From January 1, 2026, Clause 6, Article 10 of Resolution 198/2025/QH15 has specifically stipulated that business households and individuals do not apply the tax contract method. Business households and individuals pay taxes according to the law on tax management.

At the same time, in Section 2.2 Section 2, Part I, Article 1 of the Project attached to Decision 3389/QD-BTC in 2025, the Ministry of Finance guides: From January 1, 2026, business households will officially switch from the contract tax method to the method of self-declaration and tax payment.

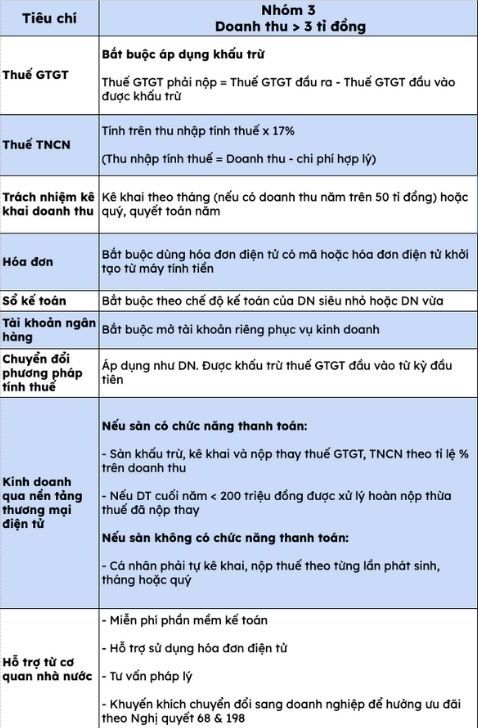

In Table 2, tax management models for households and individuals are classified and instructions on how to calculate tax on business households in 2026 in detail when removing contract tax to declare and pay taxes on self for 3 groups of business households.

For business households with a revenue of VND3 billion or more in group 3, it is mandatory to apply deductions when paying value-added tax (VAT):

VAT payable = Output VAT - Input VAT deductible

Personal income tax will be calculated as follows:

Taxable income x 17%

In which, taxable income = Reasonable Revenue - Expenditures.

If a business household or individual has an annual revenue of over VND 50 billion, they are responsible for declaring monthly or quarterly, and settling annually.

For business households in group 3, it is mandatory to use electronic invoices with codes or electronic invoices generated from cash registers. In addition, business households are required to follow the accounting regime of micro or medium enterprises.

Opening a separate account for business is also a mandatory requirement. Group 3 is also subject to the conversion of tax calculation methods when applied like enterprises, and is deductible for input VAT from the first period.

Notably, households and individuals doing business through e-commerce platforms need to pay attention to the following 2 cases:

If the exchange has the function of payment: The exchange deducts, declares and pays VAT and personal income tax in percentage of revenue. If the year-end revenue is below VND 200 million, the tax payment will be processed and the excess tax paid on behalf of the taxpayer will be refunded

If the exchange does not have the function of payment: Individuals must self-declare and pay taxes for each arising, month or quarter.

In particular, state agencies will provide free accounting software, support businesses to use electronic invoices and provide legal advice. In addition, state agencies encourage business households in group 3 to convert to enterprises to enjoy incentives according to Resolution No. 68-NQ/TW and Resolution No. 198/2025/QH15.