Spot gold rose 1.5% to 114.68 USD/ounce, after hitting a peak of 117.69 USD on Monday and has increased by nearly 60% since the beginning of the year. Platinum rose 2.3% to 2,703.11 USD/ounce after a record milestone of 2,918.80 USD, while palladium rose 2.2% to 1,976.62 USD.