After seeing gold prices increase sharply, becoming a safe haven amid the growing wave of uncertainty, the former advisor of the US Federal Reserve (FED) on Tuesday gave a serious warning, saying that a "systematic liquidity crisis" is quietly taking place.

This is also a development that, according to her, will force the FED to abandon the fight against inflation, not because it has won, but because the financial system itself is showing signs of cracking.

This warning was issued in the context of the financial market showing clear paradoxes. In the session on Tuesday, the Dow Jones industrial index increased by more than 200 points, supported by positive business results of businesses such as General Motors and Coca-Cola, helping the S&P 500 approach the historical peak.

However, the optimistic picture in the stock market is completely opposite to the increasing pressure in the bond and commodity markets, where signs of liquidity tensions are gradually emerging.

Danielle DiMartino Booth, who was an advisor to former FED branch Chairman Dallas, Richard Fisher, during the 20062015 period, said that the current market phase difference cannot be maintained long term.

Booth, who is now CEO of QI Research, a macroeconomic consulting firm, has long been a staunch critic of the Fed's policies. According to her, the Fed's decision-making streak over the years has dug deep into the structural weaknesses in the financial system, causing potential risks to accumulate.

In an interview with Kitco News, she said: "It's clear that the system is running out of liquidity, and the Fed will be forced to suspend its game."

Booths comments mentioned the Feds quantifying policy a liquidity withdrawal program from the financial system by keeping a maximum of $95 billion in government bonds and mortgaged stocks maturing each month without reinvesting them.

The scenario of March 2020 is repeating

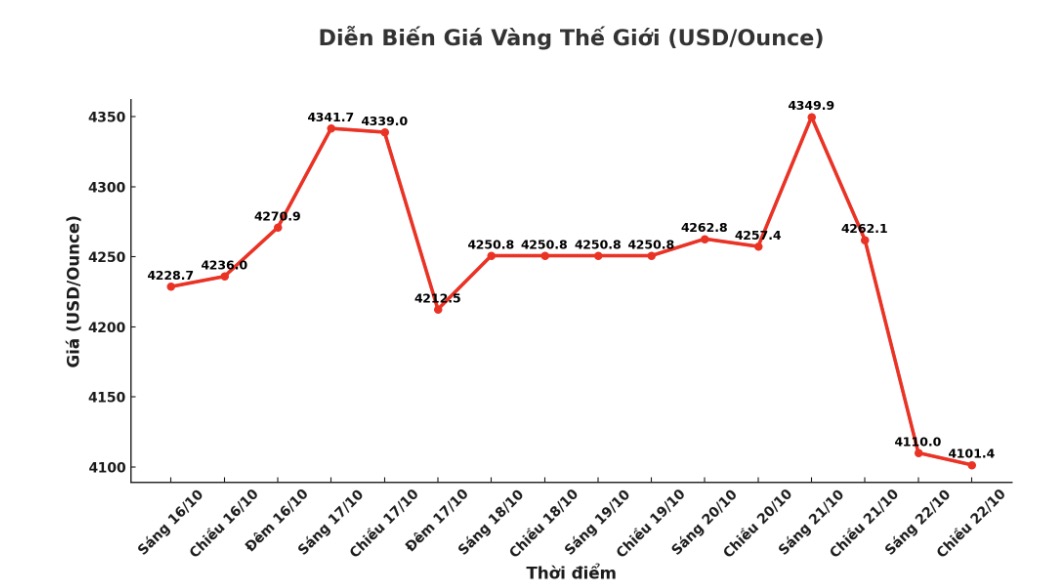

Danielle DiMartino Booth's assessment was made in the context of gold prices falling the most in 5 years, losing more than 5% to nearly 4,125 USD/ounce after just setting a historic peak of over 4,380 USD/ounce a day earlier.

She said that this is not a fundamental return to gold, but a sign of forced sell-off, as the market enters a wave of "selling to collect cash" - a phenomenon that occurred during the chaotic period at the beginning of the COVID-19 pandemic.

I think what we are seeing right now is a repeat of March 2020, Booth said. In that context, investors who are called to deposit or need to mobilize money urgently often have to sell assets with high liquidity and the highest profit.

When liquidity becomes a problem, they will sell the assets that win the most, she explained, warning that this type of volatility is not a healthy sign for gold.

Cowards in the credit market

The focus of Booth's warning is on the private credit market - a sector that has exploded to more than $1.7 trillion but operates beyond the strict scrutiny of regulators. She said that loose appraisal standards during the period of super low interest rates are making this area a potential source of spreading risk.

Booths comments reinforce recent warnings from global financial leaders. On Tuesday morning, Governor of the Bank of England Andrew Bailey, in a hearing before the National Assembly, compared US private credit failures to the sub-standard debt crisis of 2007. Both the Fed and the IMF have highlighted the sector's rapid growth as a potential systemic risk.

Booth commented: "If bankruptcies in the private credit market are occurring, it shows that banks have not fully appraised and managed risks during the period of abundant cash flow."

According to her, these are not isolated incidents, but manifestations of systemic problems, similar to the recent warning of JPMorgan Chase Jamie Dimon when comparing that in the financial system, a crow rarely appears alone.

If lending standards are looser than they should be, as Jamie Dimon said, we will soon see more competators, Booth stressed.

She said this risk is spreading throughout the consumer lending segment, in the context of US household debt reaching a record of 18.4 trillion USD, while the rate of bad credit card and car purchase loans all increased beyond pre-pandemic levels.