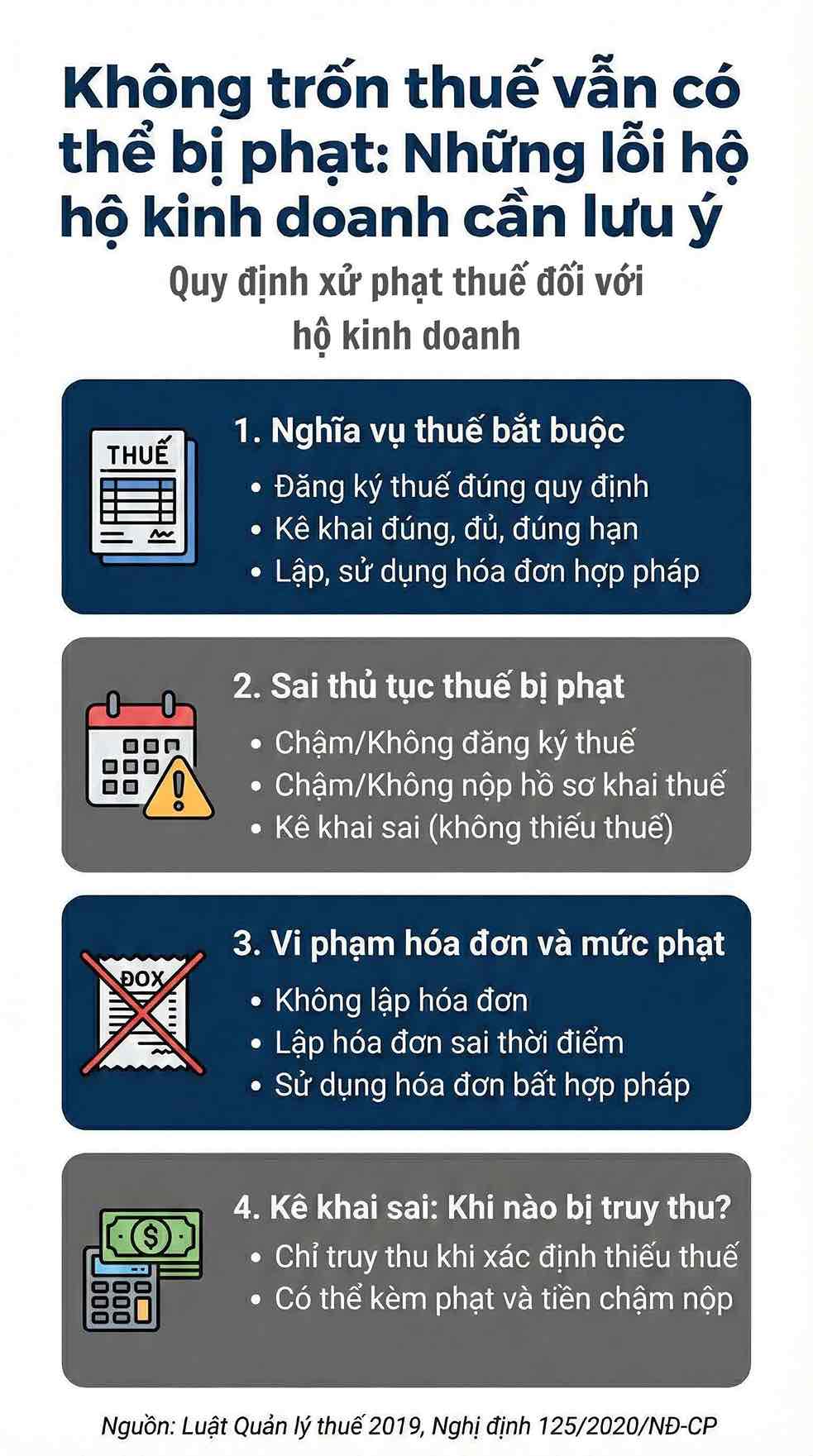

During the production and business activities, business households are responsible for fully complying with legal regulations on tax registration, tax declaration, as well as issuance and use of invoices. The current administrative sanctions for violations in the field of taxes and invoices are implemented according to the Law on Tax Administration 2019 and Decree 125/2020/ND-CP of the Government, amended and supplemented by Decree 102/2021/ND-CP.

According to the tax authority, the reality shows that there are still a number of business households that have not fully fulfilled the above legal obligations, leading to the risk of being fined during the tax inspection and examination process.

Compulsory tax obligations for business households

According to Article 16 of the Law on Tax Administration 2019, taxpayers, including business households, are obliged to register for tax according to regulations; declare taxes in a complete, accurate, honest and on time; prepare, manage and use invoices and documents; and provide information and documents related to determining tax obligations when requested by the tax authority.

Failure to perform or not fully perform the above obligations is the basis for competent authorities to consider sanctioning administrative violations in the tax field. This regulation is applied uniformly to all business households, regardless of scale, form of operation or revenue level.

Violations of procedures, violations of invoices and fines

According to Decree 125/2020/ND-CP, business households can be administratively sanctioned for violating regulations on tax procedures. Common violations include: late tax registration or failure to register for tax according to regulations (Article 7); late payment or failure to submit tax declaration documents (Article 10); declaration of incorrect information in tax records but not causing tax payable (Article 11).

For violations of a minor nature, occurring for the first time and not causing tax obligations, the law allows the application of warning. In case of violation to another level, the fine will be applied according to the penalty levels prescribed in the decree.

In addition, business households are responsible for making invoices when selling goods and providing services. Violations such as not making invoices, making invoices at the wrong time or using invoices in violation of regulations are all punished according to Articles 16 and 24 of Decree 125/2020/ND-CP, with administrative penalties corresponding to each violation.

Incorrect declaration: When will tax be collected

According to Article 107 of the Law on Tax Administration 2019, tax collection is only applied when the tax authority clearly determines that there is a missing tax amount due to incorrect declaration, failure to declare or through inspection and examination, determining that the tax payable is higher than the declared amount.

In these cases, business households may be charged the remaining tax, and subject to administrative sanctions according to Article 17 of Decree 125/2020/ND-CP and must pay late payment fees according to the provisions of law.

According to Article 3 of Decree 125/2020/ND-CP, the handling of administrative violations in the tax sector must ensure that each violation is only punished once; the form of punishment is applied corresponding to the nature and severity of the violation; and not punished when there is not enough legal basis. Penalties for tax violations and tax collection are two independent mechanisms, applied on different legal bases.

In the context of tax management being increasingly deployed on a data platform, enhancing comparison and post-inspection, a clear understanding and full compliance with regulations on registration, declaration and invoices is considered a necessary requirement for business households.

To fulfill their obligations from the beginning not only helps limit the risk of being fined and collected, but also creates a stable legal foundation for long-term business operations.