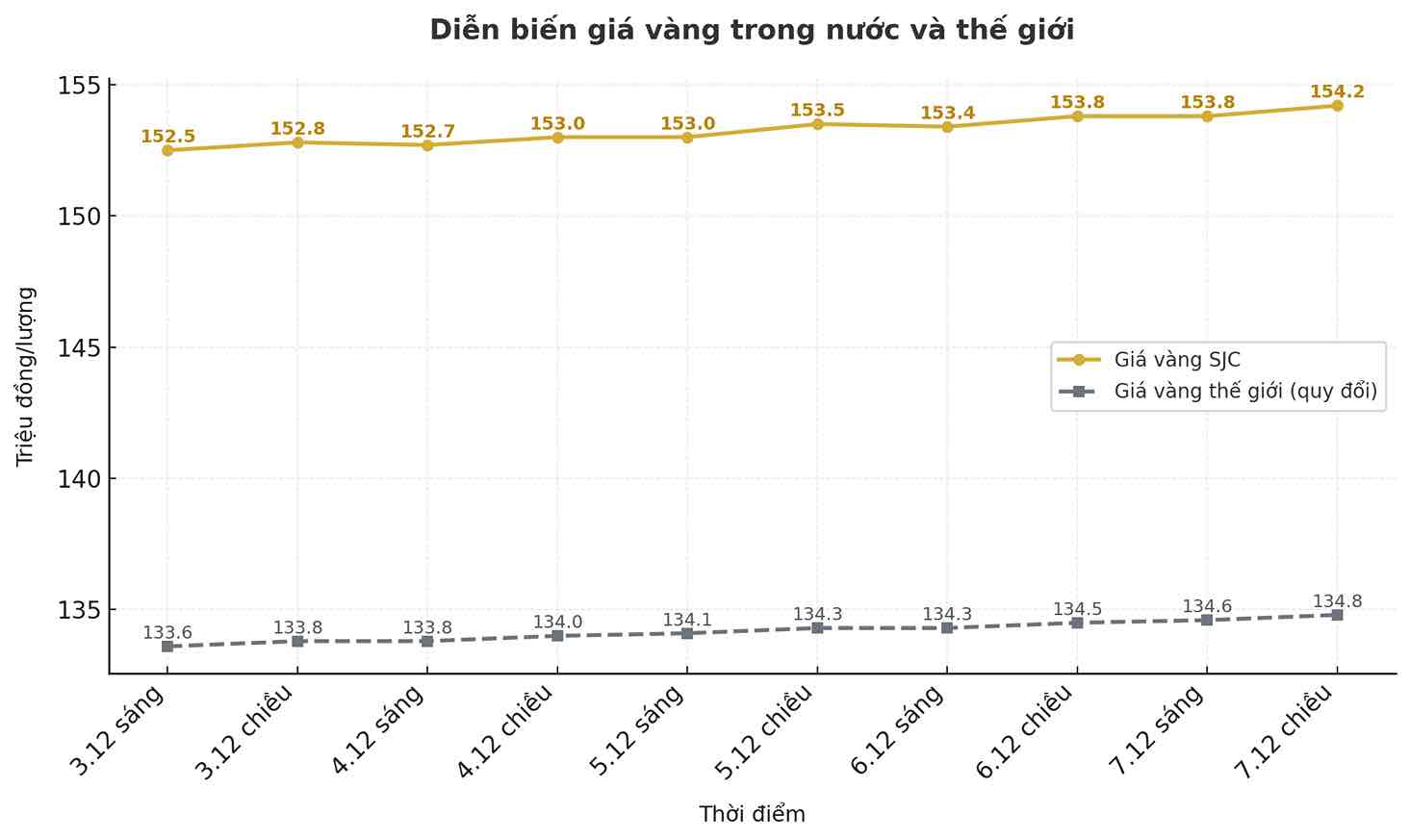

Domestic gold prices as of the afternoon of December 7 continued to maintain a strong increase. According to the listing table of SJC Jewelry Company, gold bars are traded at 152.2 million VND/tael for buying and 154.2 million VND/tael for selling, an increase of 500,000 VND compared to the previous session.

9999 plain gold rings at many other enterprises also exceeded the 155 million VND/tael mark, reflecting the increasing purchasing power in the whole market.

In the international market, the world gold price was recorded at 4,197.8 USD/ounce, almost unchanged compared to the previous session. Converted at the exchange rate of VND 26,408/USD, world gold is equivalent to about VND 133.6 - 135 million/tael, 19 - 21 million VND/tael lower than domestic SJC prices - the highest difference since mid-2025.

Gold supply is in transition

After Decree 232/2025/ND-CP takes effect, officially eliminating the State's monopoly mechanism for gold bar production, many enterprises in the industry are still in the stage of completing the licensing process, importing raw materials and trial production. This conversion has temporarily caused an unstable supply of gold bars to the market.

Along with that, the trend of gold accumulation continues to spread. In the context of many fluctuations in the world economy, people tend to diversify their asset portfolio, considering gold as a safe value channel. The end of the year is also the peak period of buying gold as gifts, weddings and savings, causing domestic market demand to increase sharply.

These factors cause domestic gold prices to remain flat, reflecting the difference between domestic supply and demand and world market developments, instead of simply being affected by international prices.

Gold trading is more stable as the gap narrows

The nearly VND21 million/tael gap between domestic and world gold prices makes short-term transactions more sensitive, while the majority of investors tend to observe the market more cautiously.

In the last three sessions, world gold prices have decreased by nearly 30 USD/ounce, but domestic gold prices have remained almost unchanged. This development shows that the domestic market is operating according to the laws of supply - demand and stocking psychology, rather than short-term fluctuations in the world.

Analysts say that gold is still a long-term value preservation channel, especially in the context of a global economy with many potential risks. However, with the current price level at a high level, people should carefully consider the time of buying and closely monitor the developments of world gold prices and the USD/VND exchange rate.

According to observations, when the gap between domestic and world gold prices narrows to below 10 million VND/tael, the market tends to be more stable, creating reasonable investment opportunities for people and long-term investors.