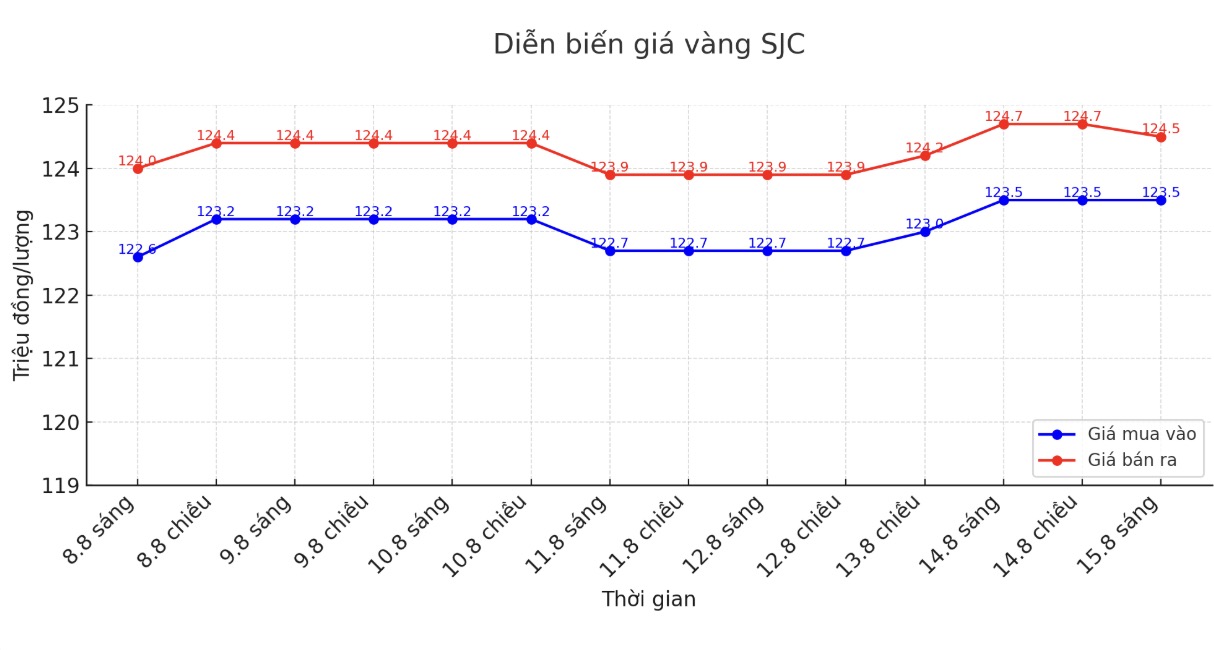

Updated SJC gold price

As of 10:00, the price of SJC gold bars was listed by DOJI Group at 123.5-124.5 million VND/tael (buy - sell), unchanged for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.5-124.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and an increase of 300,000 VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.7-124.5 million VND/tael (buy - sell), keeping the same for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.8 million VND/tael.

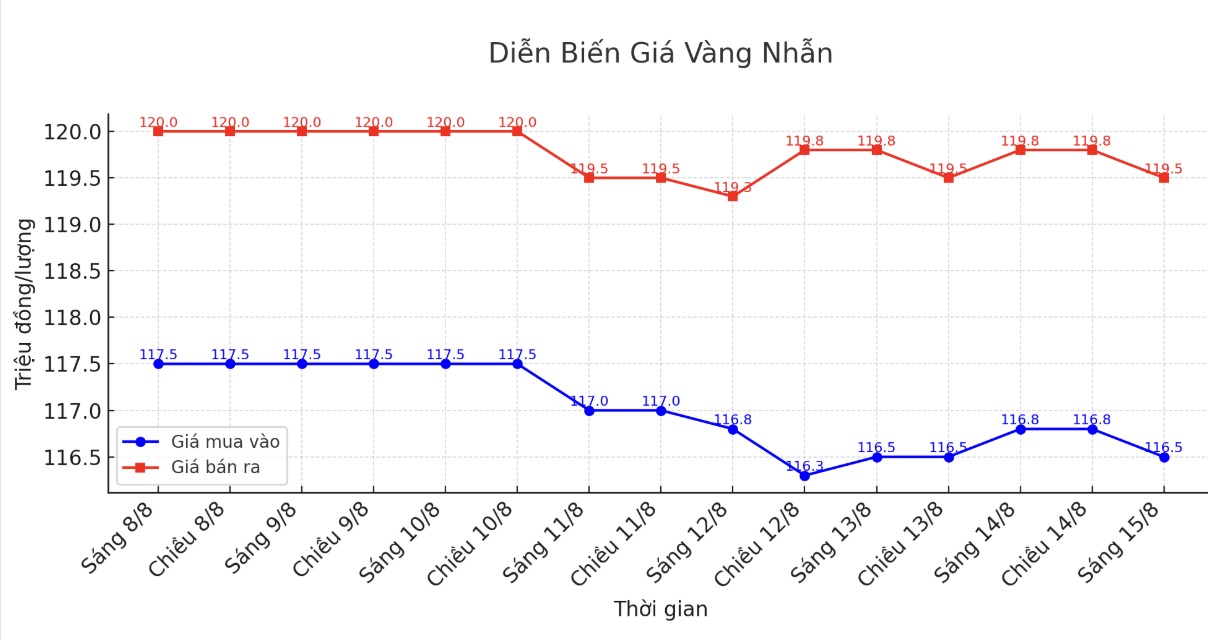

9999 round gold ring price

As of 10:00, DOJI Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy - sell), down 300,000 VND/tael for buying and kept the same for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

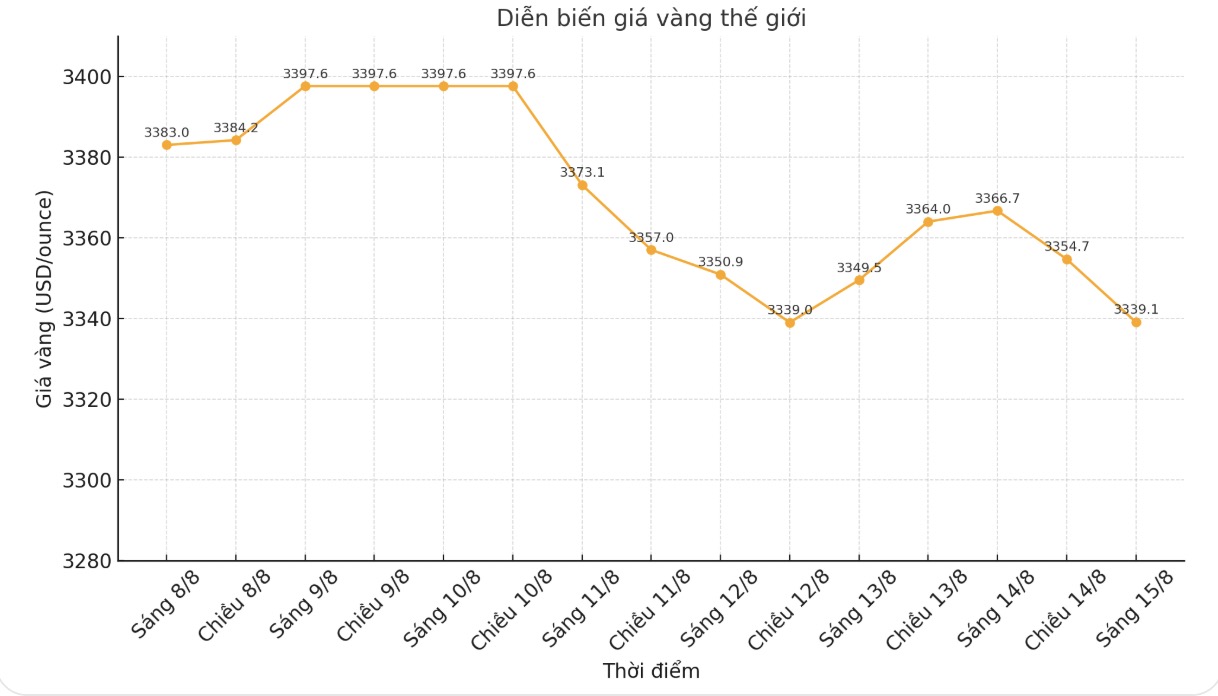

World gold price

At 10:00, the world gold price was listed around 3,339.1 USD/ounce, down 27.6 USD compared to a day ago.

Gold price forecast

World gold prices fell after the important US inflation report announced results much higher than expected.

The US producer price index (PPI) in July increased by 0.9% compared to the previous month, much higher than the sideways level in June and far exceeding the forecast of 0.2%. This is the strongest increase since June 2022.

This report reinforces the hawkish view on US monetary policy, which does not want the US Federal Reserve (FED) to cut interest rates soon. Compared to the same period last year, the overall PPI increased to 3.3% - the highest level in 5 months and exceeded the forecast by 2.5%. Core PPI (excluding food and energy) also increased by 0.9%, higher than the forecast of 0.2%.

For the year, core PPI increased by 3.7% compared to 2.6% previously. The hotter-than-expected PPI data in July onlyred the possibility of the Fed cutting interest rates by 25 basis points in September, but almost ruled out the possibility of a 50 basis point cut that a few investors had expected before.

The gold market is still stuck in a solid accumulation pattern. Despite taking a partial profit, an investment firm still expects the precious metal to be well supported through the end of the year.

In a recent interview, Mr. Tom Bruce - macro investment strategist at Tanglewood Total Wealth Management (an American asset management and investment consulting company), said that he took advantage of the sideways move of gold prices to reduce the holding ratio, from 12% to 10%.

However, he added that the sale was only to rebalance the portfolio, and the current 10% holdings were the company's maximum. In the first half of this year, Tanglewood held gold at a higher level due to the price of this precious metal increasing by nearly 30%.

I think gold could continue to move sideways for a while, but we are still optimistic in the long term, he said.

According to Ryan McIntyre - managing partner at Sprott Inc., once the market recognizes the impact of the US public debt problem, gold prices could fluctuate strongly.

In this week's interview, McIntyre analyzed factors driving the gold market, including long-term factors and newer factors and their impact in the coming months.

According to this expert, a long-term factor pushing gold prices to record levels is the increase in central banks' gold purchases since the outbreak of the Russia-Ukraine conflict. McIntyre believes that this demand still plays a big role, both creating a price "view" and sending a signal to the market.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...