The adjustment in recent sessions has quickly attracted bottom-fishing buying power, while the silver market is forecast to still fluctuate strongly, according to analysts.

Gold prices recorded the strongest intraday increase since 2008 on Tuesday, after experiencing a two-day fierce sell-off. The reason came from US President Donald Trump's nomination of Mr. Kevin Warsh as Chairman of the Federal Reserve (Fed), the stronger USD and investor profit-taking activity.

Inflation is still much higher than the target, public debt is increasing, and investors continue to see precious metals as a channel for portfolio diversification, avoiding stocks, bonds and legal tender currencies," said Bart Melek, Head of Commodity Strategy at TD Securities.

UBS and JP Morgan forecast that gold prices could reach 6,200-6,300 USD/ounce by the end of this year, while Deutsche Bank believes that gold prices will rise to 6,000 USD. Citi maintains the base scenario for 2026, with a Q1 average price of about 5,000 USD/ounce.

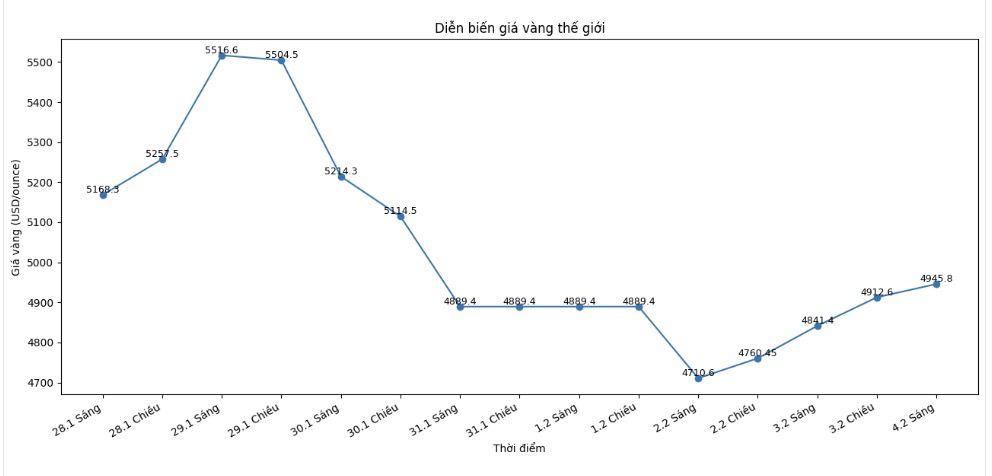

Gold and silver once set records at 5,594.8 USD and 121.6 USD/ounce on January 29 before turning down. Gold prices alone plummeted 9.8% in Friday's session - the sharpest drop in 43 years, according to LSEG data.

Analysts believe that this is a necessary and healthy correction.

The physical gold market will play a key role in establishing a price level, especially after the Lunar New Year holiday," said Suki Cooper, an analyst at Standard Chartered, referring to the major holiday in China from mid-February.

Investment demand, including from small investors, is becoming the main driving force driving gold prices up, in the context of other factors such as jewelry demand and buying from central banks showing signs of slowing down.

We forecast that gold prices will continue to fluctuate strongly, although the conditions for a significant increase this year are still there," said Philip Newman, Director of Metals Focus consulting company, and also believes that gold prices may exceed the 5,500 USD/ounce mark.

Silver fluctuations are even more intense due to the small market size. Silver prices have fallen sharply after hitting a peak of 121.6 USD/ounce last Thursday. The upward momentum in January was mainly driven by trend trading and large cash flow from individual investors.

According to Mitsubishi analysts, concerns about US tariff reductions after the important mineral review in mid-January, along with reduced supply in London, have caused silver to lose its important upward momentum last year.

However, the cooling down of silver prices after setting a record is considered positive for industrial demand, due to reducing cost pressure on the profit margin of solar panel manufacturers.

See more news related to gold prices HERE...