Although the world gold price is remaining high around 4,000 USD/ounce, central banks are still actively adding this precious metal to their reserves.

According to data released by Krishan Gopaul, senior analyst in charge of Europe, Middle East and Africa (EMEA) at the World Gold Council (WGC), the People's Bank of China (PBoC) bought an additional 1 ton of gold in October - the lowest purchase price in the past 3 years.

China's total gold reserves are currently at 2,304 tons, up 25 tons since the end of 2024. Despite the slow pace, Beijing has maintained a steady gold buying momentum for more than a year, showing that China's foreign exchange reserve diversification strategy has not changed.

If China attracted attention with its "unexpected move" of slowing down its purchases, Poland surprised the market with its superior gold purchase scale. The National Bank of Poland (NBP) added 16 tonnes of gold in October - the world's highest - marking its first month of increase since May.

Thus, Poland's total gold reserves have reached 530 tons, accounting for 26% of total national reserves, approaching the 30% target set by Warsaw.

According to Mr. Gopaul, this move shows that Poland is strengthening its "financial shield" in the context of Europe facing the risk of recession and fluctuations in the euro exchange rate.

In Central Europe, the Central Bank of the Czech Republic (CNB) continued to buy 2 more tons of gold in October, bringing its total reserves to more than 69 tons. CNB has purchased 18 tons of gold since the beginning of the year and set a target of reaching 100 tons by 2028.

Meanwhile, the Central Bank of Uzbekistan also increased its reserves by 9 tons of gold in October. Although it has been a net seller since the beginning of the year (12 tons), the country's total gold reserves have reached 371 tons - showing the trend of hoarding returning.

According to the World Gold Council's Q3/2025 report, global central banks bought about 220 tonnes of gold in the last quarter, up 10% over the same period last year.

In general, since the beginning of the year, the purchase volume has reached 634 tons, lower than the record of 3 years ago but still at a high level. It is forecasted that by the end of the year, the total official gold reserves may increase by 750-900 tons.

Analysts say that although the buying rate slows down in 2025, demand from central banks will find it difficult to reverse, as gold is still a safe pillar in the global financial system.

According to Matthew piggott, Director of Gold and Silver at Metals Focus, gold prices have increased by 50% in 2025, leaving central banks unable to buy too much to achieve the target reserve ratio. However, he emphasized:

Its hard to imagine central banks especially China stopping buying gold. Economic uncertainty and the need to diversify reserves will continue to prompt them to store this precious metal.

Experts say that although Beijing's "surprise move" was only 1 ton of gold added in October, amid high gold prices, it is a signal that the country still considers the precious metal as a strategic financial defense tool, in the context of increased trade tensions and geopolitical risks.

Gold buying activities will remain a major support force in the coming time

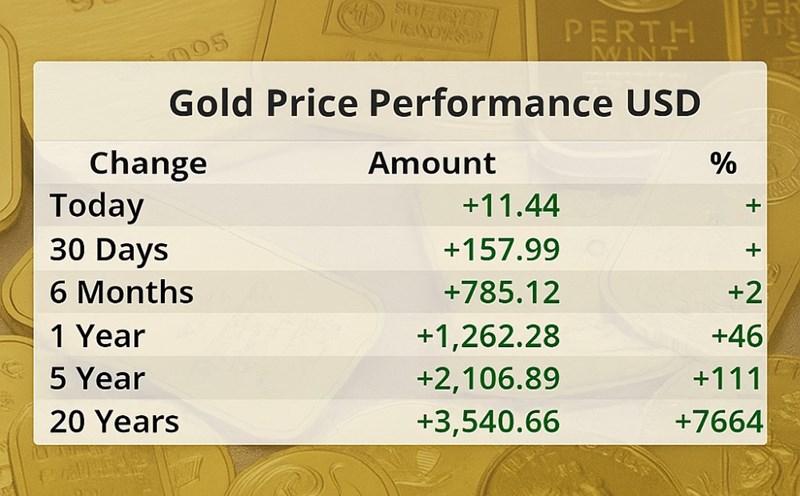

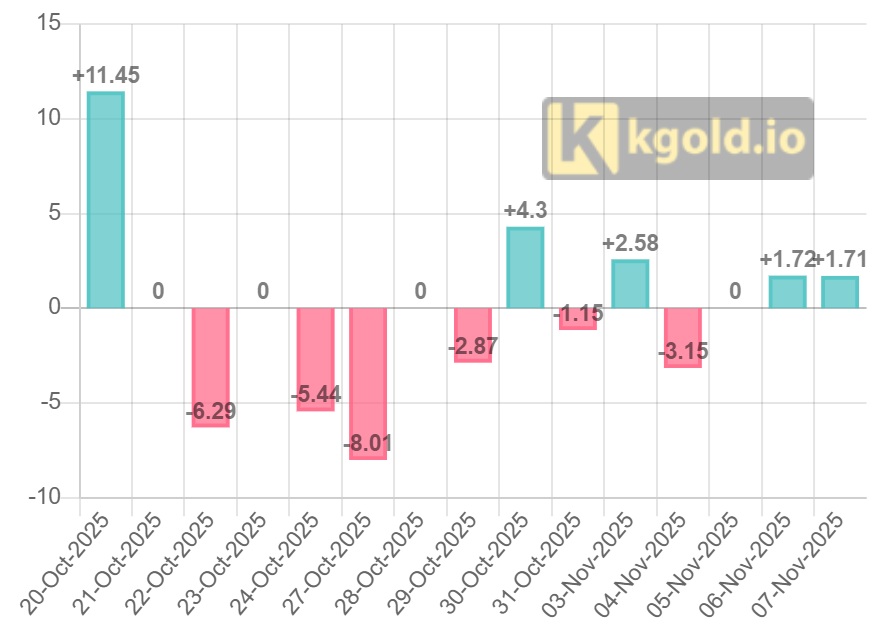

According to the expert SP Angel, it will be a surprising development if gold prices continue to be held around $4,000/ounce while speculative capital is withdrawn and especially in the context of central bank buying activities still being the main support force in the coming time.