Gold and silver prices plummeted sharply on Thursday, amid widespread global financial market sell-offs. The rise of the USD to a nearly two-week high, along with signals that US-China trade tensions are cooling down, has added pressure on the group of precious metals.

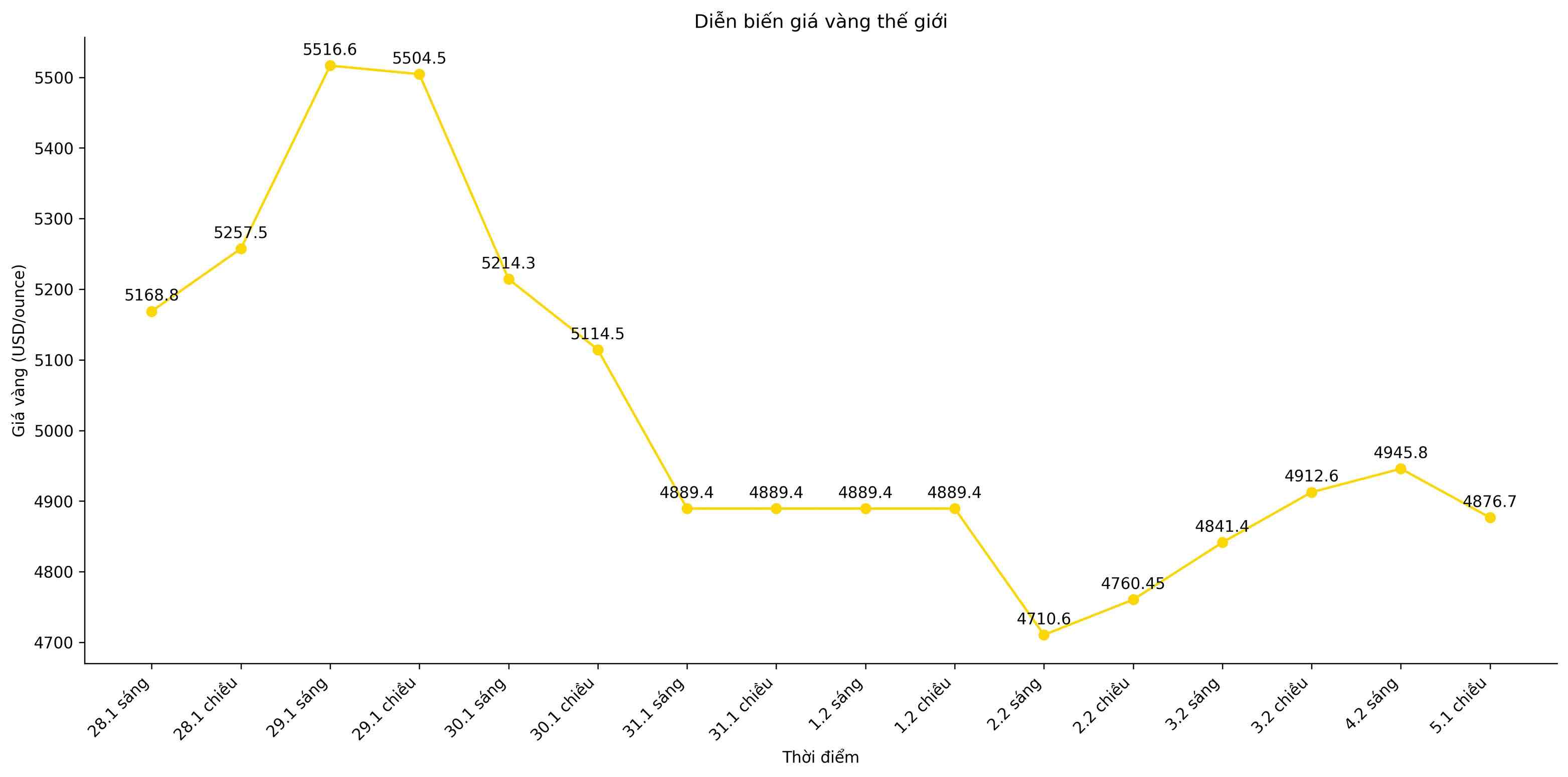

Spot gold prices fell 2.5%, to 4,867.07 USD/ounce in this afternoon's trading session, far behind the nearly weekly high recorded earlier in the session.

Gold futures for April delivery in the US also fell 1.9% to 4,855.60 USD/ounce.

The USD is revitalized thanks to the nomination of Mr. Kevin Warsh to the position of Chairman of the US Federal Reserve (Fed), and the currency continues to maintain its upward momentum. In the context of recent extreme volatility, traders are becoming more cautious with gold," said Tim Waterer, Head of Trading Analysis at KCM.

The USD index (.DXY) rose to a nearly two-week high on Thursday, making gold – which is valued in USD – more expensive for investors holding other currencies.

Market sentiment has worsened on most types of assets, from precious metals, cryptocurrencies to regional stocks. The declines are amplifying each other, creating a negative feedback loop in conditions of thin market liquidity," said Christopher Wong, strategist at OCBC.

Asian stocks also weakened, following the downward trend of Wall Street, as concerns about rising AI investment costs continued to put pressure on technology stocks.

Spot silver prices plummeted by 14.9%, to 74.94 USD/ounce. Just a week earlier, this precious metal had set a historical peak at 121.64 USD/ounce.

Industrial demand has disappeared at high prices. Most industrial customers have stopped buying silver, and even solar panel manufacturers in China are looking for alternatives," Mr. Shah said.

If geopolitical tensions and the trend of dedollarization are temporarily removed, the room for metal prices to rise is very limited," said Kunal Shah, Head of Research at Nirmal Bang Commodities (Mumbai).

In other precious metals, spot platinum prices fell sharply by 8.7%, to 2,033.35 USD/ounce, after setting a historic peak of 2,918.80 USD/ounce on January 26. Meanwhile, palladium prices fell 5.8%, to 1,672 USD/ounce.