A wave of price increases swept through Wall Street on April 9 after President Donald Trump suddenly announced a postponement of most of the tariffs within 90 days. This is the trading session with the strongest increase in many years, marking a reversal after days of financial chaos caused by trade policies.

Reuters reported that the S&P 500 index surged 9.52% - the largest increase since the 2008 financial crisis. Nasdaq also exploded stronger with a 12.2% jump, marking the second strongest increase in history. Dow Jones was not left out either, rising nearly 3,000 points to 7.87%.

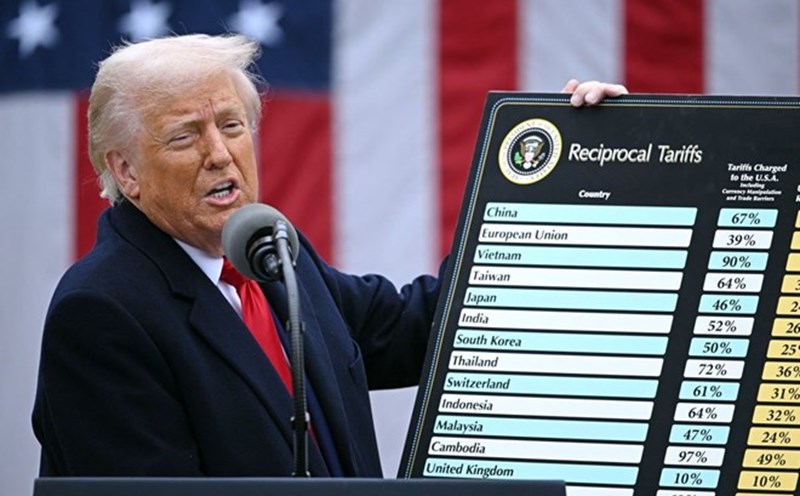

The reason is just one announcement from Mr. Trump: Temporary postponement of the new tax for most countries, except for China - the country subject to a "record" tax rate of 125%.

This is the moment the stock market has been waiting for so long. The perfect time is right when the financial reporting season begins, said Ms. Gina Bolvin, President of Bolvin Wealth Management Group.

However, investors have not been able to breathe a full welcome. The big question is: What happens after 90 days? - Bolvin asked.

Before Mr. Trump's announcement, the market was on the verge of collapse. Bond prices plummeted, the US dollar depreciated and analysts began warning of a recession if the US puts the tariff at its highest level since the 19th century.

The US Treasury Department itself is also facing a liquidity crisis as bond sell-offs have sent the 10-year yield to 4.515% - its highest level since February. After the announcement, the cooling yield will decrease to 4.328%.

In the foreign exchange market, the USD rebounded. Dollar Index increased by 0.25% to 103.03. The USD increased by more than 1% against the Japanese Yen and the Swiss francs. The euro fell slightly by 0.08%, trading at 1.0947 USD.

Meanwhile, gold prices - safe-haven assets - exploded strongly. Spot gold rose 2.6%, hitting $3,059.76/ounce, after once climbing nearly $3,100. Gold futures also rose 3% to $3,079.40.

The market considers gold a hedge against instability. Expectations are rising, interest rates are rising and tariffs are a major threat. Gold benefits from all those factors, said Bart Melek, head of commodity strategy at TD Securities.

Since the beginning of 2025, gold prices have increased by more than 400 USD, reaching a historic peak of 3,167.57 USD/ounce on January 3 - thanks to safe-haven demand and net buying from central banks.

The oil market is not out of the picture. Brent oil price increased by 4.23% to 65.48 USD/barrel, while US WTI oil increased by nearly 4.7% to 62.35 USD/barrel.

Despite the market reversal, investors are still hesitant about the potential risks from Mr. Trump's tax policies. The sudden "tightening - expanding" of taxes such as turning on the switch, affects the stability of the investment environment in the US.

A previous report from Deutsche Bank warned that the market and financial world are entering an undiscovered space.

In the short term, Mr. Trump's brake has created a wave of brilliant recovery. But analysts are skeptical about whether this is the beginning of stability, or just a warm sunshine in the tariff typhoon season?