Updated SJC gold price

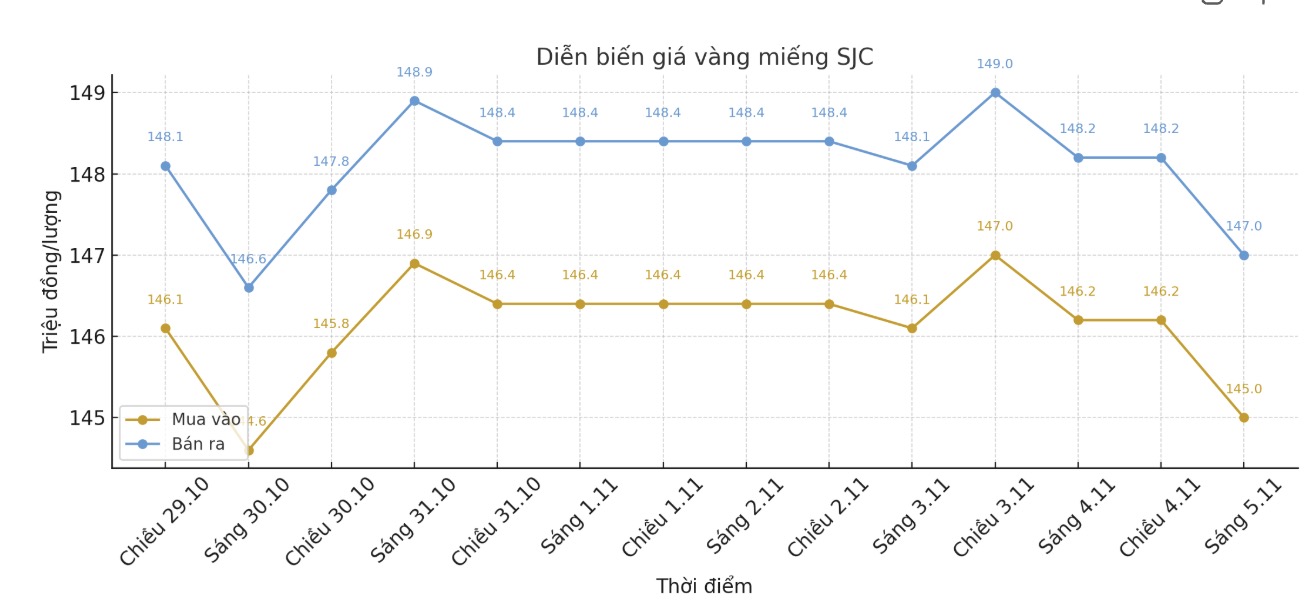

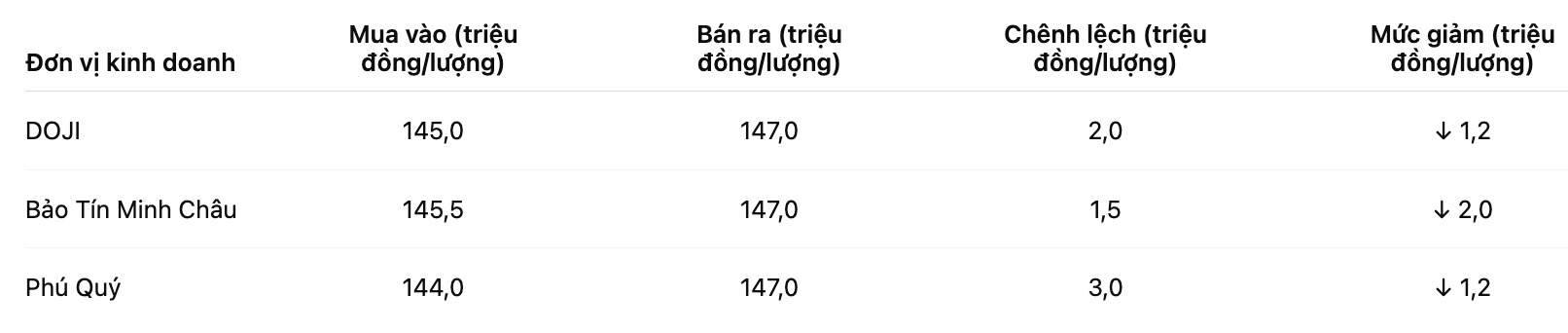

As of 9:53, the price of SJC gold bars was listed by DOJI Group at 145-147 million VND/tael (buy in - sell out), down 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 145.5-147 million VND/tael (buy - sell), down 2 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 144-147 million VND/tael (buy - sell), down 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

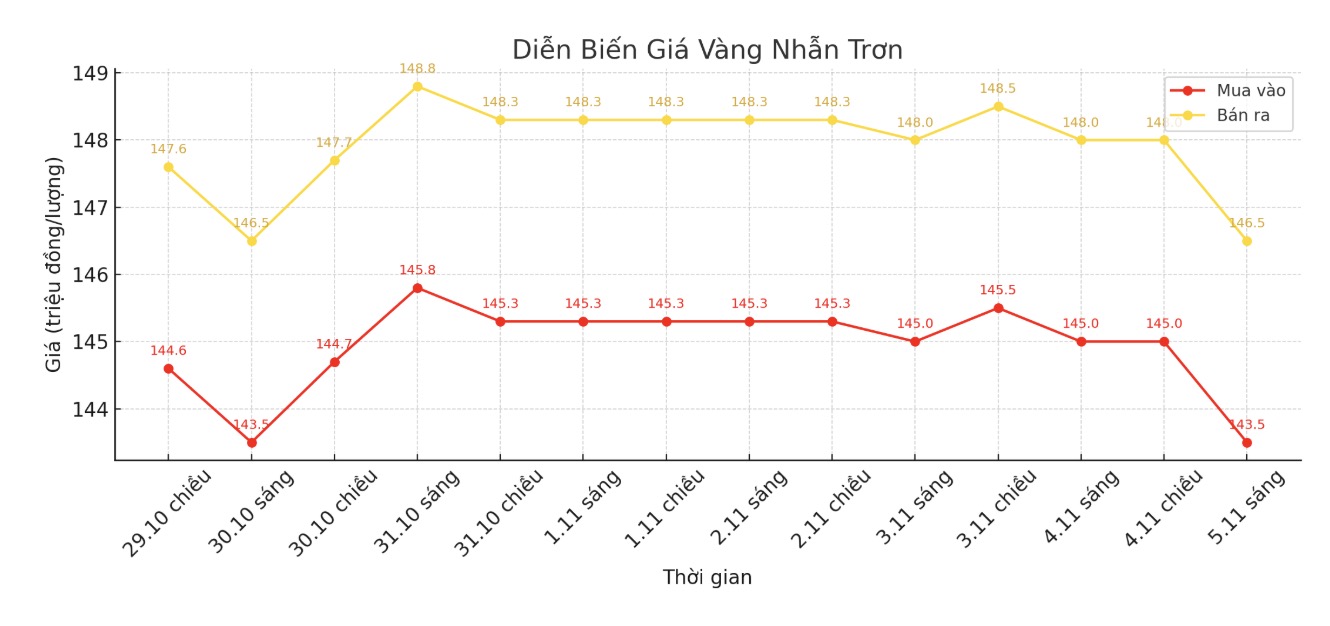

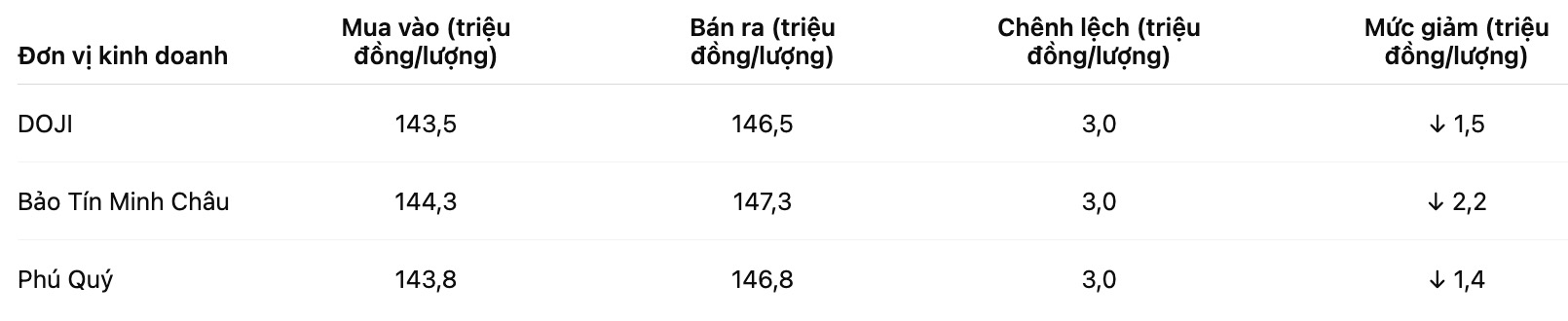

As of 9:53, DOJI Group listed the price of gold rings at 143.5-146.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 144.3-147.3 million VND/tael (buy - sell), down 2.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 143.8-146.8 million VND/tael (buy - sell), down 1.4 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

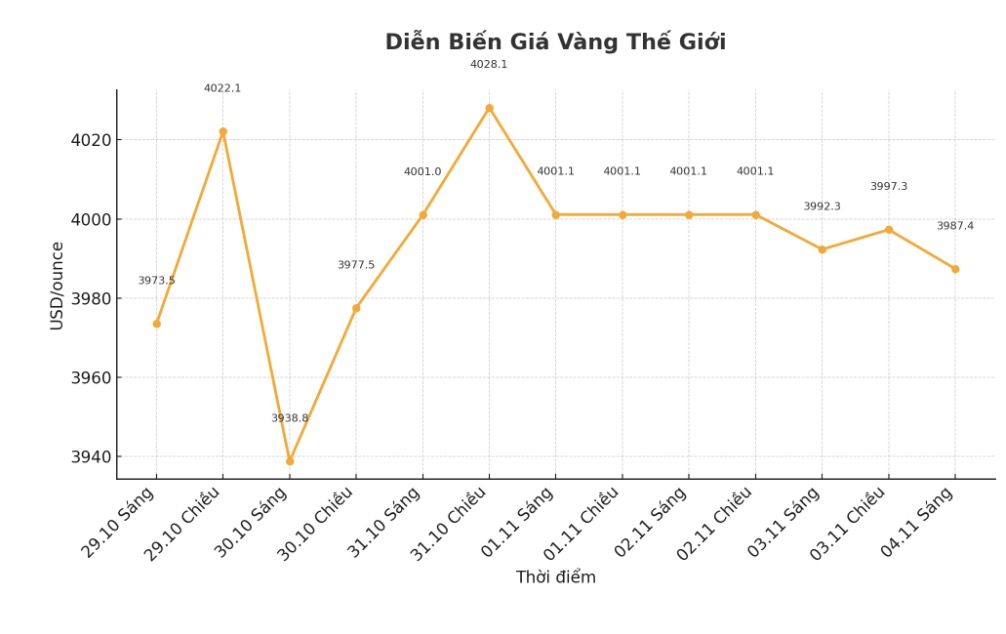

World gold price

At 9:55 a.m., the world gold price was listed around 3,946.9 USD/ounce, down 40.5 USD compared to a day ago.

Gold price forecast

Gold prices fell sharply as the USD reached a 3-month high, investors are waiting for US economic data to grasp the monetary policy roadmap of the US Federal Reserve (FED).

According to the CME FedWatch tool, traders are now predicting a 71 percent chance of the Fed cutting interest rates at its meeting on December 9-10, down from a 90% " bet" last week.

Recent statements from Fed officials show a division in views on how to respond to the current data shortage.

Ms. Rhona OConnell - an analyst at StoneX, commented that gold is cooling down after a period of heating up, but still reflects concerns about the independence of the FED, the possibility of slow growth with high inflation (inflation), along with geopolitical risks and international tensions.

Notably, gold prices fell despite the global stock market witnessing a strong sell-off. The global stock market fell sharply as Wall Street leaders warned that stock valuations were at too high a level.

According to Bloomberg, investors are increasingly concerned about the risk of a bubble in the AI stock group, in the context that many executives of large financial groups believe that the market may face a correction of more than 10% in the next 12 to 24 months.

Capital Group Chairman and CEO Mike Gitlin recently commented that the company's profits are still solid, but the worrying problem lies in valuation. He said that most investors see stocks as being in the "reasonably high" zone, not as cheap. Gitlin also warned that the credit market is showing similar signs as the yield gap is narrowing significantly.

This assessment was shared by Morgan Stanley Ted Pick and Goldman Sachs leader David Solomon, who both believe that adjustments are a normal phenomenon in the market's movement cycle.

Another signal that shows increasing caution is the decline of Palantir technologies shares by about 3% in the after-hours trading session, even though the company has just announced business results beyond expectations.

Palantir raised its annual revenue forecast to $4.4 billion and reported Q3 revenue to $1.18 billion, up 63% year-on-year, with adjusted earnings reaching 21 cents per share. However, investors are concerned that stock valuations have been too high after a long series of increases.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...