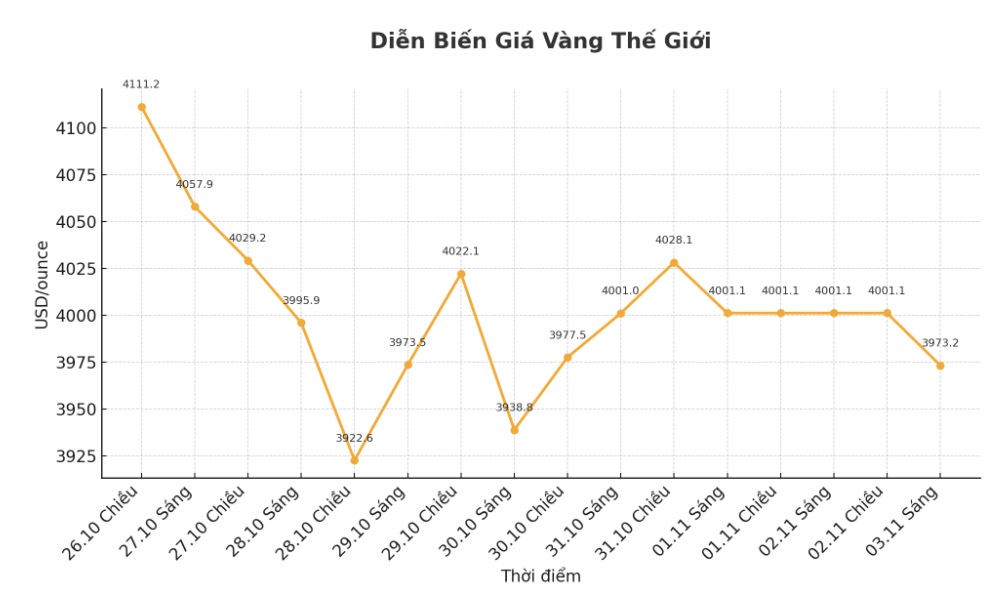

Gold under short-term pressure

Rich Checkan - Chairman and COO of Asset Strategies International - commented that gold prices will fall this week: "Although I believe that the long-term trend of gold will continue to increase, in the short term, gold seems to lack the motivation to break out to new peaks.

Some believe this stems from tensions with cooling down China. Others said that the tougher stance of the Federal Reserve Chairman Jerome Powell has made the market doubt the possibility of a rate cut in December.

Some also believe that this is a profit-taking activity, or even a deliberate effort from speculators to pull gold prices down".

"Whatever the cause, this is only temporary... but I think the adjustment is not over yet. Prepare for the possibility of gold re-testering the below $4,000/ounce zone, Checkan warned.

Meanwhile, Alex Kuptsikevich - senior market analyst at FxPro - said that gold's correction is not over yet.

The strengthening of the US dollar and US bond yields have dragged gold prices below $4,000/ounce. The precious metal is gradually losing its supporting factors, which have helped it set a new record - such as expectations of a Fed easing policy, the risk of a US-China trade war, geopolitical tensions, negative forecasts for the global economy and demand for central banks' gold reserves," he said.

However, the situation has changed: The White House no longer puts as much pressure on the Fed as before, the US and China have found a common voice, the Middle East conflict has calmed down, and the global economy remains strong despite facing tariffs. The Fed is more cautious about cutting interest rates, while central banks are also slowing down gold purchases," he said.

Kuptsikevich compared the current rally to the gold cycles of 1979 and 2011, when prices rose sharply similarly. History shows that after the breakthroughs and then the declines, gold often enters a long accumulation phase. That means after retreating from the peak, gold will find a new stable price zone. However, in the coming weeks, the risk of further declines will still prevail, he said.

The prospect is still very solid

James Stanley - Senior strategist at Forex.com - commented: "Last Friday, spot gold prices returned to above $4,000/ounce, which is a very positive signal after the first sell-off of the week.

Gold's rally over the past two months has been in the form of the parabol, which has since formed a two-peak model and adjusted strongly, but the support level at $3,895/ounce is still holding firm, and buyers are gradually regaining the initiative.

I think the recent sell-off was mainly due to portfolio adjustment activities, but basically, the outlook for gold is still very solid".

Adam Button - Head of currency strategy at Forexlive.com - said that the news last week was unfavorable for gold, but this precious metal remained firm.

Last week was really bad for gold. Between the US-China deal and Fed Chairman Jerome Powell's speech, there is no worse scenario, but gold is still stable around $4,000/ounce," he said.

Although gold has fallen for two consecutive weeks, Button does not think this is the right time to bet against gold, especially at this time of year.

Gold tends to increase strongly seasonally. November to January is the time when gold is usually at its peak. Although prices have increased by 50% this year, the rules of this crop are still very strong and have been true for 10 to 15 consecutive years, he explained.

He said those who are waiting for deeper prices could be disappointed. Everyone wants to buy gold when it drops to $3,500/ounce, but basically, buying is not easy at the moment especially when the US and China are cooling down trade tensions.

However, in the past, every time the two countries welded, there were conflicts only a few months later. Therefore, it is still a risk factor towards increasing gold prices".

Button predicted that gold could re-assess the $3,870/ounce zone before entering the accumulation phase. Trading in the range of $3,800 to $4,300 an ounce would be the best for the market, even if it lasted for a whole year, it would be a good sign. I think there needs to be a big boost to get gold to a new high before the seasonal rally ends," he said.

Michael Moor - founder of Moor Analytics - has the view of "slightly leaning towards increase in the short term, but still in the downtrend since the peak". Moor stressed: "Currently, we may be at the end of the rally."

See more news related to gold prices HERE...