Although many forecasts lean towards positive scenarios, experts still recommend investors to be cautious before the possibility of new sources of fluctuations appearing.

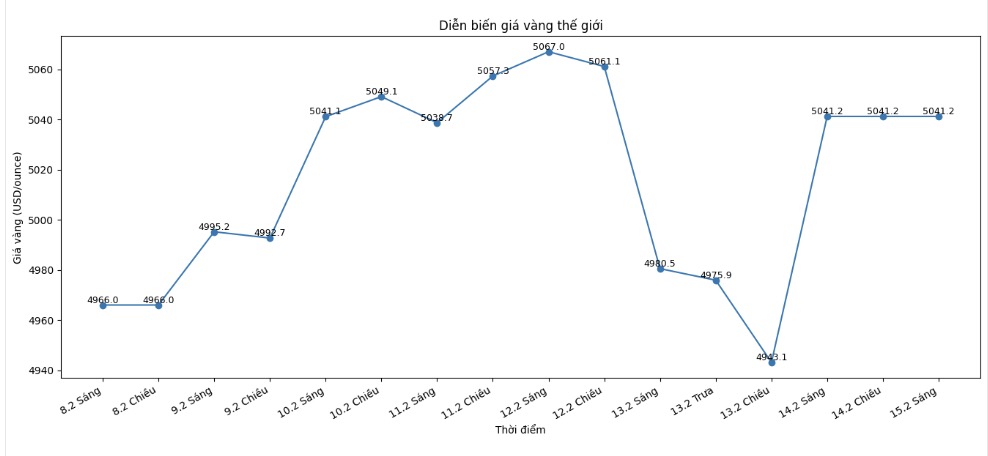

Marc Chandler - CEO of Marc Chandler - said that gold is in a sideways phase after being blocked from the upward momentum in the middle of the week.

Gold prices closed the week at a higher level than a week ago, but the widespread accumulation trend continued. This precious metal was blocked around the 5,120 USD/ounce mark in the middle of the week and formed a small bottom zone of nearly 4,880 USD/ounce" - he assessed.

According to the leader of Bannockburn Global Forex, the accumulation process may end upwards, although the risk of prolonged tug-of-war is still present. "I think the accumulation process will end upwards, but the risk is that the state of tug-of-war may extend further," he said.

Marc Chandler also noted that economic data that could cause strong volatility has temporarily subsided in the next few weeks. However, the market may face a new source of volatility from legal factors. "The US Supreme Court ruling on the president's use of emergency power to impose tariffs may be released later this week," he said.

From another perspective, Jim Wyckoff - senior analyst at Kitco, said that Thursday's fleeting sell-off still has no convincing explanation. According to him, many hypotheses are put forward from CPI rumors, concerns related to AI to profit-taking pressure, but no reason is strong enough.

Technically, Wyckoff assessed that buyers on the April gold contract are aiming to close above the strong resistance level of 5,250 USD/ounce. Conversely, sellers are seeking to pull prices down below the important support zone of 4,670 USD/ounce - the bottom of last week.

Notable milestones given by this expert include near resistance at 5,016.4 USD/ounce and 5,100 USD/ounce. Meanwhile, near support is at 4,900 USD/ounce and 4,800 USD/ounce.

Currently, many opinions believe that gold price movements are affected by monetary policy expectations, especially from the US Federal Reserve (FED). Data compiled by the London Securities Exchange Group (LSEG) shows that the market currently forecasts a total interest rate cut of about 63 basis points this year, with the first cut possibly taking place in July. Gold - an unprofitable asset - often benefits in a low interest rate environment.

In addition, a mid-week report showed that the US created 130,000 jobs in January, significantly higher than analysts' forecast of 70,000. This data partly eases concerns about economic weakness, but also makes the market more cautious about the pace of monetary easing.

In Asia, China's gold demand remained strong before the Lunar New Year holiday, while the Indian market switched to discounted status.

In the latest report, ANZ analysts raised their Q2 gold price forecast to $5,800/ounce, from $5,400/ounce previously. The bank emphasizes the role of gold as a "life insurance" asset in the context of uncertainty.

ANZ also noted that silver - although still supported by investment demand - may lose its recent dominance as industrial buyers become cautious in the face of high prices.

See more news related to gold prices HERE...