Gold and silver prices continued to fall in the second session, as investors prepare for the annual rebalancing of commodity indices – a development that could lead to the sale of billion-dollar futures contracts in the next few days.

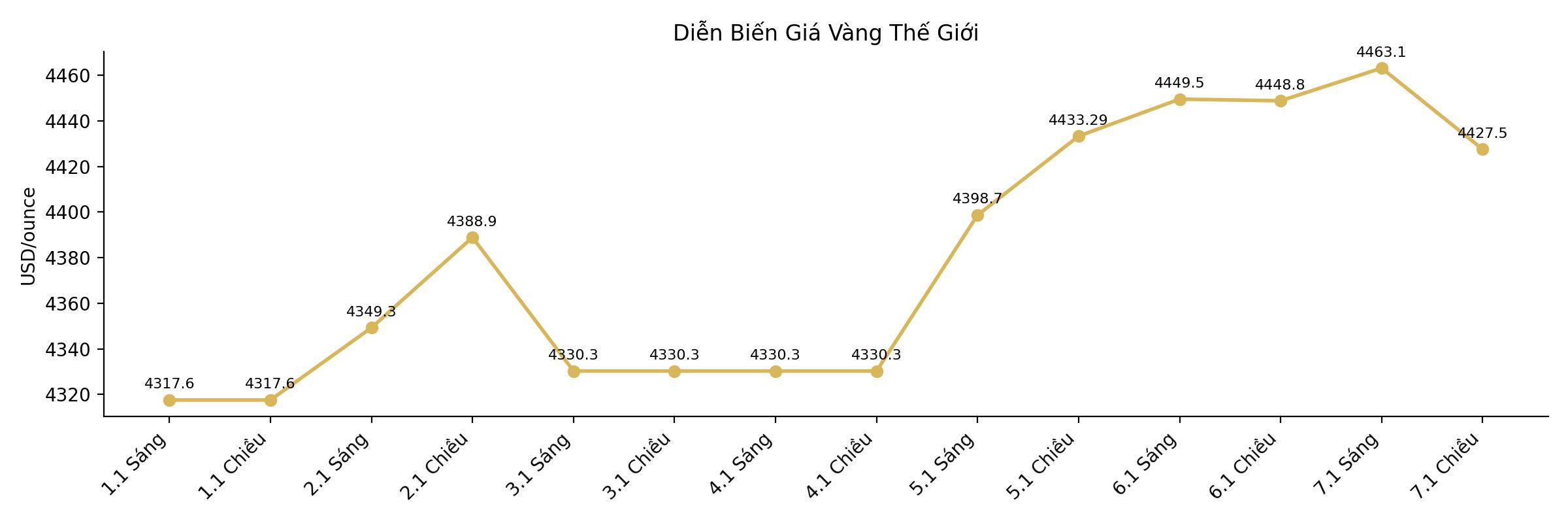

Spot gold fell below $4,427.53/ounce, previously losing nearly 1% in the next session. Passive funds following the index began selling precious metal futures from Thursday to adjust to a new weight structure - a process that was once annual but this year has become more noteworthy due to the hot increase in gold and silver in the previous year.

Silver fell more than 3% on Thursday, especially easily affected by strong selling pressure, considering recent fluctuations. Citigroup estimates that about 6.8 billion USD of futures silver contracts could be sold to meet rebalancing requirements, equivalent to about 12% of the total number of positions opened on the Comex exchange.

Selling from gold futures contracts is forecast to be on a similar scale, according to Citigroup, based on Bloomberg Commodity Index and S&P Goldman Sachs Commodity Index tracking funds. This pressure stems from the sharp increase in the weight of precious metals in commodity baskets.

I have followed this process closely for many years, and have never seen a flow as large as this time," said Kenny Hu, a strategist at Citigroup.

Although prices may be under short-term pressure, gold and silver have not yet shown signs of strong correction, after recording the best increase since 1979. Both continuously set new records in the past year thanks to strong buying power from central banks and capital flows into gold ETF funds.

According to the World Gold Council (WGC), total net gold purchases of central banks reached 45 tons in November, according to a report on January 6. The People's Bank of China also extended its gold buying streak to 14 months, according to data released on Wednesday, showing that official demand is still an important pillar for precious metals.

Geopolitical tensions escalating around Sino-Japanese trade relations and the US arrest of Venezuelan leader Nicolas Maduro also contributed to supporting gold in recent days. As of Wednesday's closing session, gold increased by about 3% this week.

Now, investors are focusing their attention on a series of important US economic data to be released on Friday, including the December jobs report. Weaker than forecast data may reinforce expectations that the US Federal Reserve (Fed) will accelerate the interest rate cut roadmap – a factor that benefits the unprofitable precious metal.

The upward momentum of silver was about 150% last year, even more spectacular than gold. The market once experienced a historic "short squeeze" in October, and the white metal also benefited from concerns that the US may impose import tariffs in the future.

The index rebalancing may "hide the upward momentum in the short term, but in the long term, silver still has more momentum," said David Wilson, Commodity Strategy Director of BNP Paribas.

As of this afternoon's trading session, gold fell 0.7% to 4,424.54 USD/ounce. Silver fell 2.7% to 76.07 USD. Platinum and palladium extended their decline from the previous session, while the Bloomberg Dollar Spot Index almost went sideways.