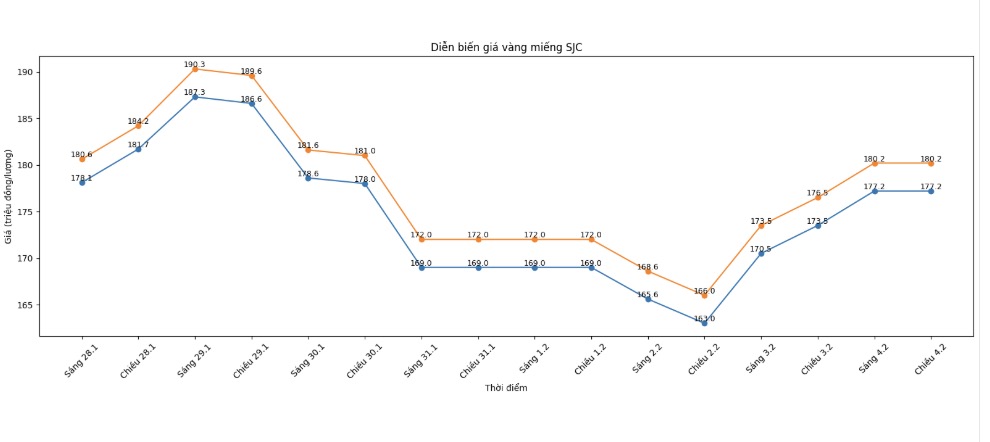

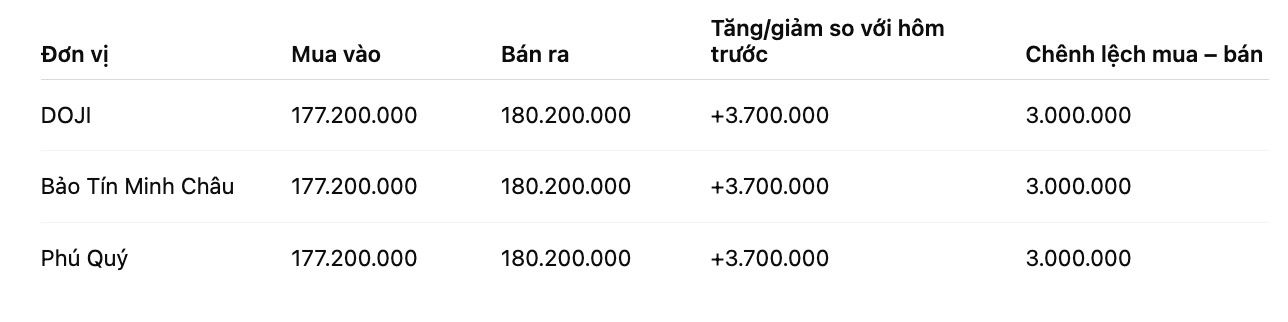

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 177.2-180.2 million VND/tael (buying - selling); an increase of 3.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 177.2-180.2 million VND/tael (buying - selling); an increase of 3.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 177.2-180.2 million VND/tael (buying - selling); an increase of 3.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

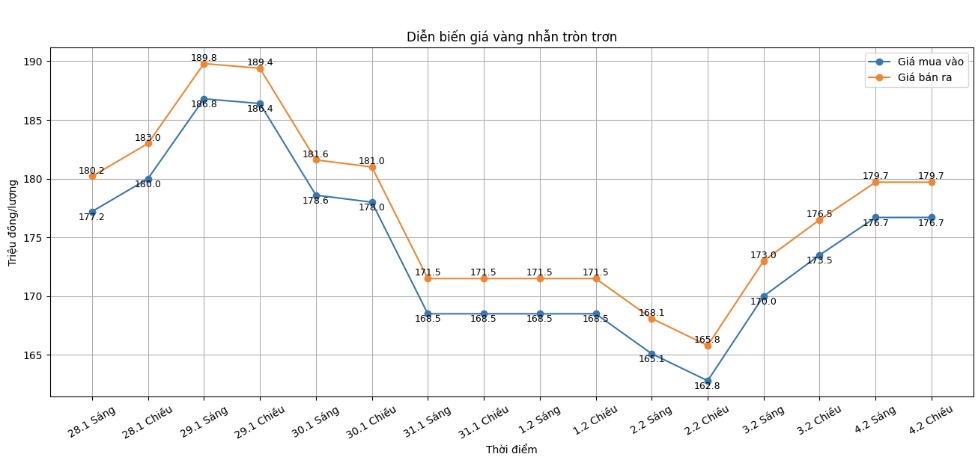

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 176.7-179.7 million VND/tael (buying - selling); an increase of 3.2 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 177.2-180.2 million VND/tael (buying - selling), an increase of 3.7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 177.2-180.2 million VND/tael (buying - selling), an increase of 4.2 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

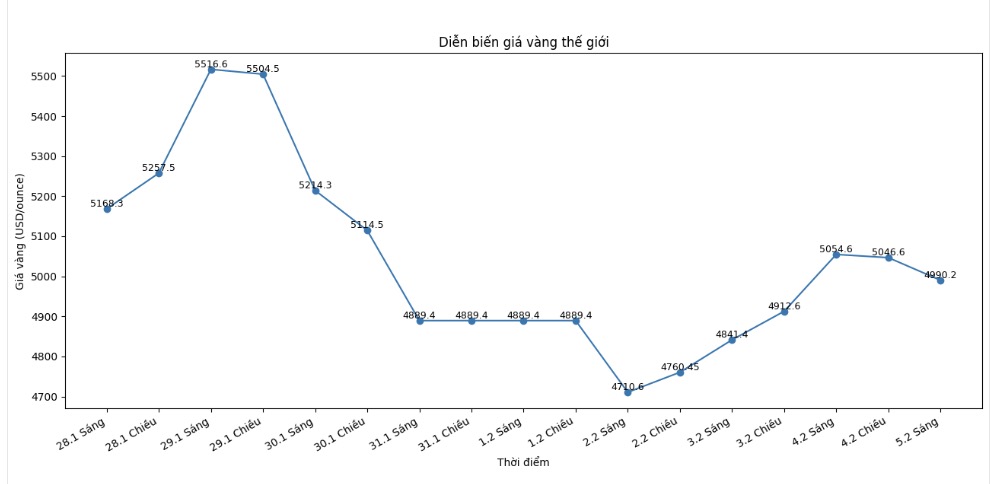

World gold price

At 6:05 AM, world gold prices were listed around the threshold of 4,990.2 USD/ounce; up 44.4 USD compared to the previous day.

Gold price forecast

Gold slightly increased, silver increased, but both decreased sharply compared to the solid increase in the night. Profit-taking pressure from short-term futures contract traders is a prominent factor.

The recovery of the USD index is also a disadvantageous factor from the outside market for the precious metal. The most recent April gold contract increased by 14.3 USD, to 4,947.00 USD. The March silver price increased by 3.314 USD, to 86.57 USD.

Also worrying for the "bull" side of gold, Bloomberg said that major gold ETFs in China recorded the largest daily net withdrawal ever on Tuesday - a total of nearly 1 billion USD - as investor confidence was shaken by the sudden correction of gold after hitting a historic peak. The four largest physical gold ETFs in mainland China witnessed net withdrawal of about 6.8 billion yuan (equivalent to 980 million USD) on Tuesday, according to Bloomberg data. This is the second consecutive day of decline for Huaan Yifu, Bosera, E Fund and Guotai ETFs, just a few days after they recorded record capital inflows last week.

Technically, the April gold futures contract last week formed a "key reversal" pattern downwards on the daily chart. This is an important technical signal showing that the market may have created a short-term peak, although the overall upward trend has not been completely denied. This is reflected in the market ranking by Wyckoff at 6.5, showing that buyers are still holding a relative advantage, but this advantage is no longer overwhelming and the market has entered a sensitive phase with corrections.

In the short term, the price increase target of the buying side is to create a closing session exceeding the strong resistance zone at 5,250 USD/ounce. In the opposite direction, the selling side is aiming to push the price down below the important technical support zone at the bottom of this week, around 4,423.20 USD/ounce. In the immediate future, the near resistance levels are at 5,000 USD/ounce and 5,113.90 USD/ounce respectively (the peak formed in the night trading session). The near support levels are determined at 4,900 USD/ounce, followed by 4,800 USD/ounce.

Key external markets today showed the USD index up, while crude oil prices fell slightly, trading around 63.25 USD/barrel. The yield on 10-year US Treasury bonds is currently at 4.28%.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...