Gold prices fell in Wednesday's trading session as investors took profits after the precious metal hit its highest level in more than a week. The strengthening USD also put pressure on the entire group of precious metals, as the market is waiting for a series of important US jobs data to be released this week.

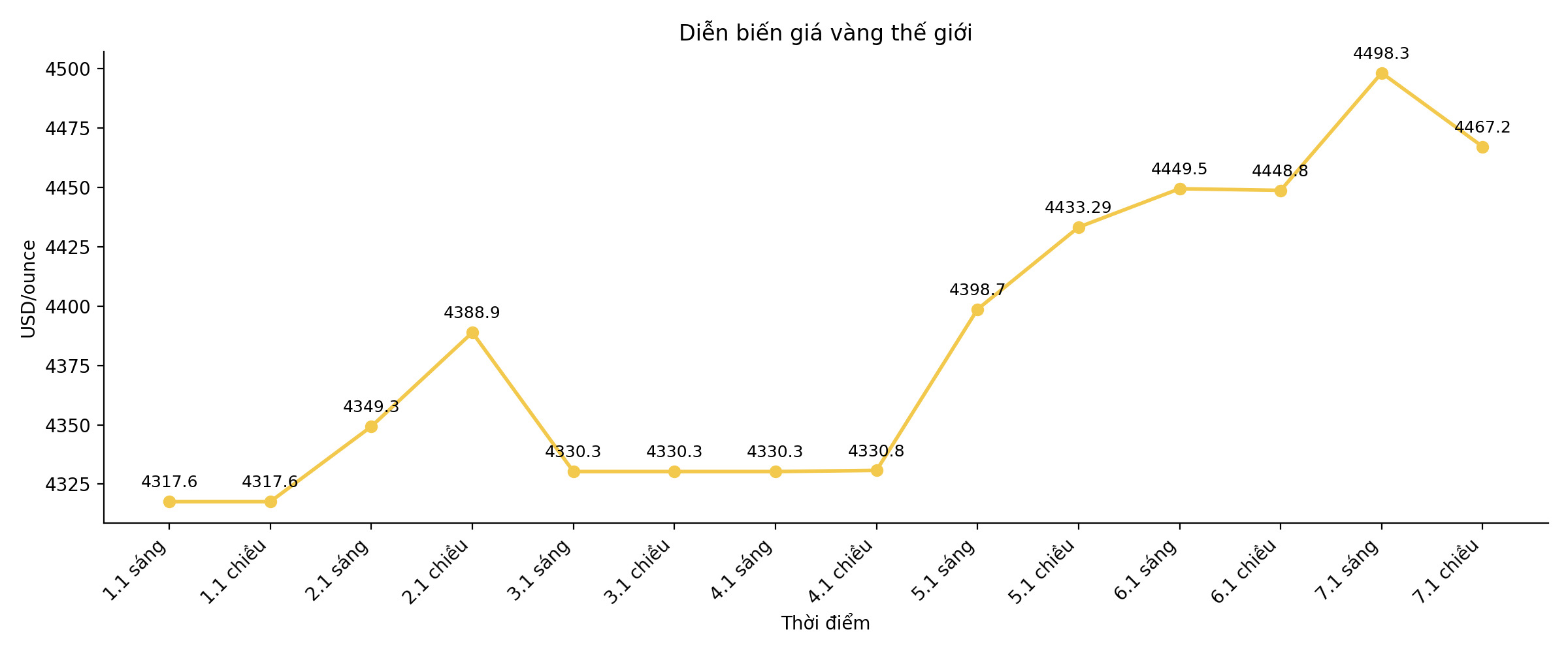

In this afternoon's trading session, spot gold prices fell 1.1% to 4,449.38 USD/ounce. Previously, gold had reached a historic peak of 4,549.71 USD/ounce on Monday last week. Gold futures for February delivery in the US also fell 0.8% to 4,460.50 USD/ounce.

According to Mr. Kyle Rodda, senior financial market analyst at Capital.com, gold price movements are currently not too heavily influenced by fundamental factors, but are mainly dominated by speculation and short-term fluctuations.

The price trend is mostly still in the upward direction, but the market is showing a clear two-way fluctuation," Mr. Rodda said, while saying that the stronger USD is contributing to pulling gold prices down.

In this session, the USD remained near its highest level in more than two weeks, making USD-denominated assets – including gold – more expensive for investors holding other currencies.

Investors are currently expecting the US Federal Reserve (Fed) to cut interest rates at least twice this year, but are still cautious to wait for more signals from upcoming economic data. The focus of the week is the US non-farm employment report on Friday. Previously, the JOLTS survey and the ADP private sector employment report released on Wednesday were also considered factors that could shape market sentiment in the short term.