Gold's rally could last another 2 years

According to the latest forecast from JP Morgan Bank, world gold prices may continue to increase strongly in 2026, mainly driven by buying activities from central banks in emerging markets.

Mr. Alex Wolf, global macro and fixed income strategist at JP Morgan, said that gold's rally could last for at least another 2 years.

Mr. Wolf believes that gold prices could well exceed the current peak, equivalent to an increase of more than 25% compared to the present. Gold still accounts for a fairly small proportion of the foreign exchange reserves of many central banks, especially in developing countries. Therefore, although the buying speed may slow down, the accumulation trend will continue, he said.

According to the World Gold Council (WGC), central banks added 634 tonnes of gold to reserves in the first 9 months of 2025, down from the same period in previous years but still far exceeding the average before 2022. The WGC forecasts that total gold purchases for the whole year of 2025 could reach 750-900 tons, showing that demand is still very high.

Leading countries in the gold rally include China, Poland, Turkey and Kazakhstan. In particular, Beijing is promoting a strategy of reducing dependence on the financial system with the US as the center, considering gold as a safe channel to replace it.

Mr. Wolf commented that many emerging economies currently have budget surpluses and large cash flows that need to be reinvested. A part will still be headed toward the US dollar, but the proportion of investment in gold is increasing, he added.

Not only central banks, but private investors are also expected to continue to pour capital into gold. According to Mr. Wolf, the proportion of gold in investors' portfolios is still low. If only a small portion of investors increase their holdings of gold to about 5% of their portfolios, this additional demand will push prices higher.

Potential for a new acceleration cycle

Technical analysts on Wall Street believe that the parabol price increase model is forming on the long-term gold price chart, showing the possibility of a strong acceleration cycle in the next 12-18 months.

Based on the Fibonacci Extension analysis method, target prices are determined to be in the range of 4,700-5,200 USD/ounce, equivalent to an increase of about 25-30% compared to the present.

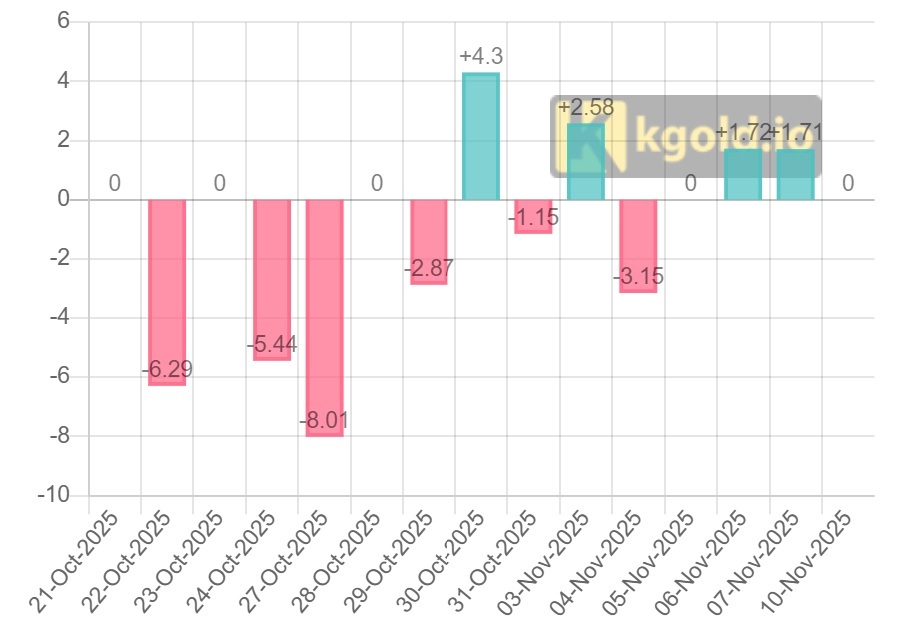

Analysts also note that the recent correction is not a reversal signal, but just a break in the long-term uptrend. Large trading volumes in the declines show that financial institutions are taking advantage of buying, consolidating the foundation for a new growth cycle.

In addition to JP Morgan, Goldman Sachs Bank also maintains a positive view, predicting that gold prices could reach $4,900/ounce by the end of 2026. The bank's report believes that long-term investment demand and gold's strategic defensive role will continue to maintain sustainable buying power, despite short-term fluctuations.

In the context of prolonged geopolitical instability, weak confidence in legal documents, and a wave of gold reserves from central banks, most investors believe that gold will continue to be a "shelter" for value in the coming period and the increase has not stopped.

Along with the increase in world gold prices, the price of SJC gold bars on the morning of November 10 was listed at 150.5 - 152.0 million VND/tael (buy - sell), an increase of about 1.8 million VND/tael compared to yesterday. The price of 9999 Bao Tin Minh Chau gold rings is trading around 149.3 - 152.3 million VND/tael (buy - sell).

Gold prices are suffering 4 simultaneous impacts

Investment institutions said that gold prices are currently affected simultaneously by safe-haven demand, strong central bank purchases, profit-taking pressure from investors and fluctuations in the USD.

In addition, the monetary policy of the US Federal Reserve (Fed), along with the developments of the US stock market, are also important factors affecting the trend of precious metal prices. When US stocks hit a record peak and the US dollar weakened, gold was often seen as a safe-haven asset.