From July 1, 2025, gasoline will have 2% VAT reduced

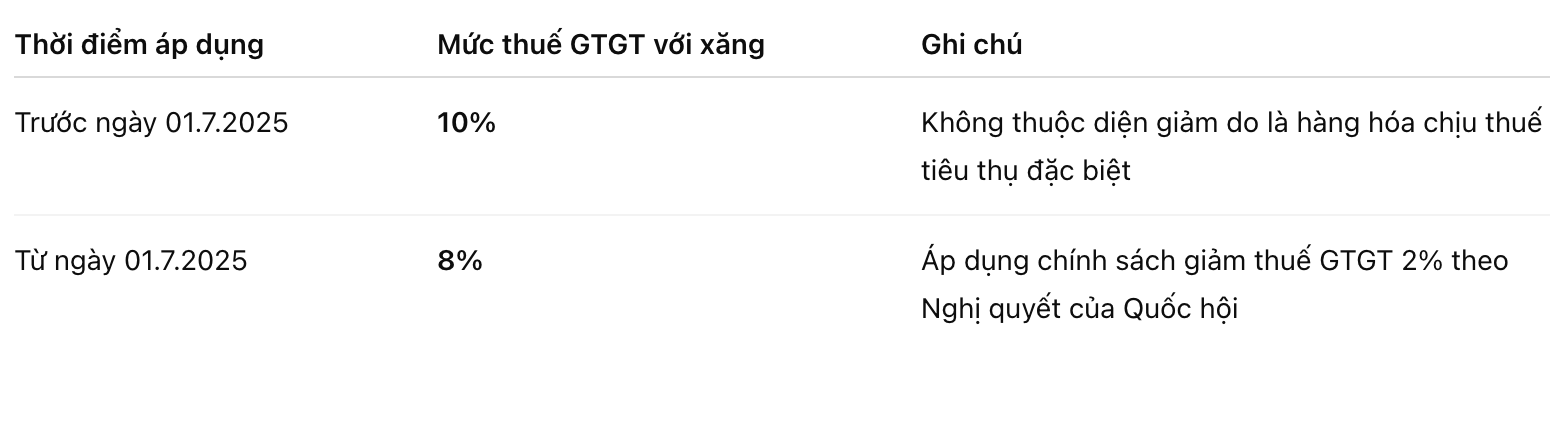

On June 17, 2025, the National Assembly passed a Resolution on reducing value-added tax (VAT), applicable from July 1, 2025 to December 31, 2026. A noteworthy point is that gasoline - a commodity previously not subject to tax reduction - will officially apply the current VAT rate of 8% instead of 10%.

According to the Resolution, a 2% reduction in VAT will apply to groups of goods and services subject to a tax rate of 10%, except for the following groups: telecommunications, finance, banking, securities, insurance, real estate business, metal products, mining products (except coal), and items subject to special consumption tax - deducting fuel.

This means that gasoline is a commodity group with a 2% VAT reduction, applied consistently throughout the effective period of the resolution.

Comparison of VAT rates with gasoline products before and after July 1, 2025

Groups of goods and services are subject to VAT reduction according to Decree 180/2024/ND-CP

According to Clause 1, Article 1 of Decree 180/2024/ND-CP, a 2% VAT reduction will not apply to the following groups:

Telecommunications, finance, banking, securities, insurance, real estate

Metals and prefabricated, Mined metal products (except coal), refined petroleum, chemicals

Goods and services subject to special consumption tax (except for gasoline)

Information technology products according to legal regulations

For coal products, the tax reduction only applies at the exploitation and sale stage. The following stages such as selection and distribution are not subject to this VAT reduction.

How to apply VAT reduction

Enterprises calculate taxes according to the deduction method: Apply a tax rate of 8% for goods and services subject to reduction.

Enterprises, business households, and individuals calculating taxes based on the percentage of revenue: Reduced by 20% of the percentage when issuing invoices for goods and services with reduced taxes.

This VAT reduction policy is expected to support businesses, stimulate consumption and contribute to promoting growth in the context of many challenges for the economy.