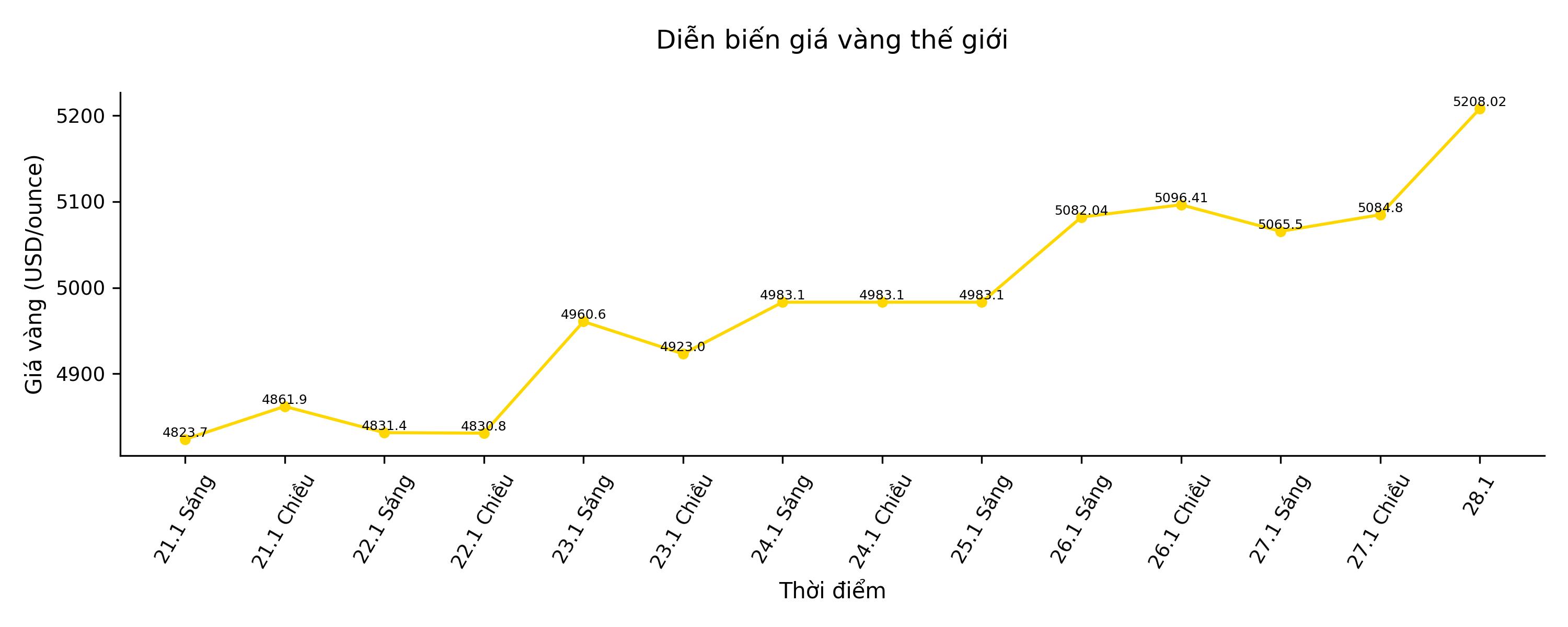

Gold prices hit a new peak above 5,200 USD/ounce, extending the acceleration streak under the impact of the weakening USD and the wave of escaping government bonds and major currencies.

Spot gold rose another 0.4% on Wednesday, after jumping 3.4% in the previous session - the strongest increase in the day since April. President Donald Trump declared he was not worried about the USD depreciation, pushing the world's largest reserve currency to its weakest level in nearly 4 years.

That weakening momentum, combined with geopolitical risks and cash flow escaping from currencies and Treasury bonds, is fueling shelter demand for precious metals. Since the beginning of the year, gold has increased by about 20% and for the first time exceeded the 5,000 USD/ounce mark this week. At the same time, silver also broke through more than 50%.

A large sell-off on the Japanese bond market is the latest signal of concerns surrounding huge public spending, while speculation that the US may intervene to support the Yen has put pressure on the USD, making the precious metal cheaper for most buyers. The USD strength index fell 1.1% on Tuesday - the sharpest decrease since April.

Speaking in Iowa, Mr. Trump said the USD "is still stable" and the exchange rate will fluctuate cyclically. "No, I think it's great," he replied when asked if he was worried about the currency's depreciation.

The White House's moves, such as threatening to annex Greenland, the possibility of military intervention in Venezuela and new attacks on the independence of the US Federal Reserve (Fed), continue to destabilize the market. The US President also threatened to increase taxes on Korean goods and impose a 100% tariff on Canada if Ottawa reaches a trade agreement with China.

In the interest rate market, bond traders are increasingly betting that the Fed will be more "hawkish", based on the expectation that BlackRock's Investment Director, Rick Rieder, will replace Mr. Jerome Powell. This figure has repeatedly supported a sharp reduction in borrowing costs – a particularly favorable environment for non-profit precious metals.

According to Ms. Suki Cooper, Head of Global Commodity Research at Standard Chartered, expectations of a softer and less independent Fed, along with geopolitical risks, are driving private capital flows into gold faster. “If short-term corrections are not counted, the risk of price increases still prevails,” she said.

In this morning's trading session, gold increased by 0.2% to $5,208.02/ounce after hitting a peak of $5,202.51. Silver increased by 1% to $113.14. Platinum and palladium simultaneously went up, while the Bloomberg Dollar Spot index increased slightly by 0.2% in the session but still decreased by 1.4% this week.