According to Bloomberg's knowledgeable sources, Cambodia is expected to become one of the first countries to deposit gold in China's warehouses, registered on the Shanghai Gold Exchange (SGE). The deal only applies to new gold purchases, rather than warehouses relocation from existing reserves.

The move marks the first concrete step forward in Beijing's strategy to build a global financial system that is less dependent on the US dollar and the West. According to sources, in addition to Cambodia, some other countries are also considering sending gold reserves to China, in the context of the increasing trend of "de-dollarization".

The Governor of the National Bank of Cambodia recently said that the country is considering a few locations to store gold reserves, but did not confirm whether China will be on that list.

According to the World Gold Council (WGC), Cambodia's gold reserves are currently at about 54 tons of gold, accounting for 25% of the total $26 billion in national foreign exchange reserves.

On the Chinese side, the People's Bank of China (PBoC) has not commented, but observers say this move is in line with China's long-term strategy of turning the country into the world's gold center, similar to the role that Switzerland and the UK have held for decades.

Cambodia and China have a long-standing relationship. Chairman Xi Jinping visited Cambodia earlier this year. Beijing currently holds about a third of Phnom Penh's public debt, with bilateral trade turnover reaching 15 billion USD last year. Under the Ring Road and Road (BRI) initiative, China has funded and built a series of key projects in Cambodia, from the new airport in Phnom Penh to the expressway.

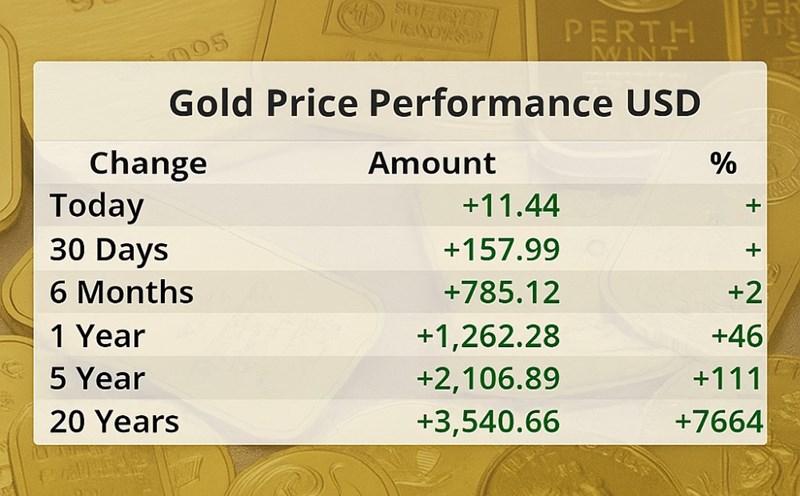

In the context of increasing geopolitical tensions and the risk of global financial conflicts, many central banks have stepped up gold storage as a "safe shield" to replace the USD. It is this trend that contributed to bringing gold prices to record levels last month.

However, analysts also believe that sending gold abroad is not always safe. Some countries such as India and Serbia have withdrawn gold, considering it a measure to ensure financial sovereignty in times of turmoil.

If the agreement with Cambodia is confirmed, China will officially step into the list of "global gold investors", along with London (UK), Zurich (Switzerland) and New York (USA) - thereby marking a strategic step in efforts to reshape the international financial order.

The world gold price at 9:16 a.m. on November 6, Vietnam time, was trading at 3,978.61 USD/ounce, up 27.93 USD, equivalent to an increase of 0.71%.

Regarding domestic gold prices in Vietnam, SJC gold bar prices at 9:00 a.m. on November 6 traded around 146 - 147.5 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is listed at 145 - 148 million VND/tael (buy - sell).