World gold prices are striving to stand firm above the 4,300 USD/ounce mark, but the upward momentum is becoming increasingly fragile as US economic data continues to send positive signals, weakening safe haven demand.

According to data just released by the US Department of Labor, the number of first-time unemployment benefits applications in the week ending December 27 decreased sharply by 16,000 applications, to 199,000 applications - significantly lower than market forecasts. Data from the previous week was also adjusted up to 214,000 applications.

This development shows that the US labor market still maintains a solid state, thereby reducing expectations that the US Federal Reserve (Fed) will soon ease monetary policy - a factor that is beneficial for gold prices.

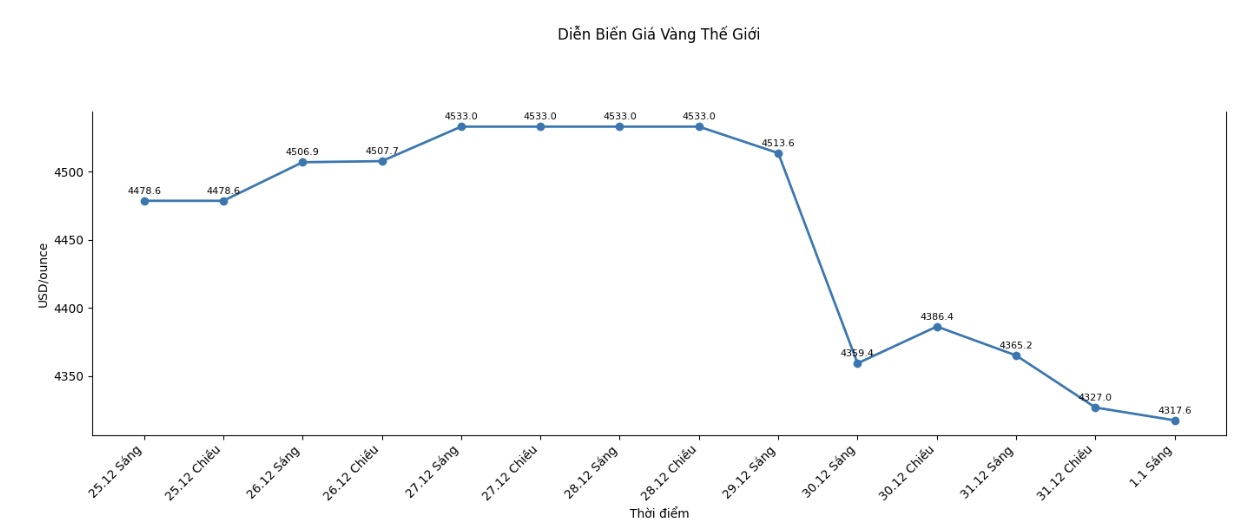

In the last trading session of 2025, spot gold prices recorded at 4,333.10 USD/ounce, down slightly 0.10%. The market is lacking momentum to break through in the context of low liquidity and cautious investors ahead of the new year.

Notably, the 4-week average of unemployment benefit applications - a measure reflecting a more stable labor trend, increased to 218,750 applications, compared to 216,750 applications last week. Meanwhile, the number of people continuing to receive unemployment benefits reached 1.866 million people, lower than market expectations.

Experts believe that if US labor data continues to be positive, gold prices may face further adjustment pressure in the short term, despite the fact that this precious metal is still maintaining a record high in 2025.