The breakthrough of the digital economy

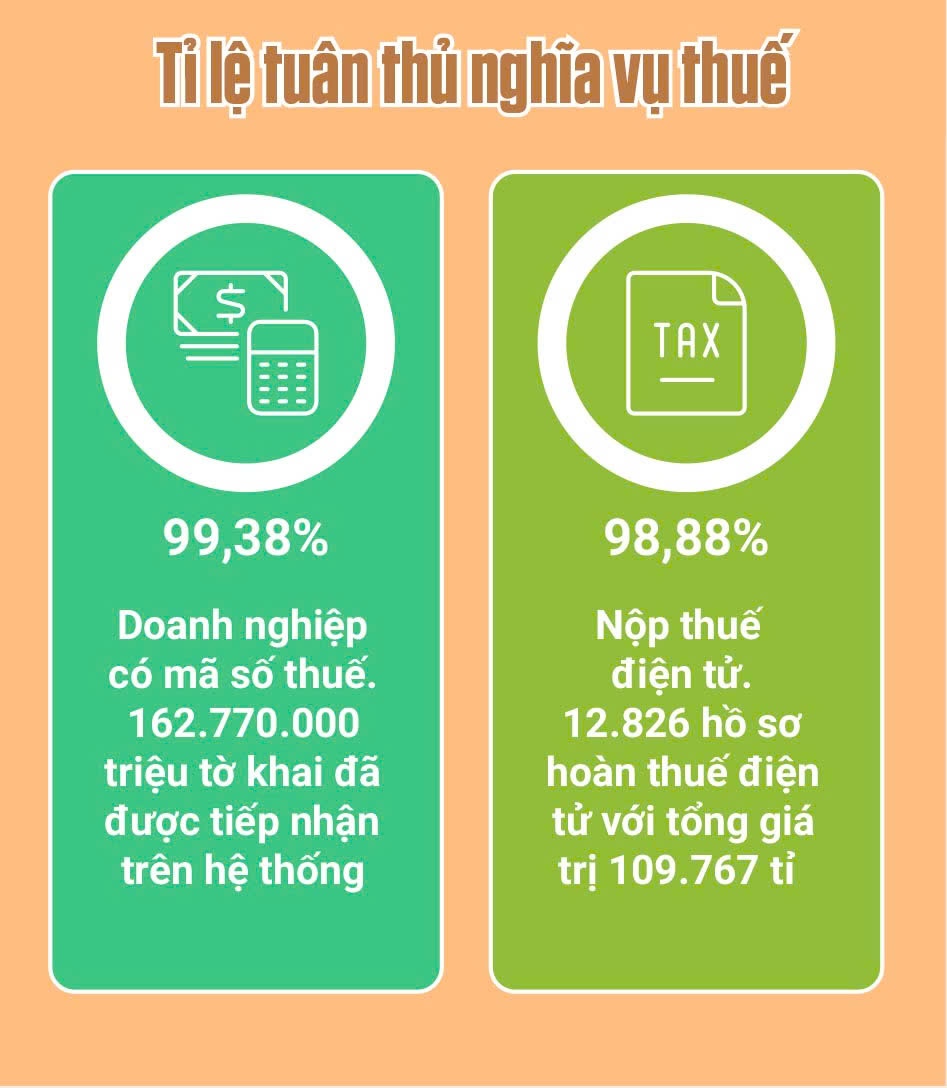

Informing Lao Dong, Mr. Mai Xuan Thanh - Director of the Tax Department of the Ministry of Finance - said that as of September 30, 2025, 99.4% of operating enterprises nationwide have declared taxes electronically with the total number of electronic tax declarations received into the system being approximately 162.8 million declarations; nearly 98.9% of enterprises registered and paid taxes electronically through 57 commercial banks; 100% of enterprises with tax refunds are electronically refunded. 100% of businesses nationwide have used electronic invoices with the number of electronic invoices received and processed by tax authorities since the implementation of being more than 17.5 billion invoices, of which the number of encrypted invoices reached more than 3.65 billion invoices, un encrypted invoices reached 10.32 billion invoices, electronic invoices generated from cash registers reached nearly 3.58 billion invoices; 297,421 businesses and business households have used electronic invoices generated from cash registers. The rate of taxpayers satisfied with the services of tax authorities reached over 92%.

These numbers are not just about performance, but also about a system that is operated by governance and data. The tax system has been multi-dimensionalally connected with the Bank, Treasury, Customs, Social Insurance and the Ministry of Public Security through interdisciplinary API. Data becomes a common language, allowing the tax industry to shift from inspection - handling to expectation - service.

In parallel, the compliance relationship management system (CRM) is being applied to assess the risks of each taxpayer, a familiar approach in OECD economies, and has now gradually become a reality in Vietnam.

On a broader scale, the breakthrough is also reflected in the e-commerce sector, an emerging source of revenue for the digital economy. In 2024, the amount of tax revenue from e-commerce reached VND 116,000 billion; after only 9 months of 2025, the figure has skyrocketed to VND 152,000 billion, an increase of 64% over the same period. Notably, 176 foreign suppliers, including Google, Meta, Netflix, TikTok, have registered and paid taxes through electronic portals, contributing 8.73 trillion VND to the budget, an increase of 42% over the previous year.

The level of self-awareness of taxpayers

According to the International Monetary Fund (IMF), Vietnam's tax rate on GDP is currently only 13.1%, lower than the threshold of 15 - 16%, which is considered necessary to ensure sustainable fiscal capacity. This gap is not only a budget problem, but also a measure of consensus when people and businesses are willing to contribute to a system that they feel transparent and fair.

In 2024, the tax authority conducted 62,932 inspections and recommendations to handle VND 62,726 billion, of which the increase in revenue through TTKT was VND 16,643 billion, the loss decreased by VND 43,587 billion, and the deduction decreased by VND 2,675 billion.

In the FDI sector, the risk of price fluctuations is still a persistent challenge. In 2024 alone, the tax authority inspected and examined 711 FDI enterprises and discovered signs of "fake loopholes, real profits" in many manufacturing industries, thereby adjusting to increase taxable income by VND4,983 billion; collecting and fining VND1,675 billion, reducing losses by VND8,590 billion, and reducing deductions by VND57.4 billion.

These figures show: Technology has advanced very quickly, but people with capacity, habits and confidence have not yet kept up with that speed. That slowness is also a cultural problem: How to comply not only because of obligation, but because of self-respect for the profession, because of the feeling of being treated fairly in a trust system?

Lessons from the world

International experience from representatives of organizations such as the IMF, JICA, KOCHAM, Deloitte... all shows that tax is an effective financial tool in national governance and administration.

In Japan, the system of "self-declaration, self-payment, self-responsibility" was born in 1947, and is still considered a "tax democracy". Japanese people consider tax payment an act of participating in public life, as part of their civil rights.

In Korea, the government encourages businesses to be honest with specific incentives, in parallel with strictly handling fraud. According to the Korea Business Association in Vietnam (KOCHAM), what makes businesses feel secure is not the high or low tax rate, but the consistency and fairness of the policy.

For OECD economies, the cooperative compliance model has become a trend. Tax authorities and businesses share real-time data, risk management based on transparency and dialogue. In Australia and the Netherlands, the voluntary compliance rate remains over 95%, while tax administrative costs are among the lowest in the world.

According to the survey Deloitte Global Tax Policy Survey 2025, 94% of business leaders consider tax compliance as a strategic competitive advantage, helping them raise cheaper capital and enhance brand reputation; 86% consider digital tax conversion as a top priority.

Deloitte Vietnam recommends that businesses integrate tax data into the ERP system, apply AI to detect fraud and include compliance index in the ESG criteria set because tax transparency is becoming the new "language of trust" of the market.

The IMF estimates that just a percentage point increase in the tax/GDP ratio can help the national GDP increase by 0.3 percentage points. But to achieve that, technology is not enough, it is necessary an ecosystem of trust, where businesses voluntarily do the right thing and tax authorities keep their promise of transparency, fairness, and on time.

"Therefore, self-conscious tax culture is no longer a slogan. It is a measure of institutional maturity, a soft capacity of a country moving towards the data era, where each digital figure reflects not only management productivity, but also the quality of trust - Mr. Hoang Quang Phong - Vice President of the Vietnam Federation of Commerce and Industry - commented.