In the digital age, international payments are increasingly becoming an important driving force for global trade and investment. Systems such as SWIFT, international credit cards, cross-border e-wallets and fintech services help transactions be quick, convenient and connect millions of businesses and individuals around the world.

However, along with this boom, cybersecurity risks and personal data breaches in the international payment sector are also increasing. The attacks not only caused financial losses of hundreds of millions, even billions of USD, but also undermined user trust and had a profound impact on global economic and financial security.

The most common driver of hackers is financial interests, when they directly appropriate money, steal credit card data or exploit e-wallets for profit. In addition, transaction data and personal information in these systems are very valuable in the underground market, and can be used for fraud, blackmail or sale to other criminal organizations.

Some attack groups also have political or sabotage motives, aiming to lose confidence in the global financial system, undermine the reputation of the country or organization. In addition, the complex nature and multidimensional connectivity of international payment systems make them susceptible to security vulnerabilities, while the level of security between countries is uneven. hackers also take advantage of the huge transaction volume to launder money or hide traces, making it difficult to detect unusual transactions.

Cybersecurity risks in international payments:

Fraud and fake (Phiming, Spoofing): hackers often send emails, messages or create fake websites of banks to steal login information, thereby breaking into accounts and conducting cross-border transactions.

malware (Malware, ransomware, Trojan): When Hacking the payment system, the malware can record keyboard operations, change the account number in the money transfer order or encrypt all data to claim a ransom, disrupting global operations.

Account misappropriation and transaction fraud: hackers can take control of bank accounts or SWIFT systems to issue fake money transfer orders. This is a form of attack that causes direct financial damage and is difficult to recover because transactions often go through many intermediary banks.

Leaked personal data and financial information: Credit card information, account numbers, KYC data are often stolen and sold on the "black market" (dark web). Users are taken advantage of to open fake accounts, borrow money or make fraudulent transactions.

Supply chain and third-party attacks: Modern payment systems rely heavily on fintech service providers, payment gateways, and connection APIs. A vulnerability from a third party could pave the way for hackers to penetrate the entire system.

DDoS attack: Some major payment systems such as Visa, Master card, PayPal were temporarily paralyzed by DDoS, disrupting global transactions, directly affecting the economy and user trust.

Causes of the incidents

1. Technical loopholes: delay in patching errors (Equifax), lack of transaction supervision (Bangladesh Bank).

2. Human factors: employees being scammed, weak security management.

3. Complex supply chains: dependence on third parties (SolarWinds) causes risks to spread.

4. Legal differences and international regulations: some countries are lax, used as intermediaries.

5. Lack of investment in cybersecurity: many organizations, especially in developing countries, do not take investment in security seriously.

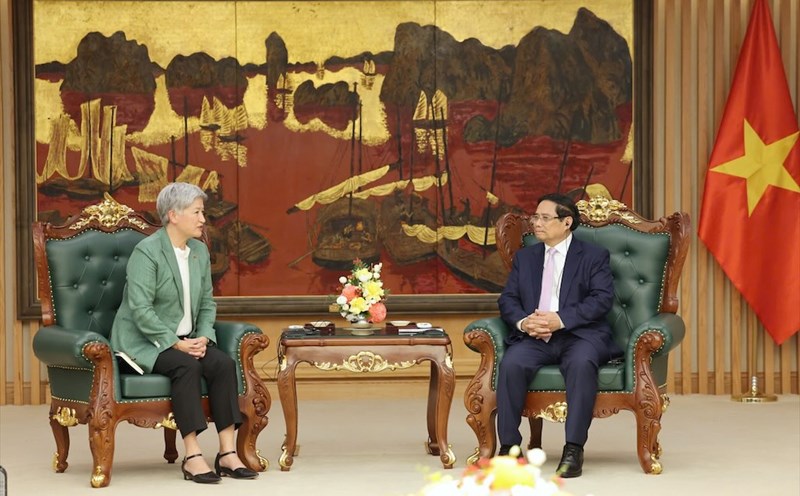

Mr. Vu Ngoc Son - Head of the Department of Research, Consulting, Technology Development and International Cooperation, National Cyber Security Association. Photo: Hai Nguyen

Lessons learned and solutions for financial institutions and enterprises:

Update and fix emergency software errors, apply multi-factor authentication (MFA); build an unusual transaction monitoring system using AI; periodic audit and security assessment of partners and third parties; train staff to raise awareness of cyber security.

For individuals: Be careful when receiving strange emails and messages related to international payments; avoid using public Wi-Fi when making financial transactions; use a virtual card or limited e-wallet to reduce risks.

Legally and internationally: Build a strict legal framework on personal data protection (such as GDPR); strengthen international cooperation in sharing cyber intelligence; Establish a cross-border emergency response mechanism when an incident occurs.

International payments are the lifeline of the global economy, but also an attractive target for cybercriminals. The above cases have shown major loopholes in international financial security: from central banks, credit institutions, service enterprises to third parties in the supply chain.

The lesson learned is that no system is absolutely safe. Only by synchronously combining advanced technology, strict security governance, human training, a clear legal framework and international cooperation, can we effectively protect personal data and ensure safety and sustainability for the global payment system.