Gold prices fell below $4,000 an ounce after China ended a multi-year refund policy for some retailers - a move that could affect demand in one of the world's largest precious metals markets.

Spot gold prices fell as much as 1% before recovering much of their day's decline, amid a slump in Chinese jewelry stocks.

Beijing announced on Saturday that it will stop allowing some retailers to receive a VAT deduction when selling gold purchased from the Shanghai Gold Exchange and the Shanghai Foreign Trade Center for Goods, whether selling directly or after processing.

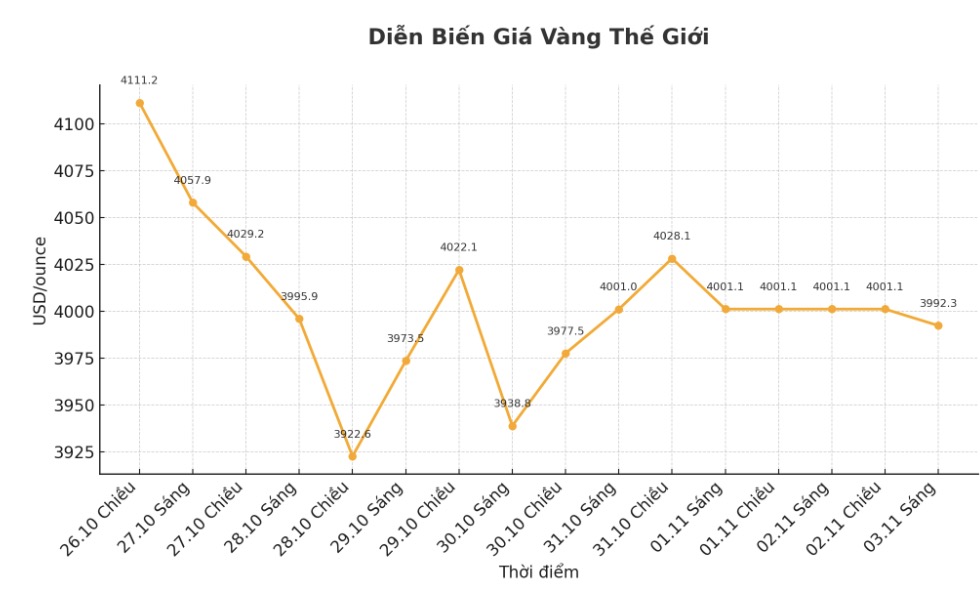

The precious metal surged to record levels in October, fueled by a wave of massive buying from individual investors, before falling sharply in the last two weeks of the month.

Despite the downward adjustment, gold prices have remained on the rise of more than 50% since the start of the year, as many fundamental factors driving the rally including central bank demand and safe-haven demand are expected to continue.

While Chinas gold demand has not played a big role in this years record rally, adjusting tax policy in the worlds largest gold consumer will reduce overall sentiment in the global market, said Adrian Ash, research director at Bullion Vault.

Previously, most enterprises in China were entitled to VAT deductions for input when selling to consumers. However, under the new policy - effective until the end of 2027 - tax incentives only apply to members of the Shanghai Gold Exchange (SGE) and the Shanghai Securities Exchange (SHFE) when they sell gold as investment products.

Conversely, when members and businesses are not members of the non-investment gold producer (such as jewelry or gold used in industry), they are only entitled to a 6% deduction of input VAT when selling to consumers, instead of 13% as before. The regulation also applies to companies that are not members but are still allowed to buy gold directly from exchanges, regardless of their purpose of use.

Spot gold prices fell 0.1%, to $3,997.4 an ounce at 10:31 (Singapore time), after losing 2.7% last week. Bloomberg Dollar spot Index is almost unchanged.

See more news related to gold prices HERE...