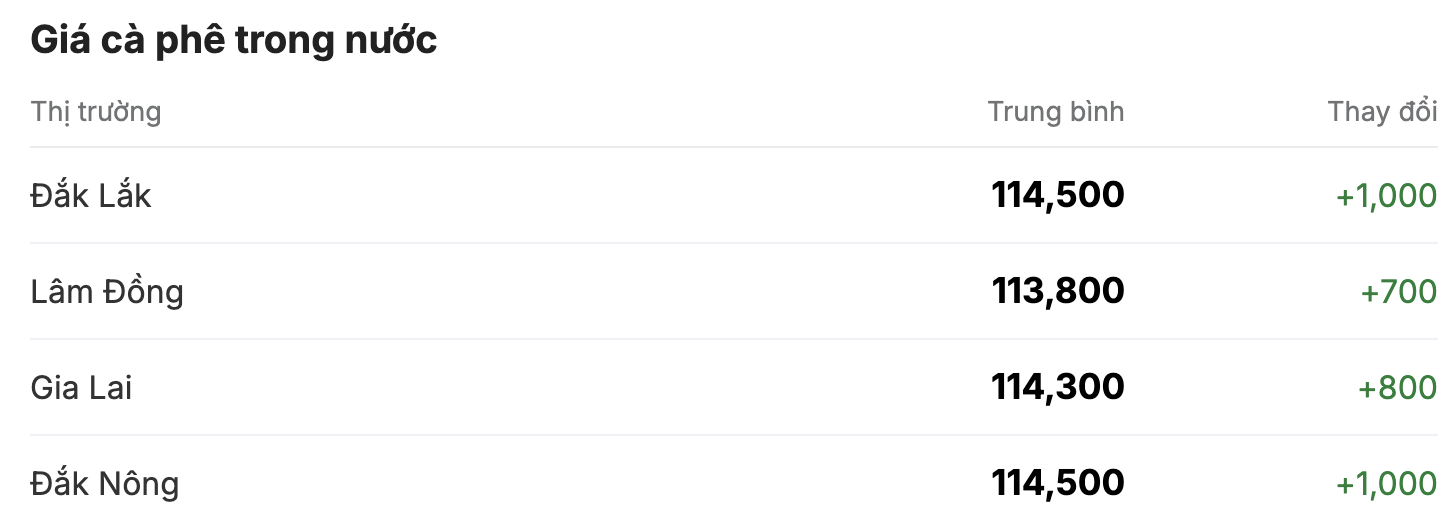

As of 11:30 a.m. today (November 19), the domestic coffee market continued to break out, increasing by an average of VND900/kg, causing prices to fluctuate between VND113,800 - VND114,500/kg. The average coffee purchase price in the Central Highlands provinces is VND114,400/kg.

Similar to Dak Lak, Dak Nong province today purchased coffee at a high price of 114,500 VND/kg, the biggest increase of 1,000 VND/kg. These are the two provinces with the highest coffee purchasing prices in the country.

Lam Dong is still the province with the lowest coffee purchase price in the Central Highlands. Compared to yesterday's closing price, the coffee price in this region stood at 113,800 VND/kg, although it has increased by 700 VND/kg.

Notably, coffee prices in Gia Lai province ranked first, increasing by VND800/kg, far exceeding the VND114,000/kg mark.

This week, domestic coffee prices were filled with green after last weekend's session was stable at 113,700 VND/kg.

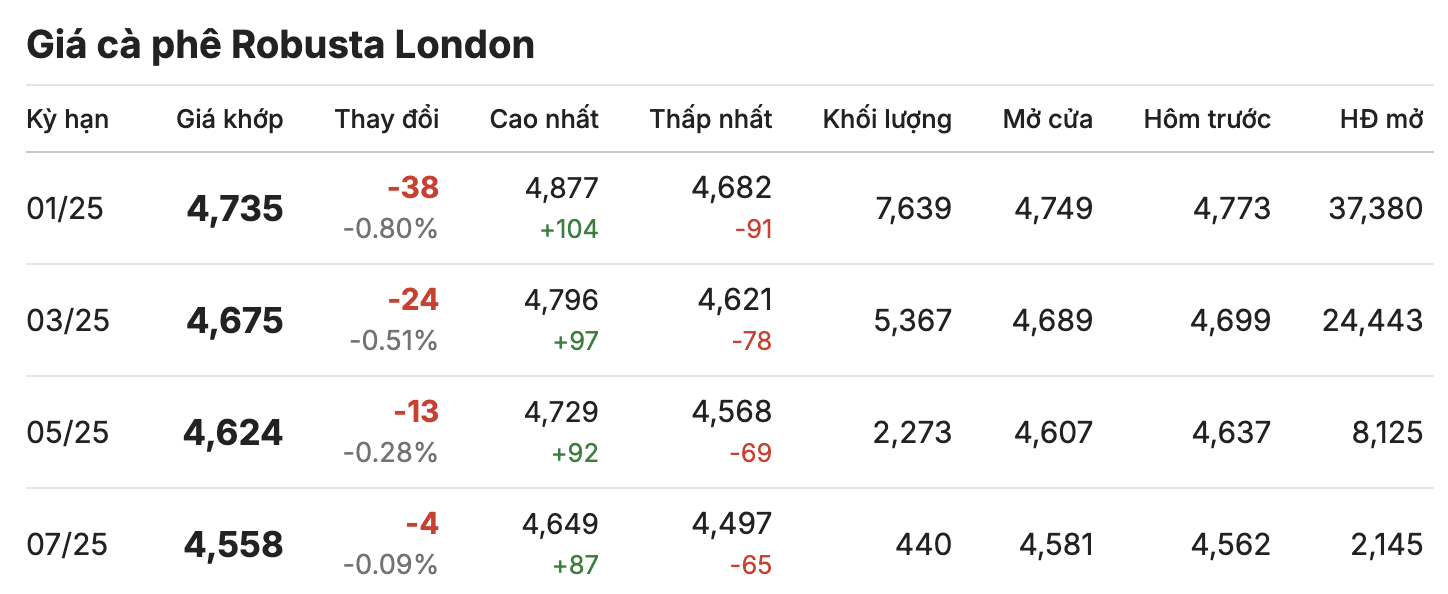

On the London and New York exchanges, the coffee market recorded a downward movement in all terms. The contract for delivery in January 2025 decreased by nearly 1% (equivalent to 38 USD/ton), listed at 4,735 USD/ton. Similarly, the contract for delivery in March 2025 decreased by less than 14 USD/ton, currently standing at 4,675 USD/ton.

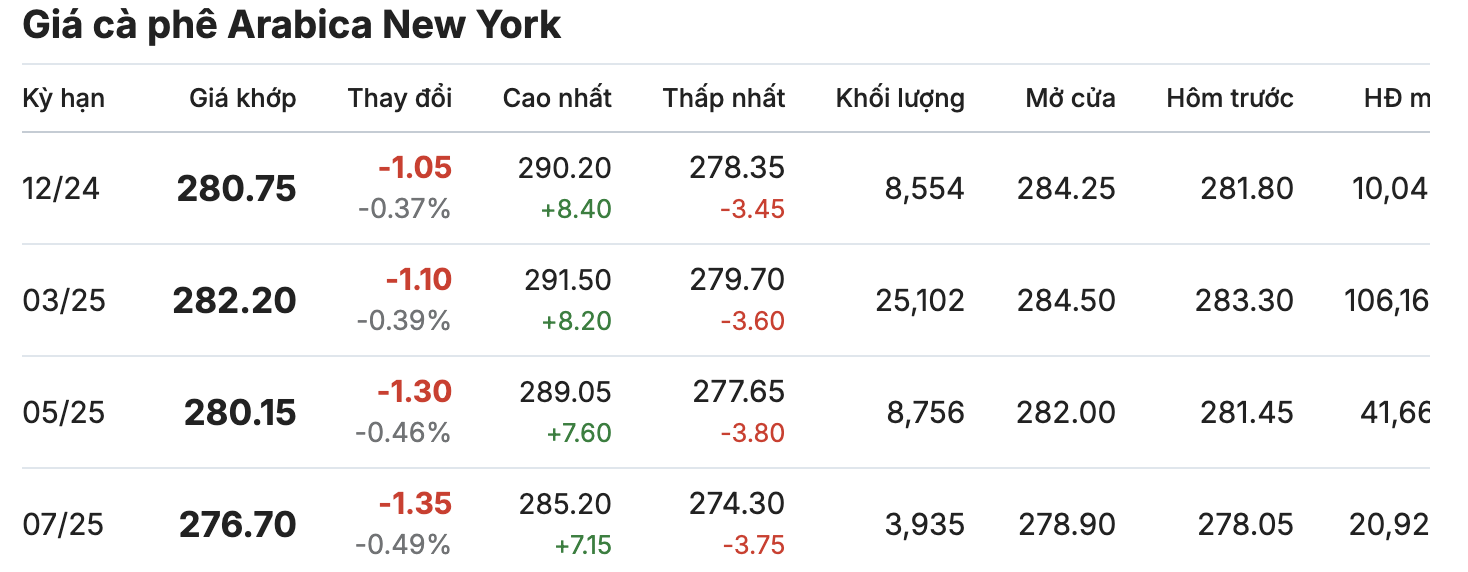

In the same direction, the developments in the New York Arabica coffee market for delivery terms in December 2024 and March 2025 also recorded a decline of more than 0.30% compared to yesterday's closing session, currently standing at 280.75 cents/lb and 282.20 cents/lb.

According to the Vietnam Coffee and Cocoa Association (Vicofa), for the first time in 30 years, Vietnamese coffee prices are number one in the world. At some point, Robusta coffee prices surpassed Arabica.

The 2023-2024 crop year is considered a miracle crop year for the Vietnamese coffee industry, when it is continuously affected by natural disasters and extreme weather, affecting export output. Although the export output is less than 1.5 million tons, the export turnover reaches over 5 billion USD. This demonstrates the role and importance of the Vietnamese coffee industry in the global market.

However, it is forecasted that in the 2024-2025 crop year, coffee output may decrease by 15%, making consumption difficult.