After five consecutive sessions of increase, world gold prices have temporarily stagnated, as investors pay attention to a series of important US economic data this week, the information is expected to reveal the readiness of the US Federal Reserve (Fed) for further interest rate cuts.

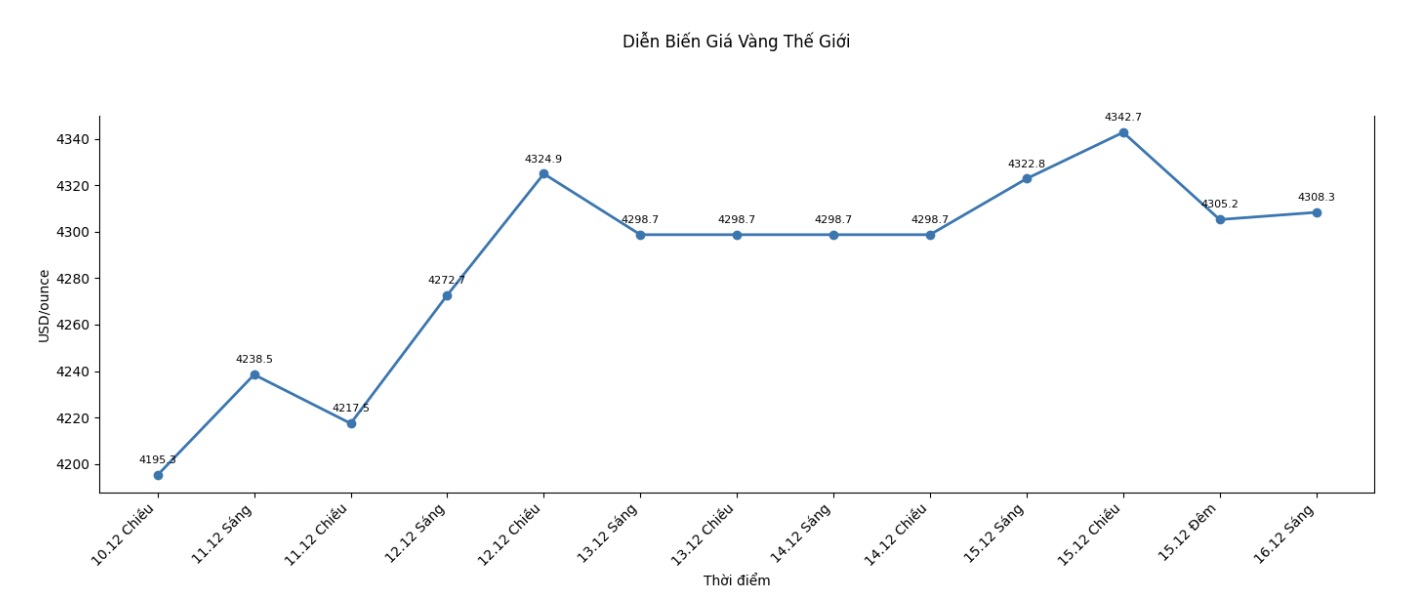

Gold is trading around $4,305 an ounce, just $80 lower than the historical peak set in October, as the attractiveness of the precious metal is strengthened after the Fed cut interest rates for the third consecutive time. However, policymakers have since given mixed views on whether the Fed will continue to ease monetary policy in 2026.

This week, the market will receive a series of US economic data delayed due to the six-week government shutdown, partly filling the information gap over the past time. The monthly jobs report is due out on Tuesday, with a forecast of an increase of 50,000 jobs and an unemployment rate of 4.5% reflecting a slowing but not yet seriously weakening labor market.

Even if the US employment data shows only moderate weakness, that is enough to strengthen the case for the Fed's next rate cuts, according to Michael Wilson, a strategist at Morgan Stanley. Low interest rates are often beneficial for gold an asset that does not yield, as holding opportunity costs fall. Several Fed officials are expected to speak this week, while US inflation data will be released on Thursday.

Since the beginning of the year, gold prices have increased by nearly 65%, while silver prices have more than doubled, putting both precious metals on track for their strongest increase since 1979. The hot rally was supported by a strong buying wave by central banks, along with the trend of withdrawing capital from government bonds and major currencies. According to the World Gold Council, holdings of gold ETFs have increased in all months of the year, except for May.

As of 8:07 a.m. in Singapore, gold prices were almost flat at $4,305.30 an ounce, down from the historical peak of $4,381.52 an ounce set at the end of October. Silver prices fell slightly by 0.2% to $63.94/ounce, after setting a record of $64.6573/ounce on Friday. platinum and palladium also fell slightly, while the Bloomberg Dollar spot lost 0.1%.