Instead of gold, the metal that Warren Buffett appreciates more in his investment portfolio is silver, because the core factor that Buffett always pursues is actual usage value.

Buffett has long been skeptical about gold. According to him, gold "can't do anything but lie there and look back at you". This assessment reflects the consistent investment philosophy of the "Omaha sage": Only pour capital into assets that create tangible value, meeting the practical needs of the economy and social life.

Unlike gold, silver possesses a long list of industrial and medical applications. In medicine, silver is widely used in antibacterial bandages, catheters, burn treatments and many other healthcare devices.

In the water treatment segment, silver is used for disinfection and purification, contributing to ensuring clean water sources. Meanwhile, for the electronics industry, silver is the best conductive metal, less corrosive, so it appears in wires, connecting components, computers, phones, cameras and even scratch-resistant coating for DVDs.

This versatility makes silver perfectly meet the "inner value" criterion set by Buffett.

Buffett does not deny that gold has aesthetic value and certain industrial applications. However, according to him, these functions are not large enough and are not as irreplaceable as silver.

From the perspective of value investment, Buffett believes that an asset that does not generate cash flow, does not serve essential needs, can hardly be considered a long-term sustainable investment.

Gold and silver prices both break through

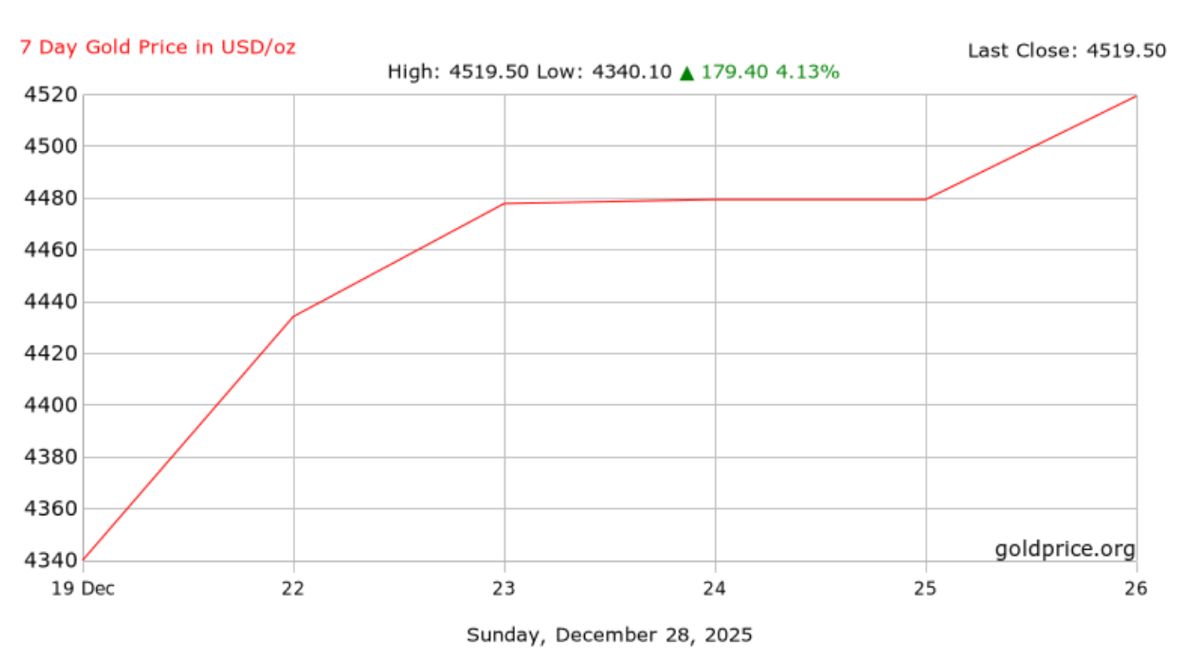

Despite Buffett's point of view, the precious metal market is currently witnessing a period of strong price increases. Gold and silver prices simultaneously climbed to record highs in the past week's trading sessions, driven by safe haven demand and positive technical signals.

Gold futures for February delivery at one point increased by more than $50, exceeding the $4,560/ounce mark. Meanwhile, silver attracted even more attention when it increased sharply, approaching the $76/ounce mark. According to Kitco News, about 57% of individual investors believe that silver may exceed the $100/ounce mark in 2026.

Although Buffett is not enthusiastic about gold, many market experts still believe that gold prices still have room to increase next year. Mr. Joseph Cavatoni, senior market strategist at the World Gold Council, said "the strategic viewpoint for holding gold is still very solid when entering 2026".

Increased inflation, geopolitical tensions and the monetary policy of the US Federal Reserve (Fed) are considered key factors dominating gold price trends.

Some gold price forecasts for next year are placed in the range of 5,000 - 6,000 USD/ounce, depending on the developments of the USD, inflation and buying demand from central banks.

World gold prices closed this week at 4,534.16 USD/ounce, up 54.63 USD, equivalent to an increase of 1.22%.

Regarding domestic gold prices, SJC gold bar prices at 9 am on December 27 were traded at 157.7 - 159.7 million VND/tael (buying - selling).

The price of 9999 Bao Tin Minh Chau gold rings is trading at 156.9 - 159.9 million VND/tael (buying - selling).

Phu Quy silver price is traded at 2.983 - 3.075 million VND/tael (buying - selling).