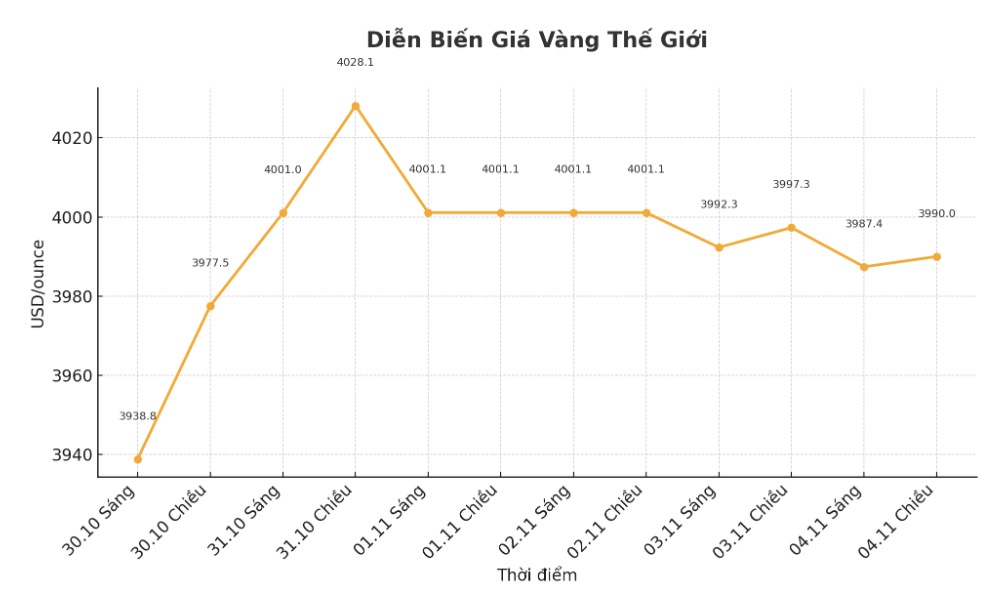

Gold prices fell below $4,000/ounce on Tuesday as the USD remained at a high level for more than three months. The US Federal Reserve's (FED) interest rate cut prospects in December weakened, along with the cooling of US-China trade tensions, reduced demand for this precious metal.

At 10:25 GMT (1:30 p.m. 25 days) Vietnam time, the US December gold futures also fell nearly 1% to $3,979.30/ounce.

The US dollar is stable, hovering near a three-month high as internal Fed division has prompted investors to adjust their expectations for further rate cuts this year.

A strong US dollar is putting pressure on gold, as traders are recalculating the possibility of the Fed cutting interest rates again before the end of the year, said Mr. Tim Waterer, Chief Market Analyst at KCM Trade.

Last week, the Fed cut interest rates for the second time this year, but Chairman Jerome Powell said that continuing to cut interest rates this year is not a certain thing.

According to CME's FedWatch tool, the market now only rates a 65% chance of a Fed rate cut in December, down sharply from more than 90% before Mr. Powell's speech.

Fed officials continued to express mixed views on the economic outlook on Monday - the debate is expected to be more intense as the December policy meeting approaches, amid a lack of important economic data such as the US Bureau of Labor Statistics' employment report due to the federal government's closure.

Gold - a non-profit asset often benefits in a low interest rate environment and period of economic instability.

Investors are now waiting for the US private sector (ADP) jobs report released on Wednesday, along with the Institute for Supply Management (ISM) PMI index this week, to find more clues on the direction of interest rate policy.

If the ADP report shows a bleak outcome, it could help gold regain its upward momentum, Waterer added.

Since the beginning of the year, gold prices have increased by 53%, but are still down more than 8% compared to the record set on October 20.

US President Donald Trump said last week he had agreed to reduce import tariffs on China in exchange for some grants from Beijing.

For other precious metals, spot silver fell 1.3% to $47.47 an ounce; platinum fell 1.1% to $1,548.15 an ounce; and gold lost 2.8%, to $1,404.68 an ounce.

See more news related to gold prices HERE...