Gold prices have increased sharply in the past year, continuously setting new highs and becoming a destination for global safe deposits.

However, behind that impressive increase, major financial institutions began to issue warnings: Gold is not always a "safe place", and may even face the risk of a sharp decline in adverse cycles.

In the 2026 outlook report, Goldman Sachs' investment strategy group believes that investors rushing to gold to diversify portfolios may be a mistake.

According to this bank, history shows that gold has experienced very strong and prolonged adjustment periods, with maximum declines reaching 70% at times.

Goldman Sachs emphasized that compared to US government bonds - a tool that often acts as a "cushion" for investment portfolios during market volatility - gold has a much higher level of risk. Long-term data shows that this precious metal does not always play a defensive role as expected by investors.

Mr. Brett Nelson, Head of Strategic Asset Allocation at Goldman Sachs' investment strategy group, said that based on 20-year cycles, gold only generates real yields - i.e., exceeding inflation - in about half of the periods tracked.

Historically, gold has even fluctuated more strongly than US stocks, with deep and unpredictable corrections" - Mr. Nelson said.

Conversely, Goldman Sachs pointed out that in the same period, US stocks had more stable performance in overcoming inflation. According to Mr. Nelson, data shows that the US stock market, in the long term, is still supported by corporate profits and economic growth.

Despite increasingly clear warnings, cash flow continues to flow strongly into gold. According to FactSet data, in a trading session at the beginning of the week, SPDR Gold Shares fund - one of the largest gold ETFs in the world - recorded inflows of up to $950 million. This investment reversed the previous withdrawal trend, bringing the total net capital inflow into the fund from the beginning of 2026 to about $118 million.

Contrary to Goldman Sachs' cautious view, Wells Fargo & Co Investment Institute forecasts that gold prices still have room to increase in 2026. According to this organization, factors such as increased geopolitical tensions, strong gold buying activity by central banks and expectations that the US Federal Reserve (Fed) will cut interest rates will continue to support gold prices.

Wells Fargo believes that the stable USD along with the trend of loose monetary policy will create a favorable environment for the precious metal, although the growth rate may slow down compared to 2025.

Mixed assessments from major financial institutions show that, although gold prices are in a high zone and continue to attract cash flow, the risk of a deep decline is still present. For investors, considering gold as an absolute safety "shield" may pose no small risks in the context of unpredictable fluctuations in 2026.

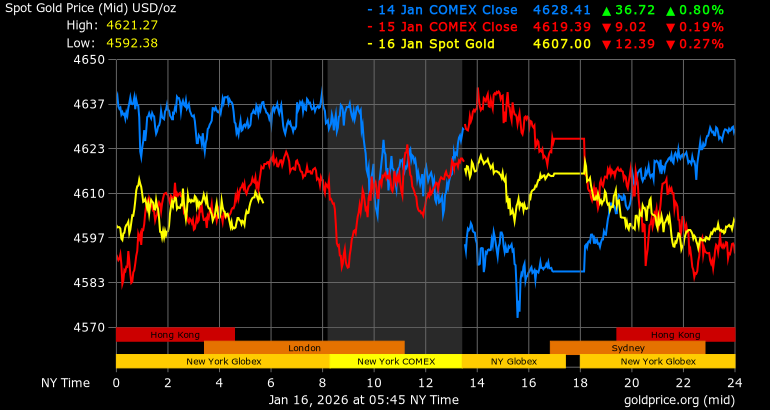

World gold price at 5:30 PM on January 16, Vietnam time, traded at 4,609.68 USD/ounce.

Regarding domestic gold prices, SJC gold bar prices are traded at 160.8 - 162.8 million VND/tael (buying - selling). 9999 Bao Tin Minh Chau gold ring prices are traded at 1598.8 - 162.8 million VND/tael (buying - selling).