Gold prices jumped to near the threshold of 4,600 USD/ounce in the first session of the week, after US Federal Reserve (Fed) Chairman Jerome Powell said that the central bank had received a summons from the grand jury regarding his hearing before Congress in June on the Fed headquarters renovation project.

This move marks a new escalation in the confrontation between President Donald Trump and the head of the Fed, while igniting concerns about the independence of the world's most powerful monetary policy maker.

In parallel, bloody protests in Iran continue to push geopolitical tensions higher, causing demand for shelter in precious metals to increase sharply. The possibility of the Islamic Republic government facing collapse is shaking the oil market and regional politics. President Trump said he is considering "options" related to Iran, while reiterating his statement to consider acquiring Greenland and questioning NATO's role, just over a week after arresting Venezuelan leader Nicolas Maduro.

This is a clear reminder of the number of risks that the market must handle: geopolitics, growth-interest debate, and now another sensational institutional risk factor" - expert Charu Chanana of Saxo Markets said.

Last year, gold had a booming year when a series of forces converged: falling interest rates, escalating political-economic tensions, and weakening confidence in the USD. More than a dozen fund managers said they were not in a hurry to take profits because they still believed in gold's long-term prospects.

US job data last week continued to reinforce expectations that the Fed would further cut interest rates, as the number of new jobs increased below forecast. This strongly supports gold – a non-profit asset. Gold also traded close to historical peaks.

The market is currently assessing at least two interest rate cuts this year, after the Fed cut three consecutive times in the second half of last year.

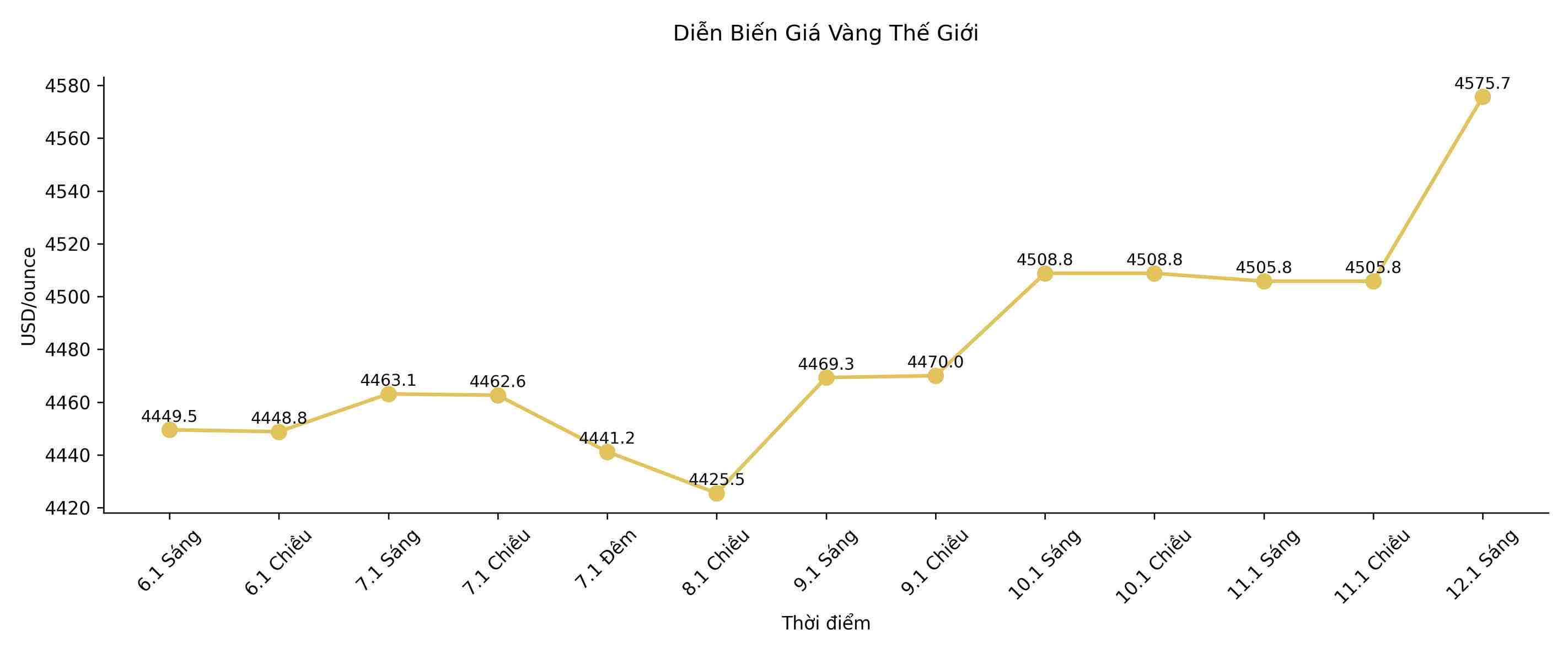

As of this morning's trading session, gold rose 1.7% to 4,585.39 USD/ounce. Bloomberg Dollar Spot fell 0.2%. Silver jumped up 4.6% after rising nearly 10% last week. Palladium and platinum also went up.

Meanwhile, the US Supreme Court has not yet given its opinion on Mr. Trump's tax rates, and is expected to announce a new ruling on Wednesday. A disadvantageous decision could shake Mr. Trump's economic policy and become the biggest legal failure since his return to the White House.