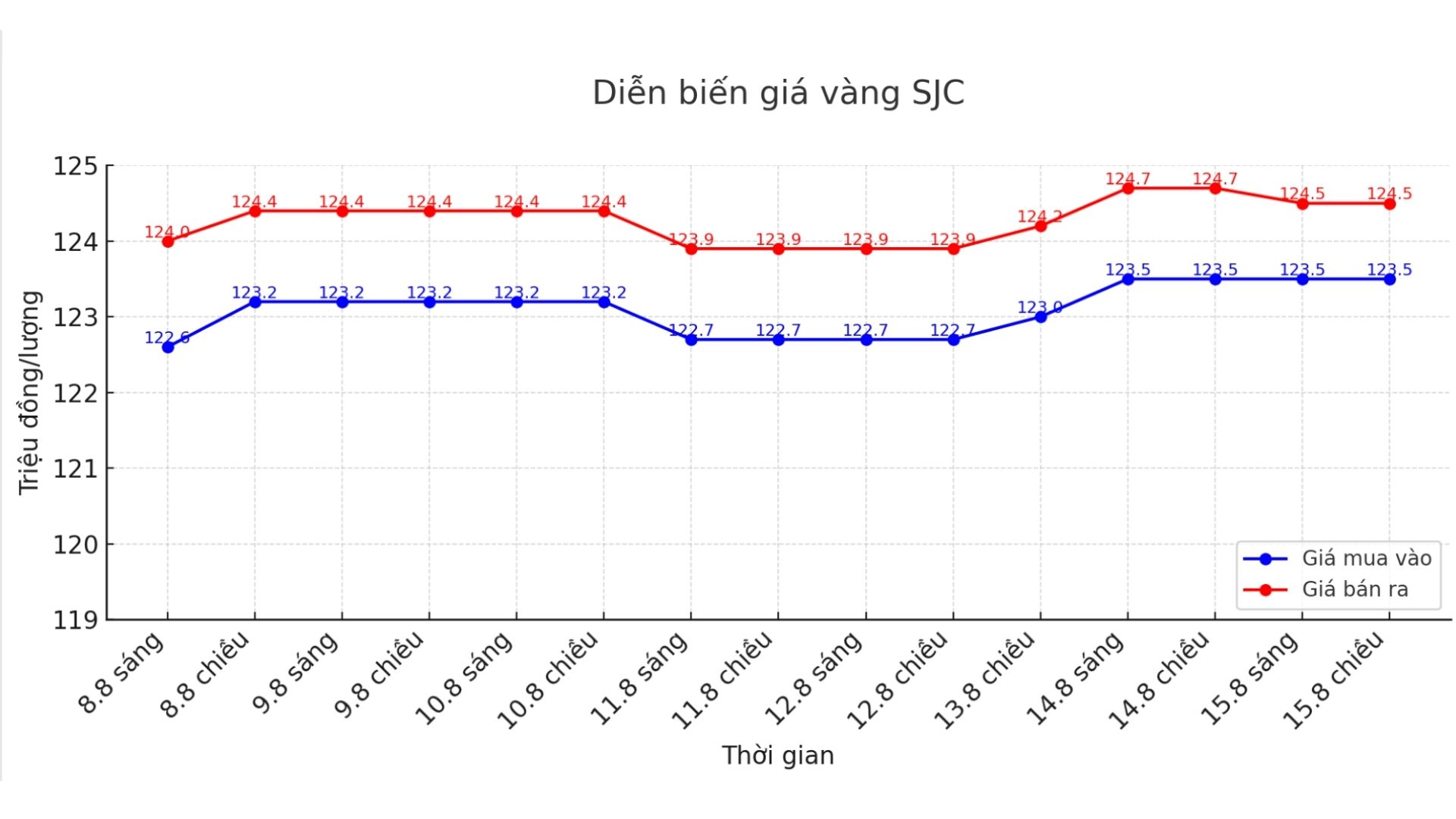

SJC gold bar price

As of 10:35 p.m., DOJI Group listed the price of SJC gold bars at 123.5-124.5 million VND/tael (buy - sell), unchanged for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.5-124.5 million VND/tael (buy - sell), down 200,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.7-124.5 million VND/tael (buy - sell), keeping the same for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.8 million VND/tael.

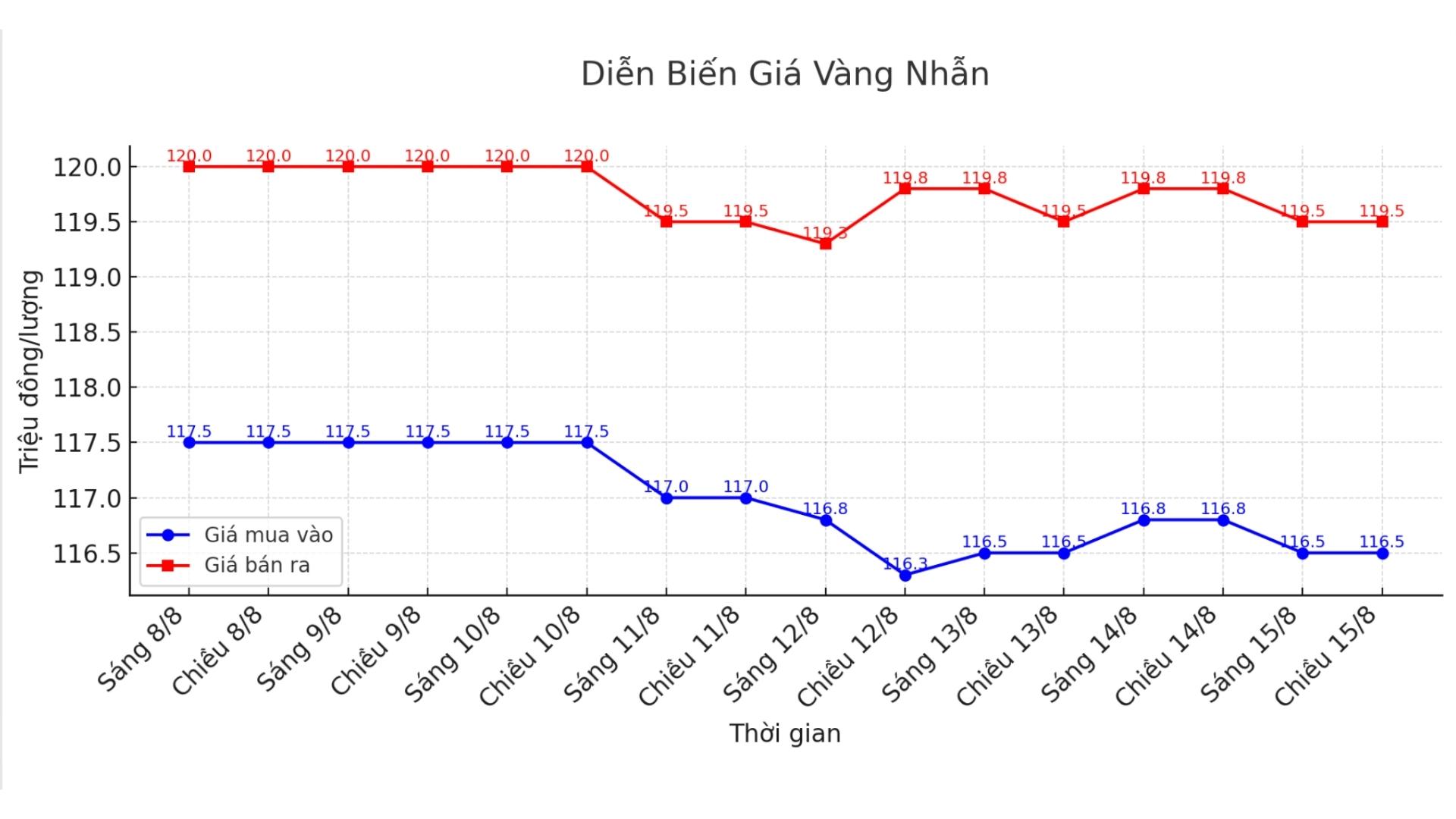

9999 gold ring price

As of 10:35 p.m., DOJI Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.8 - 119.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

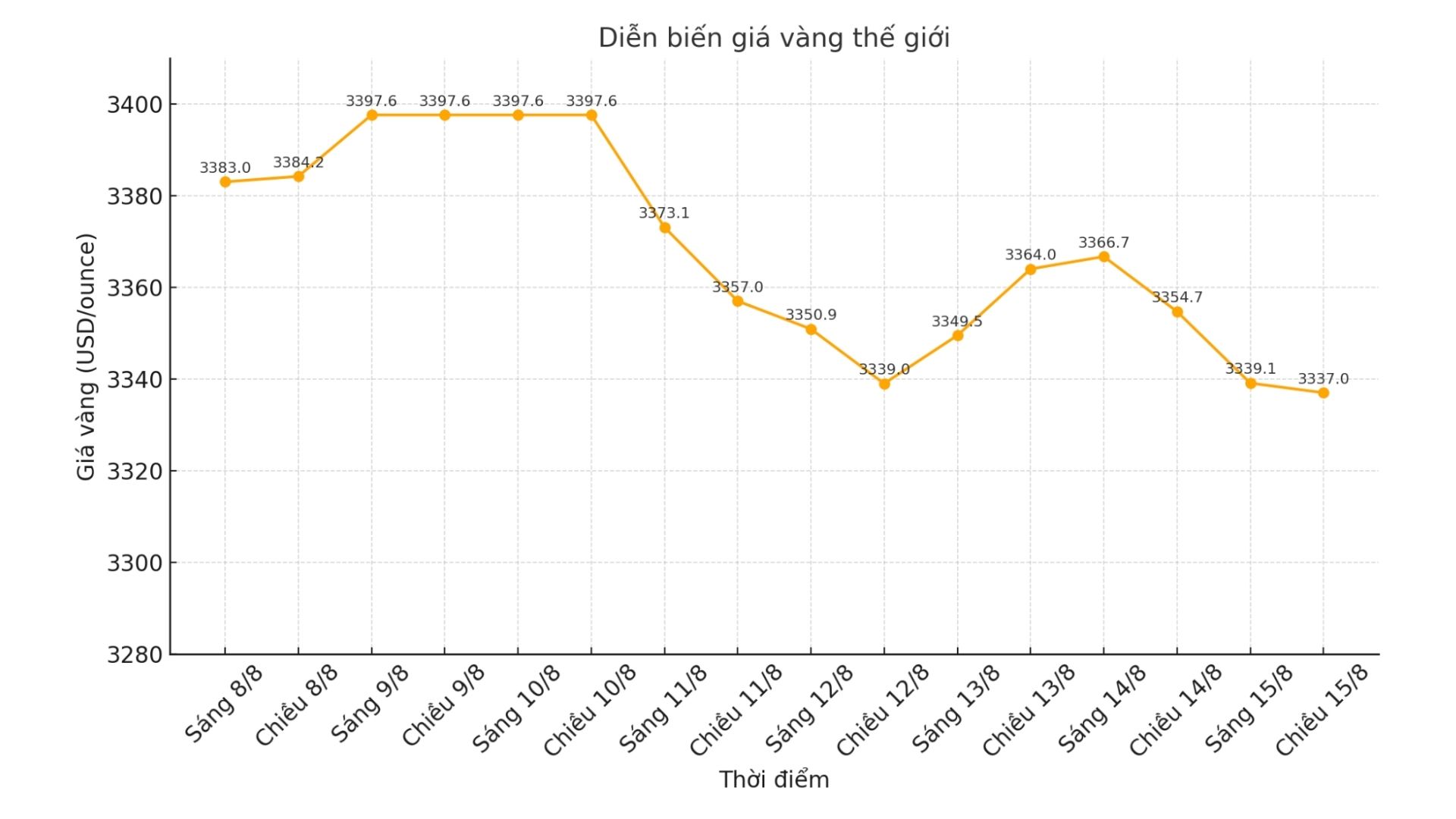

World gold price

The world gold price was listed at 5:30 p.m. at 3,337 USD/ounce, down 27 USD.

Gold price forecast

Overall, gold was under downward pressure for the whole week as US producer price data (PPI) increased more strongly than expected. This reduces expectations that the US Federal Reserve (FED) will cut interest rates aggressively in September.

In the short term, gold is showing a clearer relationship of the reversal with the fluctuations of the USD, said independent analyst Ross Norman. The greenback is currently strongly affected by economic data as well as quick news related to tariffs and geopolitical tensions".

The report released on Thursday showed that the US producer price index (PPI) in July increased the most in three years, as the cost of goods and services simultaneously increased, reflecting rising inflationary pressures. At the same time, the number of weekly unemployment benefit applications reached only 224,000, lower than the forecast of 228,000%, showing that the labor market remains stable.

This development has led investors to reduce expectations of a strong Fed rate cut, despite previously being strengthened by positive consumer price data (CPI) and a statement from US Treasury Secretary quanh Bessent that the upcoming cut could exceed 0.25 percentage points.

Gold - an asset that does not yield - often benefits in a low interest rate environment. Previously, the US CPI in July only increased slightly, raising hopes that the FED will consider a large-scale interest rate cut.

UBS commodity analyst Giovanni Staunovo said: We are seeing gold price adjustments narrowing. This shows that some investors who have missed opportunities before are taking advantage of these discounts to enter the market.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...