The US Bureau of Labor Statistics (BLS) said Tuesday that the consumer price index (CPI) in July increased by 0.2% after a 0.3% increase in June, in line with forecasts and increased by 2.7% over the past 12 months, slightly lower than the forecast of 2.8%. Core CPI (excluding food and energy) increased by 0.3% for the month, equal to June's level and in line with the forecast; however, compared to the same period last year, core CPI increased by 3.1%, higher than the expectation of 3.0%.

Gold prices fluctuated strongly on Thursday when the producer price index (PPI) suddenly skyrocketed. The overall PPI in July increased by 0.9%, much higher than the forecast of 0.2%. Annual PPI increased by 3.3% - the highest level since February 2025 (3.4%). The core PPI also rose 0.9% for the month, following June's sideways and up 2.8% year-on-year.

On Friday, the focus shifted to US consumers with mixed signals. The July retail sales report showed a 0.5% increase after June's 0.6%, in line with forecasts. Annual sales increased by 3.9%, exceeding the expectation of 3.5%. Core sales rose 0.3%, in line with forecasts, while the June figure was revised up to 0.8%.

However, a preliminary survey of the University of Michigan's August consumer confidence index fell to 58.6, well below July's 61.7 and contrary to expectations of improving to 62.

Consumption confidence fell about 5% in August, for the first time in four months, largely due to concerns about rising inflation, said Joanne Hsu, director of the University of Michigan's survey.

Bill Adams - Chief Economist at Comerica Bank - commented that American consumers have a "mixed" picture when entering the third quarter after a shaky second quarter. He said retail sales remain strong, especially in non-essential consumer goods such as cars, furniture, clothing, books and entertainment products. Consumers also take advantage of electric vehicle subsidies before they expire, spending heavily during Prime Day promotions and shopping season.

Adams also highlighted positive service consumption: Gas station sales rose 0.7% while gasoline prices fell 2.2% according to the CPI, showing high demand for travel during the summer tourist season. Restaurant spending decreased slightly by 0.4%, reflecting spending pressure, but for the whole year, food and beverage service sales still increased by 5.6%, exceeding the 3.9% price increase. In contrast, spending at construction materials stores and gardening decreased by 1% for the month and 2.6% for the year, showing a weak demand for home repair.

Adams concluded: American consumers are generally fine. The psychology is optimistic, but the behavior is still positive. Consumption can grow moderately in the second half of 2025 and will be supported in 2026 thanks to tax cuts".

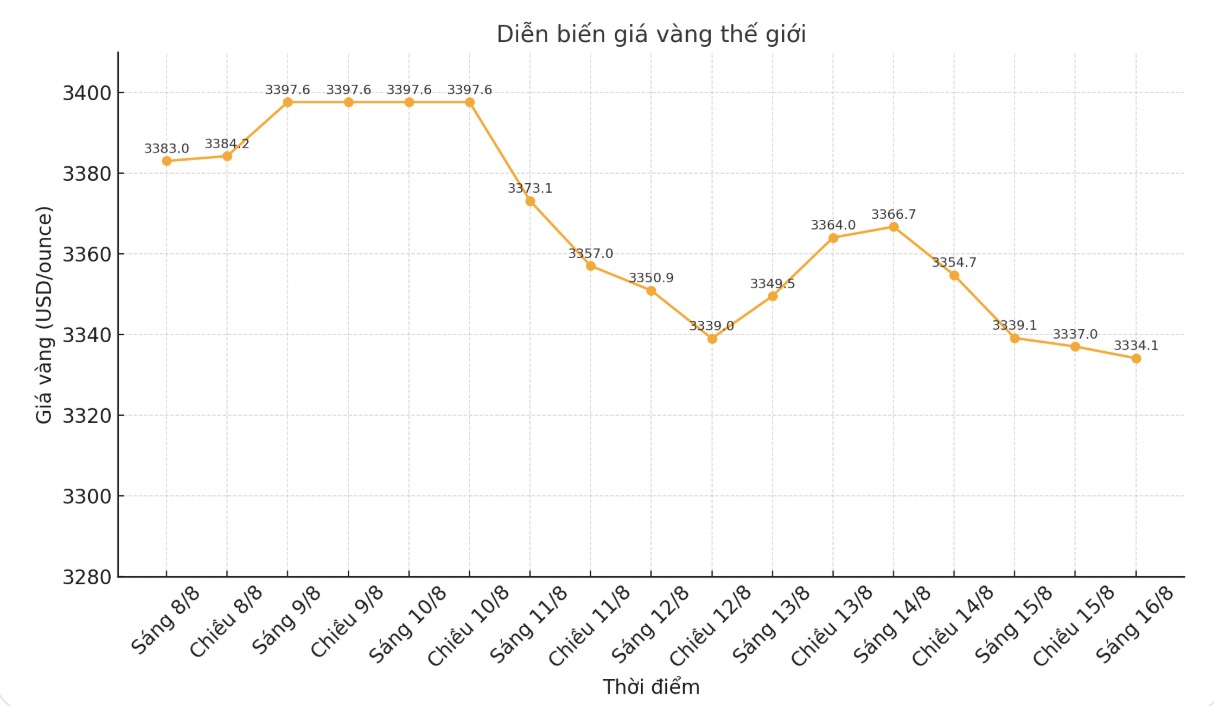

Impact on gold prices

The fact that the CPI is in line with forecasts but core inflation is higher than expected shows that price pressure has not completely cooled down. Gold is often seen as a hedge against inflation, but the prospect of the Fed maintaining high interest rates puts short-term pressure, as the opportunity cost of holding gold increases.

Meanwhile, the soaring producer price index caused strong fluctuations, pushing up bond yields and the USD. This is a negative factor for gold in the short term, as investors worry that the Fed will have little reason to loosen policy soon.

The Michigan survey shows that people are more pessimistic, thereby increasing demand for gold as a safe haven. This partly offsets the negative impact of inflation data.

A steady increase in retail sales helps strengthen the view that the US economy has not fallen into recession. However, this limits the purchasing power of defensive gold, as investors are not forced to seek safe assets.

In general, the gold market is currently in a state of tug-of-war, high inflation and a hot PPI pushing prices down, while the pessimistic consumer sentiment is supported. Gold is expected to continue to fluctuate strongly, waiting for a clearer signal from the FED.

Notable US economic data next week

There will be less data next week, but the Fed will be the focus for important events.

Tuesday: Announcement of housing data for construction and construction permits in July, Governor bowman said.

Wednesday: Minutes of the July FOMC meeting, Waller and Bostic speech, opening of the Jackson Hole Conference.

Thursday: Philadelphia Fed manufacturing index, weekly jobless claims, S&P Global comprehensive PMI in August, existing home sales in July.

Friday: FED Chairman Jerome Powell speaks at Jackson Hole an event closely watched by global investors.