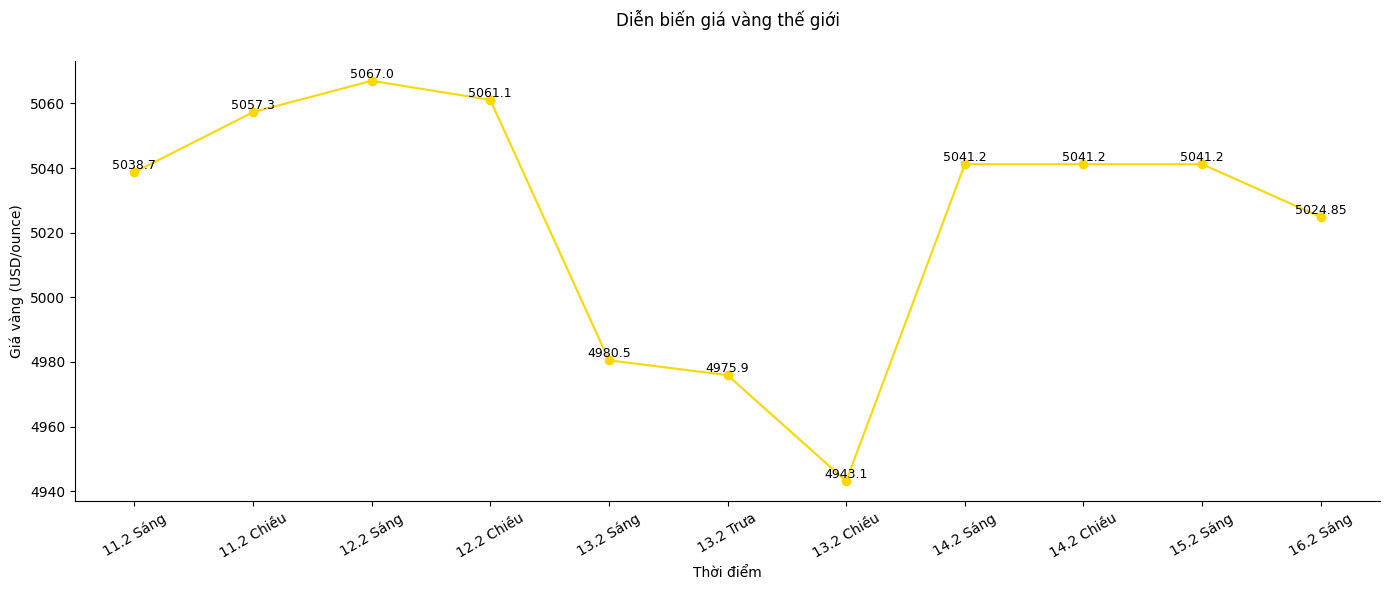

Gold prices fell as investors took profits after slight US inflation data pushed the precious metal back above the 5,000 USD/ounce mark.

Gold prices at one point fell as much as 0.8% on Monday, after rising 2.4% in the previous session. The US consumer price index (CPI) increased 0.2% in January, thereby easing concerns about a stronger increase and strengthening the basis for the US Federal Reserve (Fed) to cut interest rates. Low lending rates are often beneficial for non-yielding precious metals.

In China, the market closed this week due to the Lunar New Year holiday. The demand for precious metals in this country has been vibrant in recent months, prompting authorities at the Shenzhen retail center to issue a strict warning about "illegal gold trading activities", from leverage applications for individual investors to online live broadcasts promoting gold sales.

With China and some other Asian markets on holiday, the gold market is likely to see thinner liquidity and quieter developments in the early sessions of the week," said Hebe Chen, an analyst at Vantage Markets in Melbourne. According to her, recent price fluctuations reflect a process of "orderly accumulation and slight profit-taking" after gold prices surpassed the $5,000 mark thanks to US inflation data released on Friday.

Gold prices soared to a record high of over 5,595 USD/ounce at the end of January, as a speculative buying wave pushed the long-term upward momentum to a hot spot. A sudden sell-off lasting two days at the time of the transition month caused prices to fall below 4,500 USD/ounce, but since then, gold has regained about half of its decline in a volatile trading context.

Many banks believe that gold will soon resume the upward trend, arguing that the underlying drivers of the multi-year rally are still present, including geopolitical tensions, doubts surrounding the Fed's independence, as well as a shift away from traditional assets such as currency and government bonds. ANZ Group Holdings Ltd. forecasts gold prices could reach $5,800/ounce in the second quarter, joining the group of financial institutions that offer higher price outlooks.

Structurally, this metal still shows good resistance - the macroeconomic context is generally solid but not disruptive, while technical support thresholds are still maintained" - Ms. Chen said.

In this morning's trading session, spot gold prices fell 0.6% to 5,012.44 USD/ounce. Silver fell 1% to 76.66 USD/ounce. Platinum and palladium also traded slightly down. The Bloomberg Dollar Spot index – a measure of the strength of the USD – rose 0.1%.