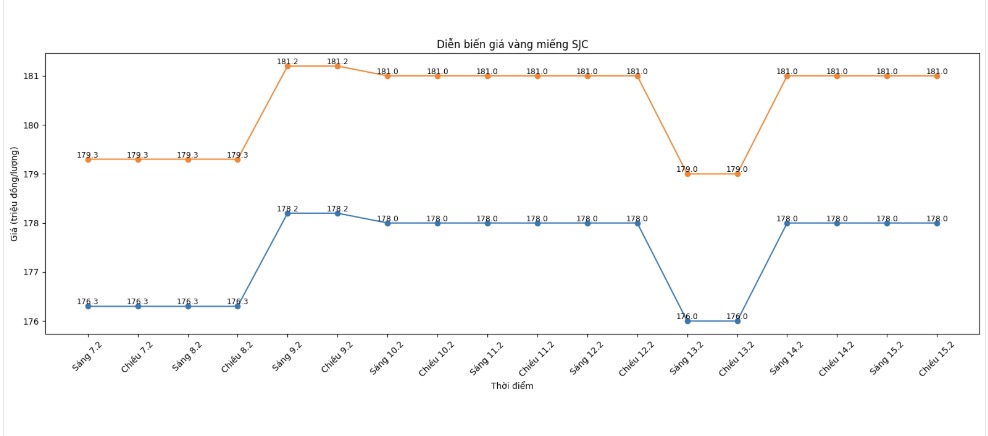

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

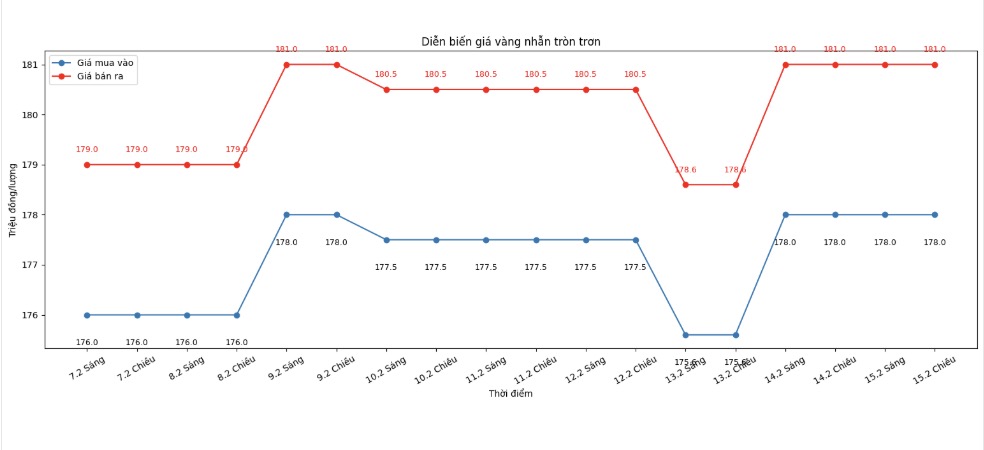

9999 gold ring price

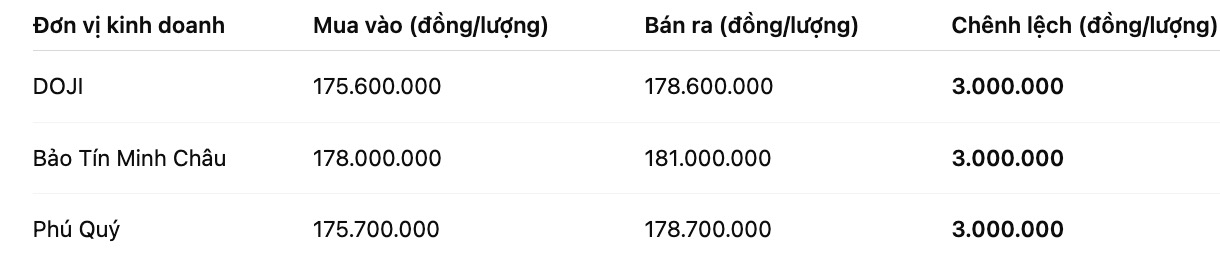

As of 6:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

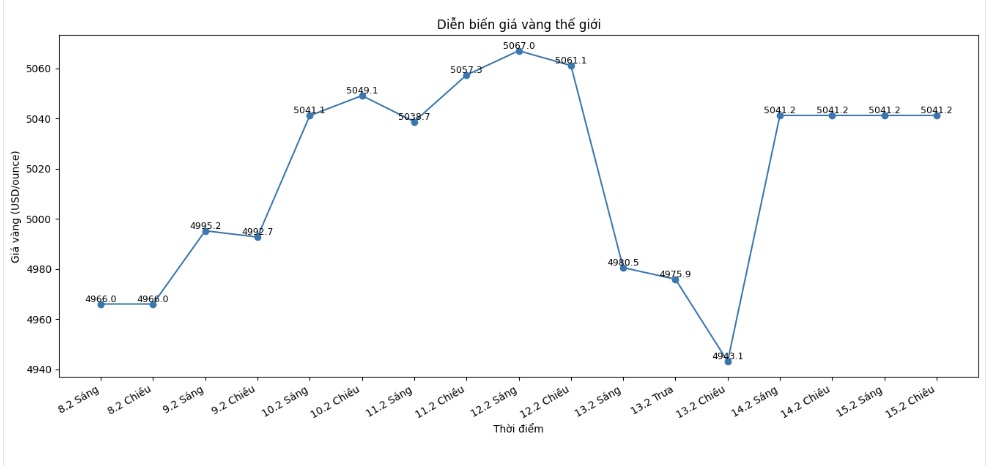

World gold price

At 6:00 AM, world gold prices were listed around the threshold of 5,041.2 USD/ounce.

Gold price forecast

The latest weekly gold survey shows a clear differentiation between experts and individual investors. Most Wall Street experts maintain a cautious attitude towards the short-term outlook of gold prices, while small investors still lean towards optimistic scenarios, despite volatile trading weeks.

This week, 12 analysts participated in the survey. After another week of strong price fluctuations, the certainty level of the Wall Street expert group decreased. 4 experts (33%) expect gold prices to continue to exceed the 5,000 USD/ounce mark this week; 3 people (25%) forecast prices to decrease. The remaining 5 analysts (42%) believe that the risk of increase - decrease is relatively balanced or prices may continue to accumulate.

Meanwhile, the online poll recorded 257 opinions from the Main Street investor group. Overall sentiment is stable as 163 traders (63%) predict gold prices will increase this week; 52 people (20%) believe prices may weaken, and 42 people (17%) believe the market will move sideways.

James Stanley - senior market strategist, emphasized that buying power has quickly returned after a strong sell-off last weekend. According to him, corrections continue to be seen as an opportunity in the context that no signals are strong enough to "go against the trend".

Agreeing with this view, Darin Newsom - senior market analyst at Barchart. com said that gold and silver are still in an upward trend, despite warning that the market may continue to experience periods of strong volatility. He also linked price movements to geopolitical contexts, as the need to hold defensive assets can be strengthened in an uncertain environment.

Adrian Day - Chairman of Adrian Day Asset Management maintains a positive stance, assessing that the gold market is undergoing a slow and unstable recovery process, but fundamental factors are still maintained.

From a technical perspective, Kevin Grady - Chairman of Phoenix Futures and Options noted that the level of open contracts on CME has decreased sharply compared to the recent peak, reflecting the shift of speculative capital flows to small-scale contracts. According to him, this structure may be one of the reasons for increased price volatility.

Looking ahead, experts believe that gold is likely still supported by expectations of monetary policy easing from the US Federal Reserve (Fed). Market data currently leans towards a scenario of interest rate cuts in the second half of the year - a factor that is often beneficial for non-performing assets like gold.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...