The short-term momentum of the gold market is changing, and prices may fluctuate around the current level in the last two months of 2025. However, one expert believes that the next big increase in gold will be a strong increase possibly an increase of about 1,000 USD per ounce.

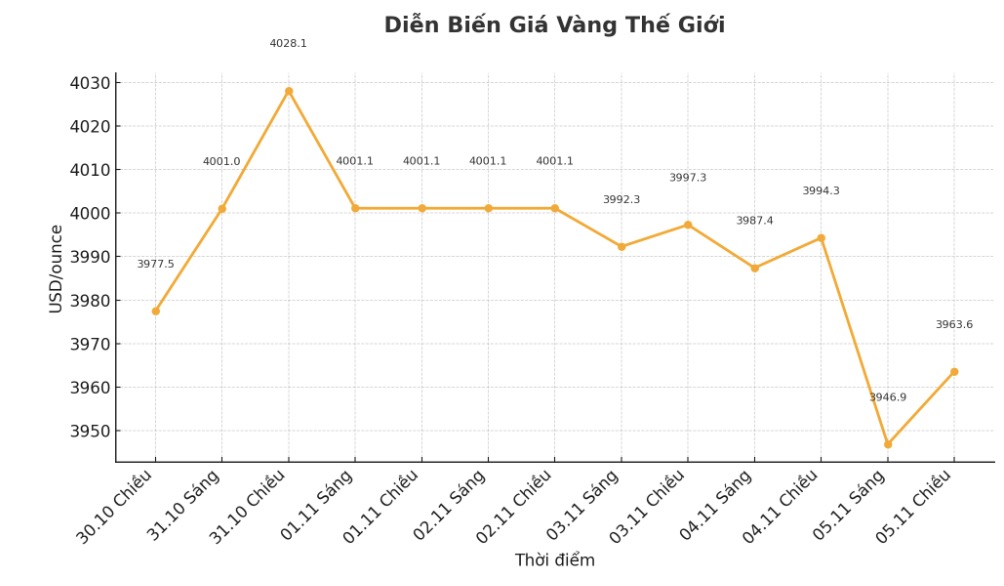

In an interview with Kitco News, Mr. Aakash doshi, Head of Gold Strategy at State Street Investment Management, said he expects gold prices to accumulate around the resistance level of 4,000 USD/ounce, noting that November and December are often a negative period for gold ETFs.

The gold price target depends on the time frame you look at, he said. If we look at the next 12 months, this rally is not over yet, but I think we could see about eight weeks of accumulation. This is a healthy correction in a long-term bull market.

This assessment was made when SPDR Gold Shares (NYSE: GLD) - the world's largest gold ETF - lost nearly 8 tons of gold held after prices peaked around 4,360 USD/ounce.

Although global ETF flows have recently shown signs of withdrawing, the gold market still saw unprecedented investment demand. doshi noted that ETF holdings are still well below the 2020 peak, and he believes it is just a matter of time before setting a new record.

Because November and December are often unfavorable, we may not have achieved that this year, but I expect to see a new high in the first quarter of 2026 he said.

State Street has not yet released an official gold price forecast for 2026, but Mr. doshi believes that $5,000/ounce is a reasonable target.

If I had to choose between $3,000 or $5,000 when the price is around $4,000 I would have leaned towards the 5,000 mark more, he said.

According to doshi, although ETFs continue to be withdrawn, this only reflects the seasonal adjustment trend after a period of hot increase in August and September due to the "fear of missing out" (FOMO) mentality. He believes that any correction will be shallow, as fundamental factors are still strongly supporting gold.

The latest data from the World Gold Council (WGC) shows physical demand for gold at a record level, even as prices are at a historical peak. doshi said investors have accepted higher prices, as they still see attractive value in gold.

During this rally, gold may be overbought but not too much, so the potential is still huge, he stressed.

An important factor changing the structure of the gold market is demand from central banks. Official reserves are expected to increase by 750900 tons this year, although lower than the level of about 1,000 tons per year in the past three years, but still double in 2021, when this trend begins.

The trend of de-dollarization has fundamentally changed the gold market. Gold is now a global alternative to pre-match regulation," the expert said.

At the same time, investment demand remains strong as the US Federal Reserve (FED) is expected to continue cutting interest rates, while inflationary pressures remain high. Lower interest rates and rising inflation will reduce the opportunity cost of holding gold a non-yielding asset.

He explained: The yield curve is trending down, meaning long-term bond interest rates are rising higher than short-term interest rates which shows that the market expects inflation to remain high. In that context, gold prices will continue to be supported."

See more news related to gold prices HERE...