Vietnam Textile and Garment Group (Vinatex, UPCoM: VGT) recorded the best business quarter since 2022, with revenue and profit increasing sharply thanks to recovery of export orders and efficiency from affiliated companies.

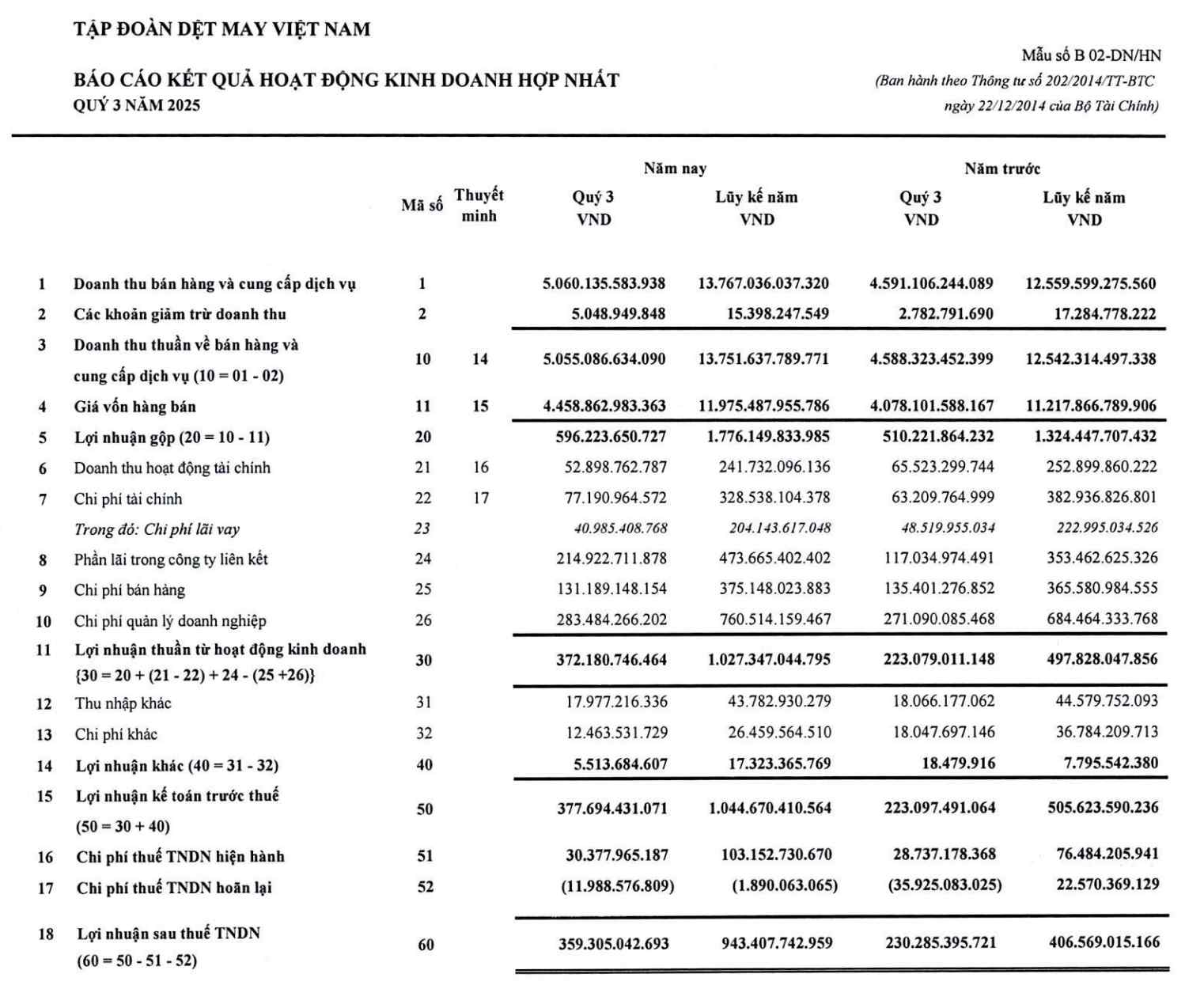

In the third quarter of 2025, Vinatex recorded revenue of more than VND 5,055 billion, up 10% over the same period and the highest in its history. This is also the first time the group has exceeded the VND5,000 billion in revenue in a quarter. Net profit reached over 225 billion VND, up 74% and was the highest level since the third quarter of 2022. Gross profit margin improved to 11.8% over the same period, although still lower than the first two quarters of the year.

The important growth driver comes from the profits of affiliated companies. In the third quarter alone, Vinatex recorded nearly 215 billion VND in interest from affiliated units, up 84% over the same period. Accumulated for 9 months, this revenue reached nearly 474 billion VND, up 34%, contributing significantly to the overall result.

Thanks to that, net profit in the first 9 months of the year reached more than 578 billion VND, up 236% over the same period. This result not only exceeded the profits in 2023 and 2024, but also approached the level achieved in 2022 - the period considered the "high peak" of the textile and garment industry. 9-month revenue reached nearly VND13,752 billion, up 10% over the same period, only lower than the record VND14,200 billion recorded in the first 9 months of 2022.

By the end of the third quarter, Vinatex had completed 75% of the revenue plan and exceeded the annual profit target by 15%. Pre-tax profit reached VND 1,045 billion, more than double the same period, bringing the group back to over VND 1,000 billion after 3 years.

According to Vinatex, the third quarter recorded a strong recovery in revenue and export turnover when member units took advantage of the opportunity to accelerate production and delivery before the effective date of the US tariff and counterpart tax policies.

The fiber industry - a sector heavily affected in 2023 - has made a profit again in this quarter. Vinatex said that timely forecasting and closing of cotton and fiber prices helped the profit margin improve significantly, completely opposite to the loss situation of the same period last year.

As of September 30, 2025, Vinatex is holding VND 1,542 billion in bank deposits, up 56% compared to the beginning of the year. Inventory decreased by nearly 5%, to VND3,134 billion, mainly raw materials and materials (VND1,410 billion, accounting for 45%) and unfinished production costs (VND799 billion, accounting for 25%).

The "unfinished basic construction" section increased to nearly VND610 billion, one and a half times higher than the beginning of the year. Of which, the Vinatex Building project at 3943 Vo Van Kiet (HCMC) accounts for 305.5 billion VND, equivalent to 50% of the total value. In the first 9 months of the year, the investment real estate rental segment contributed about VND72 billion in revenue, equivalent to 0.5% of total consolidated revenue.

Vinatex's total outstanding loans by the end of the third quarter reached nearly VND6,722 billion, up 5% compared to the beginning of the year, of which more than 63% were short-term loans.

Regarding the textile and garment sector, according to data from the Vietnam Textile and Apparel Association (VITAS), in the first 9 months of this year, the total textile and garment exports reached 34.75 billion USD, up 7.7% over the same period last year, showing clear signs of recovery after a period of stagnation.