According to Mr. Josh Phair - Managing Director of the Scottsdale Mint, the link between monetary policy and precious metal prices is gradually breaking, giving way to material scarcity and geopolitical competition.

In the context of the US Federal Reserve (Fed) appearing internally divided after the 9–3 vote, the bond market is leaning towards the possibility that the Fed will temporarily stop raising interest rates.

However, Mr. Phair believes that this development is no longer decisive for the precious metals market. According to him, the gap between the paper trading market and actual material demand has reached a level that cannot be maintained for any longer.

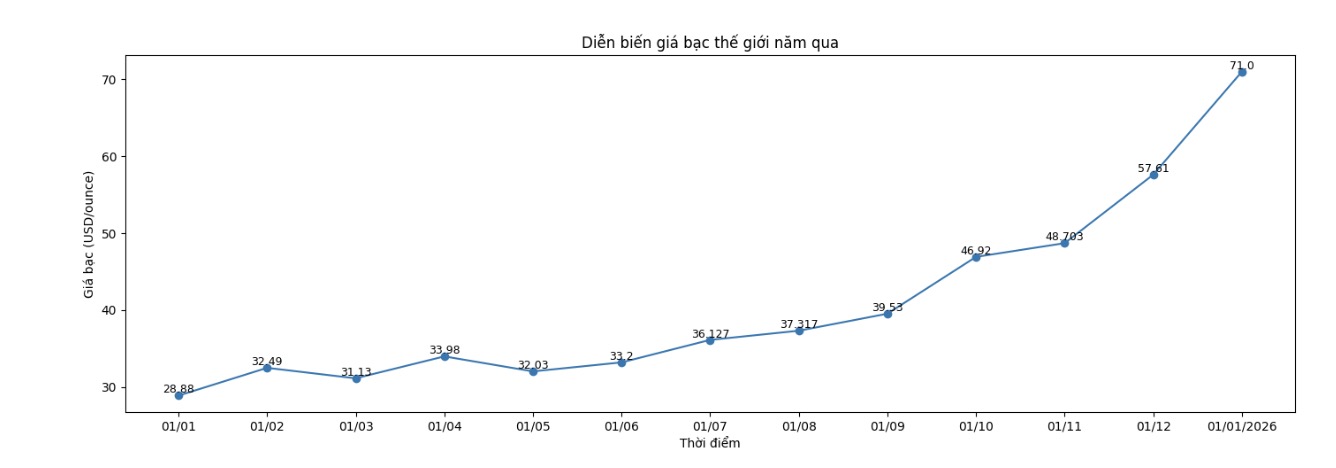

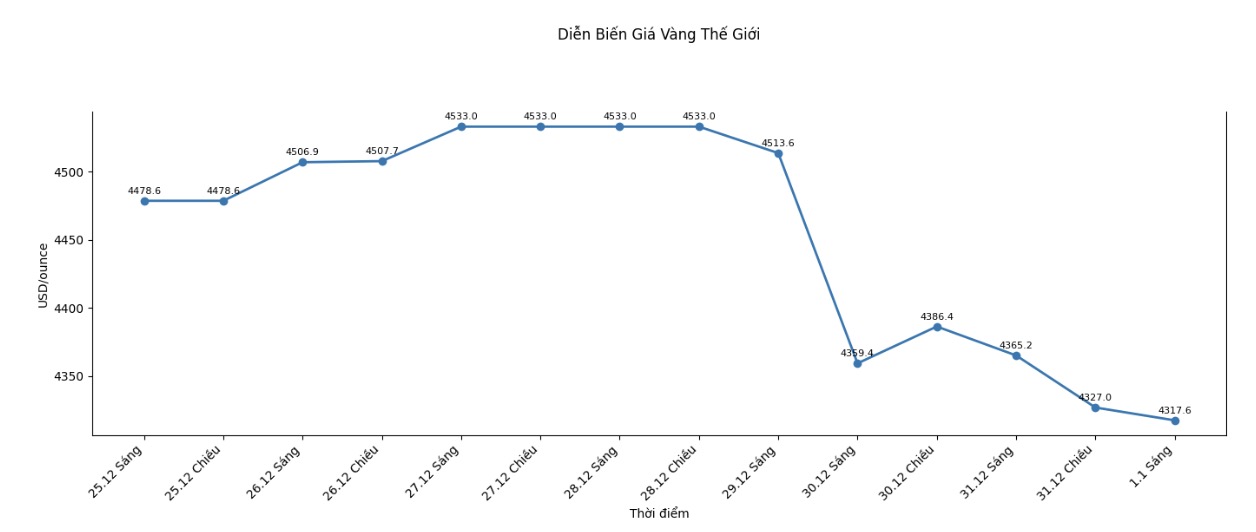

Strong price fluctuations in recent days have occurred in parallel with drastic intervention measures from commodity exchanges. CME Group recently continued to strongly raise the initial margin level for silver futures contracts, causing holding costs to increase and activating a short-term selling wave.

Silver prices have accordingly adjusted sharply, but Mr. Phair believes that material demand will soon absorb this sell-off when demand from many groups of buyers increases at the same time.

According to his assessment, the market is currently witnessing a rare phenomenon when banks, governments and individual investors participate in metal storage. In which, the role of small investors is often paid more attention to, but in fact is only a secondary factor compared to the silent accumulation trend of countries.

Mr. Phair believes that the world is witnessing the return of the "important banking" model, in which governments use the banking system to buy precious metals in large volumes but are implemented cautiously to avoid shocking the market. These buying flows are often not clearly visible, but create long-term pressure on material supply.

Supply tensions are also exacerbated by new export control measures from China. Before the spreading information about the possibility that Beijing is banning the export of precious metals, Mr. Phair said that China is actually applying a licensing mechanism, effective from the beginning of 2026, instead of a comprehensive ban.

This approach allows China to tightly control the flow of raw materials abroad while still maintaining the export of processed products.

According to Mr. Phair, the above policy could cause the market to be clearly divided between raw materials and finished goods, and at the same time create new bottlenecks for Western businesses that depend on refined silver from China. Logistics and supply difficulties are forecast to evoke issues that once appeared during the peak of the pandemic.

Besides financial and geopolitical factors, industrial demand is also emerging as a new driving force for the precious metals market. Some reports show that new generation battery technologies, including solid-state batteries, use silver as an important component.

According to Mr. Phair, precious metals not only serve the purpose of storage but also play a strategic role in the high-tech, artificial intelligence and defense industries.

Faced with strong fluctuations, rumors related to the incident of some financial institutions also appeared in the market. Mr. Phair said that it is unlikely that large banks will encounter serious problems, but did not rule out that some commodity trading companies or small compensation payment organizations are under great pressure due to too rapid price fluctuations.

Although short-term fluctuations are still high, Mr. Phair recommends that investors should look at the precious metals market in the long-term picture, especially the gold accumulation trend of central banks.

According to him, indicators comparing national debt and gold reserves show that the room for gold price increases in the long term is still very large, and monitoring the actual actions of central banks is much more important than public policy statements.