World gold prices continued to climb in Wednesday's trading session, once again setting a new record, while silver broke through the 90 USD/ounce mark - an unprecedented level in history. This development took place after US inflation was announced lower than expected, strengthening confidence in the possibility that the US Federal Reserve (Fed) will soon cut interest rates amid prolonged geopolitical instability.

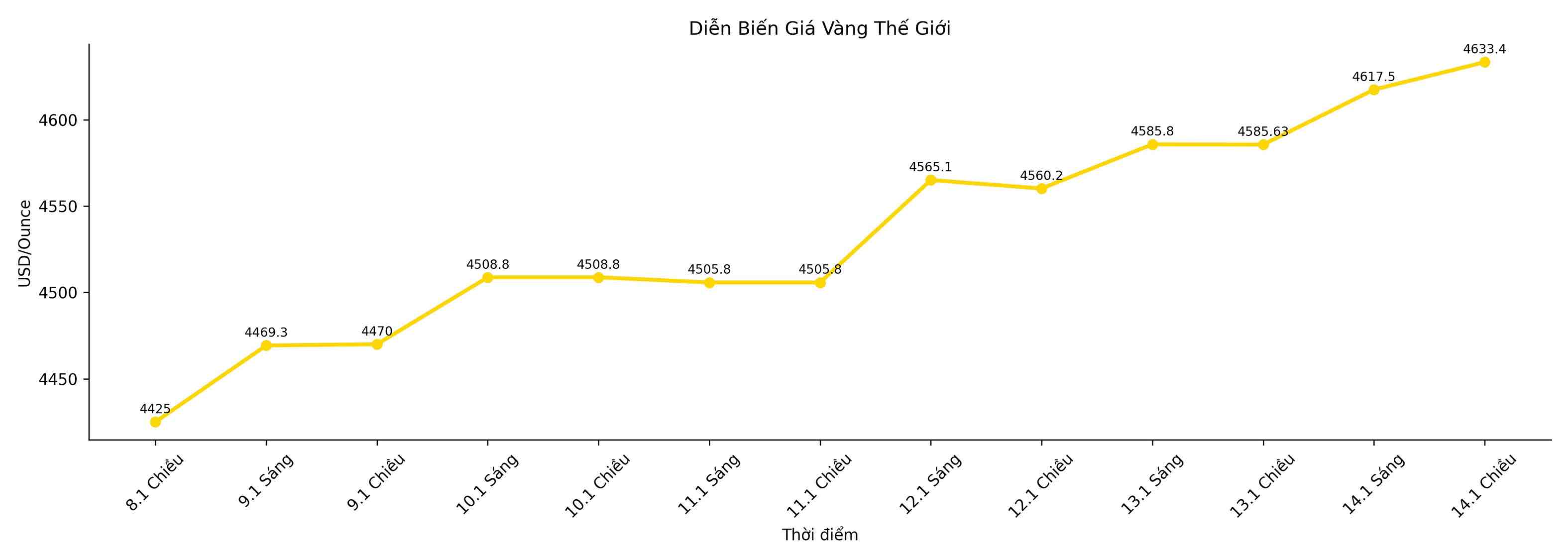

Spot gold rose 1%, to 4,633.40 USD/ounce in this afternoon's trading session, previously hitting a historical peak of 4,639.42 USD. February gold futures on the US exchange rose 0.8%, to 4,640.90 USD.

Spot gold jumped sharply 4.2%, to 90.59 USD/ounce after exceeding the 90 USD mark for the first time. This precious metal has increased by nearly 27% since the beginning of the year.

The US CPI shows that inflation remains at 2.6% compared to the same period - a fairly'pleasant' level. Investors are expecting PPIs to also be similarly moderate to maintain expectations for further monetary policy easing," said expert Tim Waterer of KCM Trade.

Core CPI in December increased by 0.2% month-on-month and 2.6% year-on-year, lower than forecasts of 0.3% and 2.7%. Core US PPI data will be released on the same day.

Previously, a series of central bank leaders and CEOs of major Wall Street financial institutions simultaneously spoke out in support of Mr. Powell, after the Trump administration announced the opening of an investigation into the Fed Chairman, a move that was heavily criticized by former Fed leaders.

According to analysts, concerns about the Fed's independence and the decline in confidence in US assets are pushing cash flow to gold more strongly.

Investors are currently expecting the Fed to have two fundamental 25-point declines this year, with the earliest possibility in June. Non-profit assets like gold often have positive developments when interest rates fall or during periods of economic and geopolitical instability.

ANZ Bank forecasts gold may remain above $5,000/ounce in the first half of 2026.

For silver, the next target is 100 USD/ounce and the double-digit increase is assessed as "completely feasible this year" - Mr. Brian Lan - Director of GoldSilver Central said.