"I remain neutral on gold this week," said Colin Cieszynski, chief market strategist at SIA Wealth Management. I think this precious metal still needs more time to accumulate and move sideways."

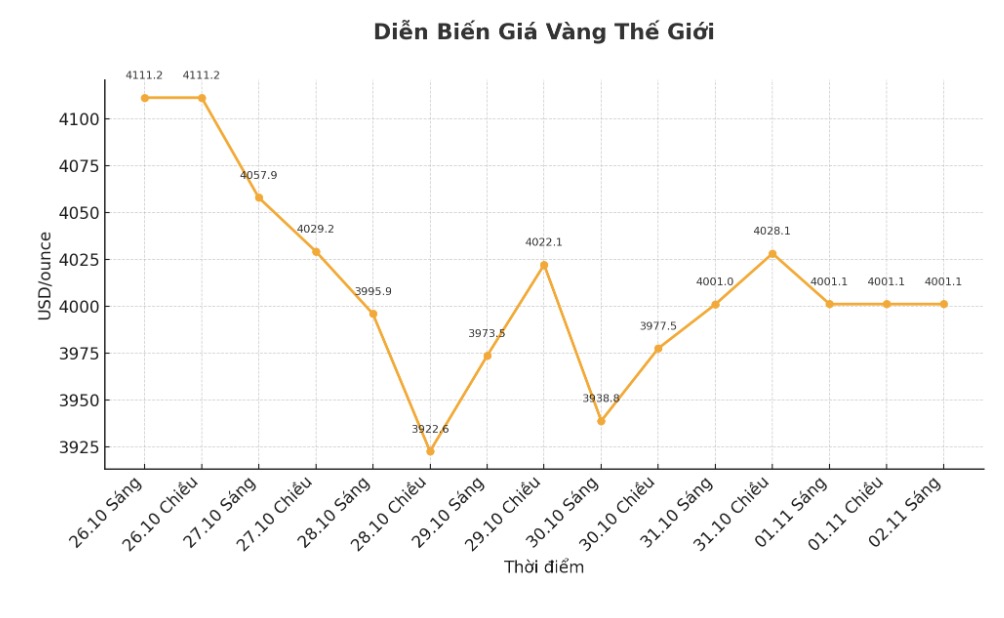

Marc Chandler, managing director at Bannockburn Global Forex, said gold has expanded its correction early last week, as spot prices fell to around $3,886 an ounce.

Although prices have stabilized in recent days despite rising US bond yields and the US dollar, gold has yet to regain its previous appeal. I think that if the price exceeds 4,075 USD/ounce, it will attract new buying pressure. Conversely, if the bottom is cracked recently, the sell-off could take prices down further, to around $3,750/ounce, he said.

Meanwhile, Daniel Pavilonis - Senior Commodity Broker at RJO Futures analyzed the impact of the US Federal Reserve's policy orientation on gold and other precious metals last Friday.

The biggest impact is the Feds saying December is not a certain time to cut interest rates. The probability of FedWatch cutting interest rates has dropped from 93% to around 60%. Yesterday it increased to over 70%, but this morning it decreased to 62%, almost completely disappearing.

It is too early to say that the Fed meeting has just ended - but I think they are temporarily satisfied with the current situation, he said.

However, Pavilonis warned that the economy still has many challenges this year. We are entering the profit announcement season, the government is closing down, and tariff policies are constantly changing.

The Fed is in a dilemma: If we cut interest rates to support the labor market, it could cause inflation which we are still facing. Although the FED affirmed that the policy is still restrained, the economy still seems to be operating quite well, despite the phenomenon of job loss in some areas related to AI and the office sector. The main problem is what happens with the government's shutdown," he said.

According to Pavilonis, no matter how fluctuates the Fed, trade or tariffs, the overall picture of gold and the precious metal group remains unchanged.

In the long term, I believe gold and silver will continue to increase. When China announced a ban on rare earth exports, silver, platinum, and palladium all increased sharply.

Currently, it is only a temporary break and a sidewalk. Gold has also been flat for four months from January to April and a similar scenario could be repeated, Pavilonis said.

See more news related to gold prices HERE...