Domestic coffee prices

On October 19 (Sunday), domestic coffee prices maintained the weekend price of VND 114,300/kg. The past trading week (October 13 - October ) was marked by fierce tensions, with a strong increase in the middle of the week thanks to Arabica, but was quickly put under selling pressure and news of a downward supply.

The net decrease last week was about VND 2,700/kg, pushing the price down to a recent low. From the peak of 122,000 VND/kg at the end of August - a month and a half full of fluctuations, the current price has decreased net by nearly 7,700 VND/kg.

Coffee prices in key Central Highlands regions are at the following levels: Dak Nong (old) (114,800 VND/kg), Dak Lak (114,500 VND/kg), Gia Lai (114,500 VND/kg), and Lam Dong (113,500 VND/kg).

World coffee prices

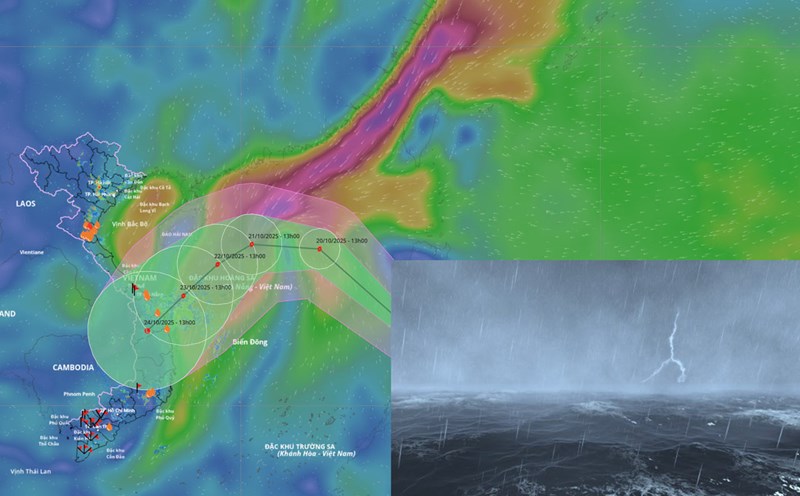

In the last session of the week, Robusta ( London) decreased sharply by 62 USD/ton. The direct reason for the decline in Robusta prices is the forecast of heavy rain in the Central Highlands, Vietnam, increasing the prospect of productivity for the new crop.

In contrast, Arabica (New York) increased by 3.65 US cents/lb, strongly supported by information that inventories decreased to a 19-month low. The tug-of-war between the two types of coffee shows that the market is being affected by two opposing forces: negative news about Robusta supply (increased output) and long-term risks of Arabica ( decreased inventories).

This price decrease was also indirectly affected by major news in the past month. These are sell-off pressure caused by the FED cutting interest rates in early October and rumors of the possibility of removing the 50% tariff imposed on Brazil, which are factors that create a fake shortage in the US market.

Assessment and forecast

This past trading week was a week of conflict between short-term news and long-term risks, showing that the market is in the decisive stage.

According to barchart.com, the factors supporting long-term prices are still very solid. Arabica inventories have hit a record low (under 500,000 bags) and the risk of severe drought in Brazil is still the biggest concern for the 2026/27 crop. In addition, the forecast for the global Arabica deficit is still high (8.5 million bags).

Meanwhile, news about the strong increase in Robusta supply from Vietnam (up 6%) and news about the possibility of lifting the 50% tariff on Brazil have put great pressure. The continuous profit-taking of investment funds is also the reason for the prolonged decline.

Coffee prices are expected to continue to fluctuate strongly next week. The market may be looking for a more stable price threshold to stand firm, with the possibility of a recovery if new information about weather risks in Brazil increases again or international inventories fall further.