Gold prices rose more than 2% in the trading session on Wednesday, extending the strongest increase since 2008 in the previous session, as bottom-fishing buying along with the weakening USD supported the precious metal.

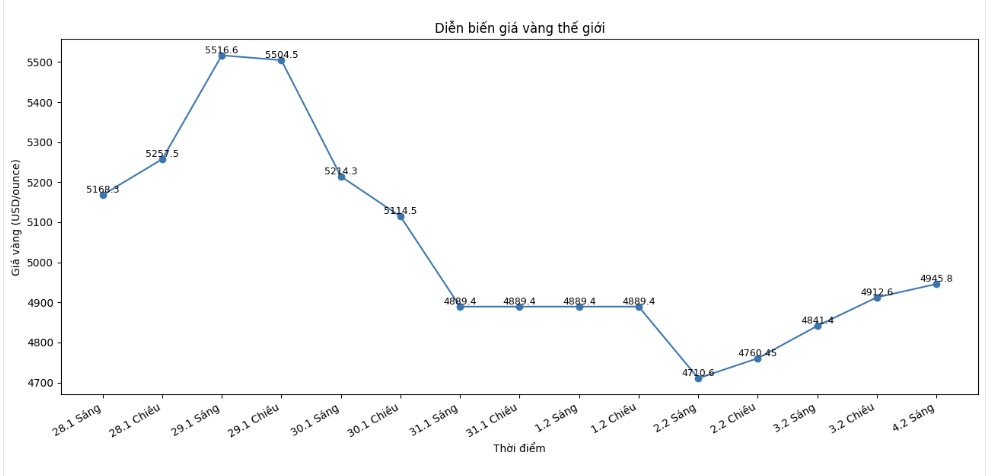

Spot gold prices rose 2.2% to $5,044.74/ounce in this morning's trading session, after rising 5.9% in Tuesday's session – the largest intraday increase since November 2008. Previously, gold had hit a record high of $5,594.82/ounce last Thursday.

US gold futures for April delivery rose 2.7%, to $5,067.0/ounce.

The USD depreciated against most major currencies, except the Japanese yen, on Tuesday, as traders adjusted after a recent rally boosted by positive US economic data and expectations that the US Federal Reserve (Fed) would be less moderate.

The weakening USD makes greenback-valued metals cheaper for holders of other currencies.

Also on Tuesday, US President Donald Trump signed a spending agreement, ending the partial shutdown of the US government.

The January jobs report – which is closely monitored by the market – will not be released this Friday due to the impact of the government shutdown.

Investors are increasing bets on rising long-term US Treasury bond yields and sharper yield curves, as upcoming Fed Chairman Kevin Warsh is expected to push for interest rate cuts, while narrowing the balance sheet of the US central bank.

Investors are currently expecting at least two Fed interest rate cuts in 2026, while waiting for ADP private sector jobs data to be released on the same day to have more clues about the policy roadmap. Gold – non-performing assets – usually perform better in a low-interest environment.

Reuters technical analyst Wang Tao said that the current wave of increase is forecast to be fast and strong, with the possibility of gold prices jumping to the 4,950–5,198 USD/ounce range.

On the other metal market, spot silver prices rose 2.1% to 86.92 USD/ounce, after setting a record high of 121.64 USD/ounce on Thursday.

Platinum prices rose 2.3% to $2,260.50/ounce, after hitting a historic peak of $2,918.80/ounce on January 26; while palladium rose nearly 3%, reaching $1,782.85/ounce.